Question: The questions are COMPLETE. No one is missing please ANSWER IT ALREADY! I post it for the 3rd time and always say need clarification but

The questions are COMPLETE. No one is missing please ANSWER IT ALREADY! I post it for the 3rd time and always say "need clarification" but the questions is COMPLETE.

Please answer it already, the questions are Complete. READ IT CAREFULLY. SHOW YOUR COMPLETE SOLUTION on number 6,7,8,9 and 10 please thank you answer it please

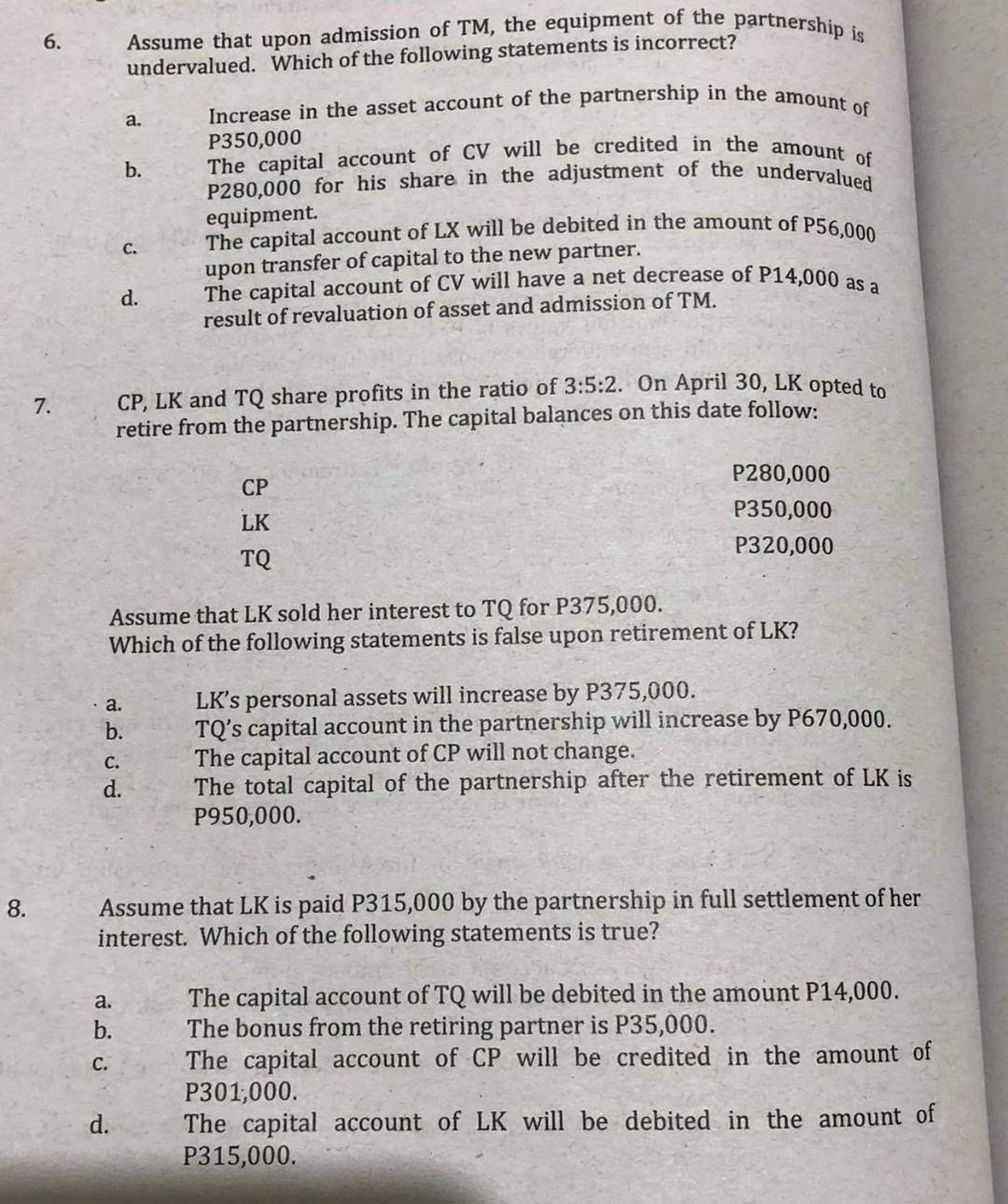

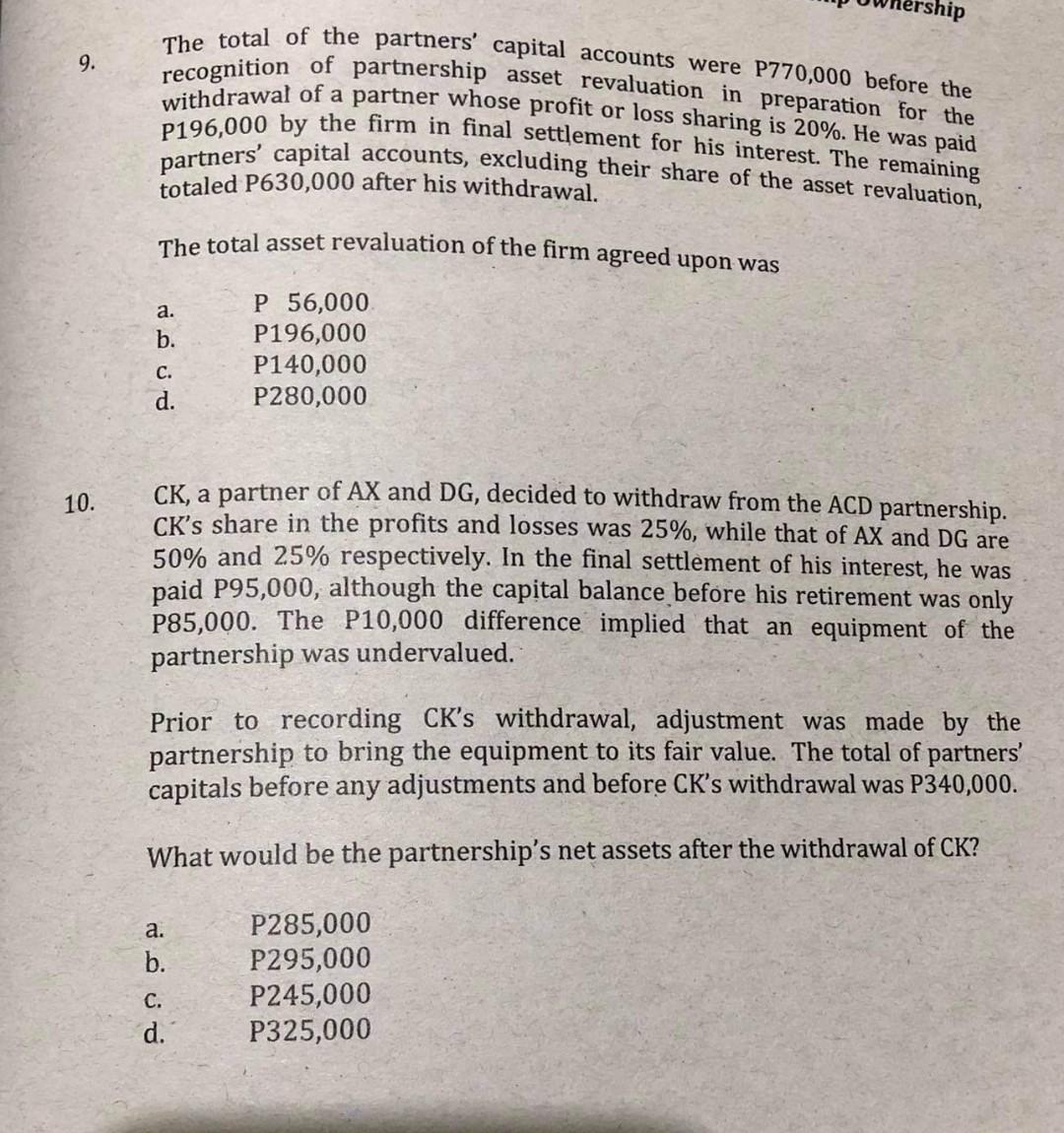

6. Assume that upon admission of TM, the equipment of the partnership is undervalued. Which of the following statements is incorrect? Increase in the asset account of the partnership in the amount of a. P350,000 The capital account of CV will be credited in the amount of b. P280,000 for his share in the adjustment of the undervalued The capital account of LX will be debited in the amount of P56,000 upon transfer of capital to the new partner. The capital account of CV will have a net decrease of P14,000 as a d. result of revaluation of asset and admission of TM. equipment C. 7. CP, LK and TQ share profits in the ratio of 3:5:2. On April 30, LK opted to retire from the partnership. The capital balances on this date follow: CP P280,000 P350,000 P320,000 LK TQ Assume that LK sold her interest to TQ for P375,000. Which of the following statements is false upon retirement of LK? a. b. C. d. LK's personal assets will increase by P375,000. TQ's capital account in the partnership will increase by P670,000. The capital account of CP will not change. The total capital of the partnership after the retirement of LK is P950,0 8. Assume that LK is paid P315,000 by the partnership in full settlement of her interest. Which of the following statements is true? a. b. C. The capital account of TQ will be debited in the amount P14,000. The bonus from the retiring partner is P35,000. The capital account of CP will be credited in the amount of P301,000. The capital account of LK will be debited in the amount of P315,000. d. ship 9. The total of the partners' capital accounts were P770,000 before the recognition of partnership asset revaluation in preparation for the withdrawal of a partner whose profit or loss sharing is 20%. He was paid P196,000 by the firm in final settlement for his interest. The remaining partners' capital accounts, excluding their share of the asset revaluation, totaled P630,000 after his withdrawal. The total asset revaluation of the firm agreed upon was a. b. P 56,000 P196,000 P140,000 P280,000 C. d. 10. CK, a partner of AX and DG, decided to withdraw from the ACD partnership. CK's share in the profits and losses was 25%, while that of AX and DG are 50% and 25% respectively. In the final settlement of his interest, he was paid P95,000, although the capital balance before his retirement was only P85,000. The P10,000 difference implied that an equipment of the partnership was undervalued. Prior to recording CK's withdrawal, adjustment was made by the partnership to bring the equipment to its fair value. The total of partners' capitals before any adjustments and before CK's withdrawal was P340,000. What would be the partnership's net assets after the withdrawal of CK? a. b. P285,000 P295,000 P245,000 P325,000 C. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts