Question: . . The records for Blossom Co show this data for 2021: Gross profit on installment sales recorded on the books was $430,000. Gross profit

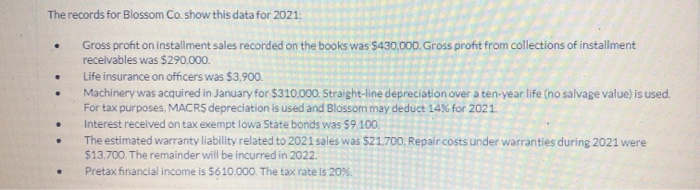

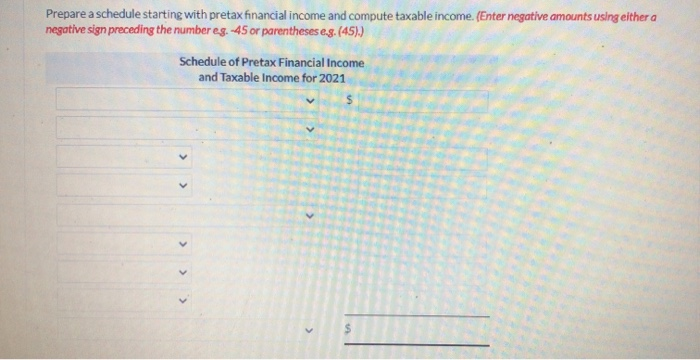

. . The records for Blossom Co show this data for 2021: Gross profit on installment sales recorded on the books was $430,000. Gross profit from collections of installment receivables was $290.000 Life insurance on officers was $3.900. Machinery was acquired in January for $310.000. Straight-line depreciation over a ten-year life (no salvage value) is used. For tax purposes, MACR5 depreciation is used and Blossom may deduct 14% for 2021. Interest received on tax exempt lowa State bonds was 59.100. The estimated warranty liability related to 2021 sales was $21,700. Repair costs under warranties during 2021 were $13,700. The remainder will be incurred in 2022. Pretax financial income is 5610.000. The tax rate is 20%. . . Prepare a schedule starting with pretax financial income and compute taxable income. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses e.g. (45)) Schedule of Pretax Financial Income and Taxable income for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts