Question: The reason that MM Proposition I without taxes does not hold in the presence of corporate taxation is because: O levered firms pay less taxes

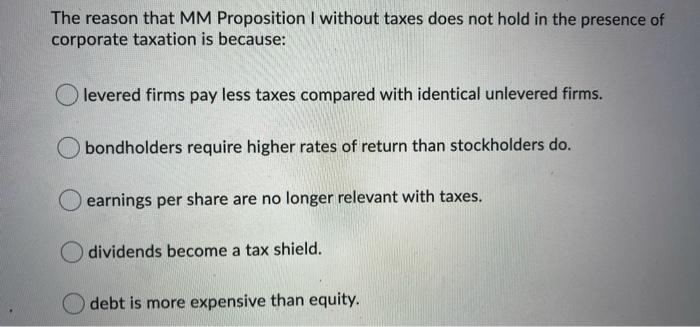

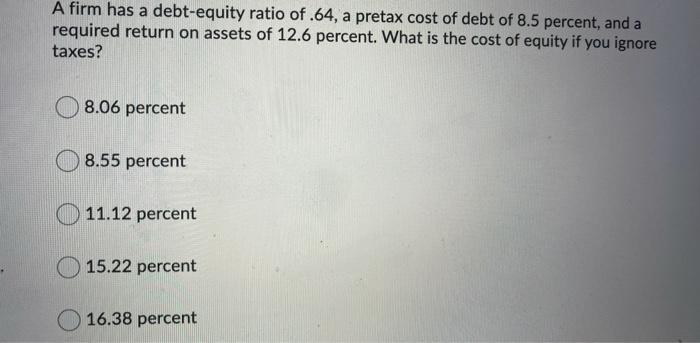

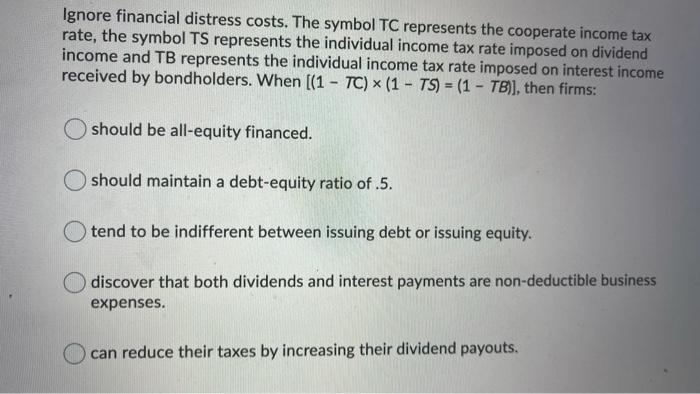

The reason that MM Proposition I without taxes does not hold in the presence of corporate taxation is because: O levered firms pay less taxes compared with identical unlevered firms. bondholders require higher rates of return than stockholders do. earnings per share are no longer relevant with taxes. O dividends become a tax shield. debt is more expensive than equity. A firm has a debt-equity ratio of .64, a pretax cost of debt of 8.5 percent, and a required return on assets of 12.6 percent. What is the cost of equity if you ignore taxes? 8.06 percent 8.55 percent 11.12 percent 15.22 percent 16.38 percent Ignore financial distress costs. The symbol TC represents the cooperate income tax rate, the symbol TS represents the individual income tax rate imposed on dividend income and TB represents the individual income tax rate imposed on interest income received by bondholders. When [(1 - TC) * (1 - TS) = (1 - TB)], then firms: should be all-equity financed. should maintain a debt-equity ratio of.5. tend to be indifferent between issuing debt or issuing equity. discover that both dividends and interest payments are non-deductible business expenses. can reduce their taxes by increasing their dividend payouts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts