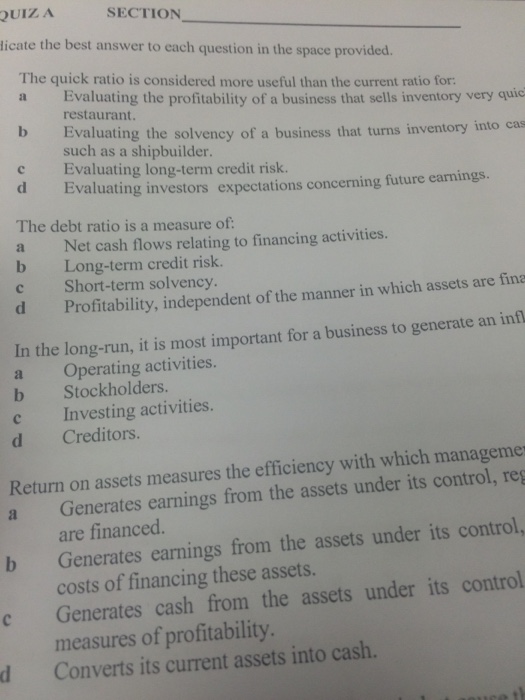

Question: The quick ratio is considered more useful than the current ratio for: Evaluating the profitability of a business that sells inventory very quick restaurant. Evaluating

The quick ratio is considered more useful than the current ratio for: Evaluating the profitability of a business that sells inventory very quick restaurant. Evaluating the solvency of a business that turns inventory into case such as a shipbuilder. Evaluating long-term credit risk. Evaluating investors expectations concerning future earnings. The debt ratio is a measure of: Net cash flows relating to financing activities. Long-term credit risk. Short-term solvency. Profitability, independent of the manner in which assets are In the long-run, it is most important for a business to generate an Operating activities. Stockholders. Investing activities. Creditors. Return on assets measures the efficiency with which managements Generates earnings from the assets under its control, are financed. Generates earnings from the assets under its control, costs of financing these assets. Generates cash from the assets under its control measures of profitability. Converts its current assets into cash. The quick ratio is considered more useful than the current ratio for: Evaluating the profitability of a business that sells inventory very quick restaurant. Evaluating the solvency of a business that turns inventory into case such as a shipbuilder. Evaluating long-term credit risk. Evaluating investors expectations concerning future earnings. The debt ratio is a measure of: Net cash flows relating to financing activities. Long-term credit risk. Short-term solvency. Profitability, independent of the manner in which assets are In the long-run, it is most important for a business to generate an Operating activities. Stockholders. Investing activities. Creditors. Return on assets measures the efficiency with which managements Generates earnings from the assets under its control, are financed. Generates earnings from the assets under its control, costs of financing these assets. Generates cash from the assets under its control measures of profitability. Converts its current assets into cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts