Question: The red is the wrong answer, but I didn't figure out where I was wrong. For the next question, I got -1.17 wrong, others are

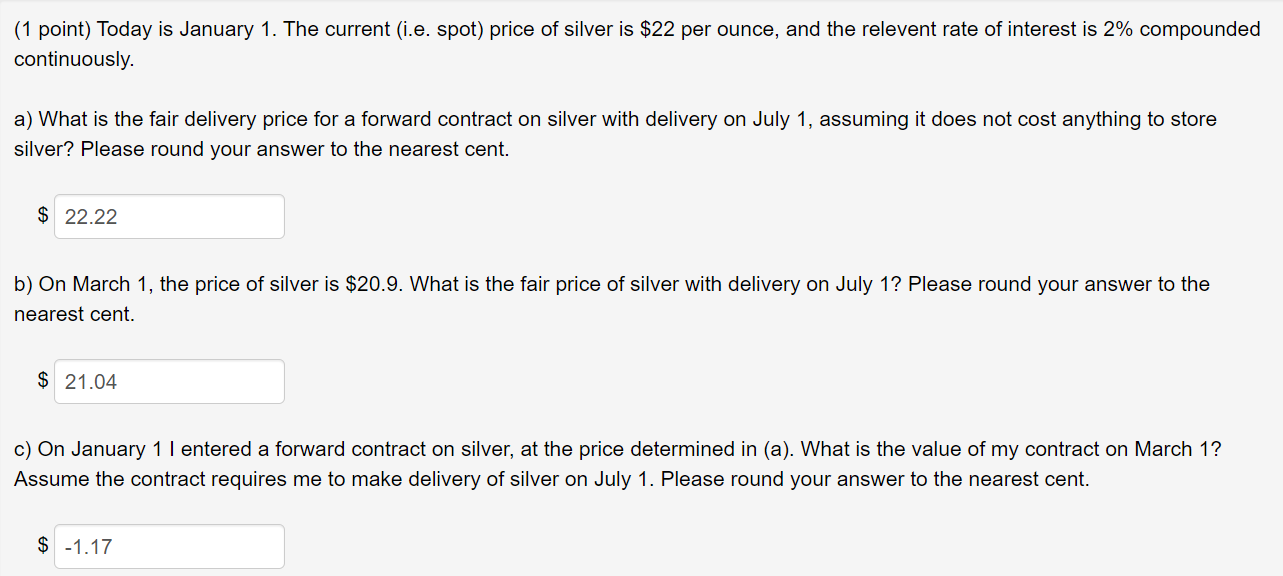

The red is the wrong answer, but I didn't figure out where I was wrong. For the next question, I got -1.17 wrong, others are correct.

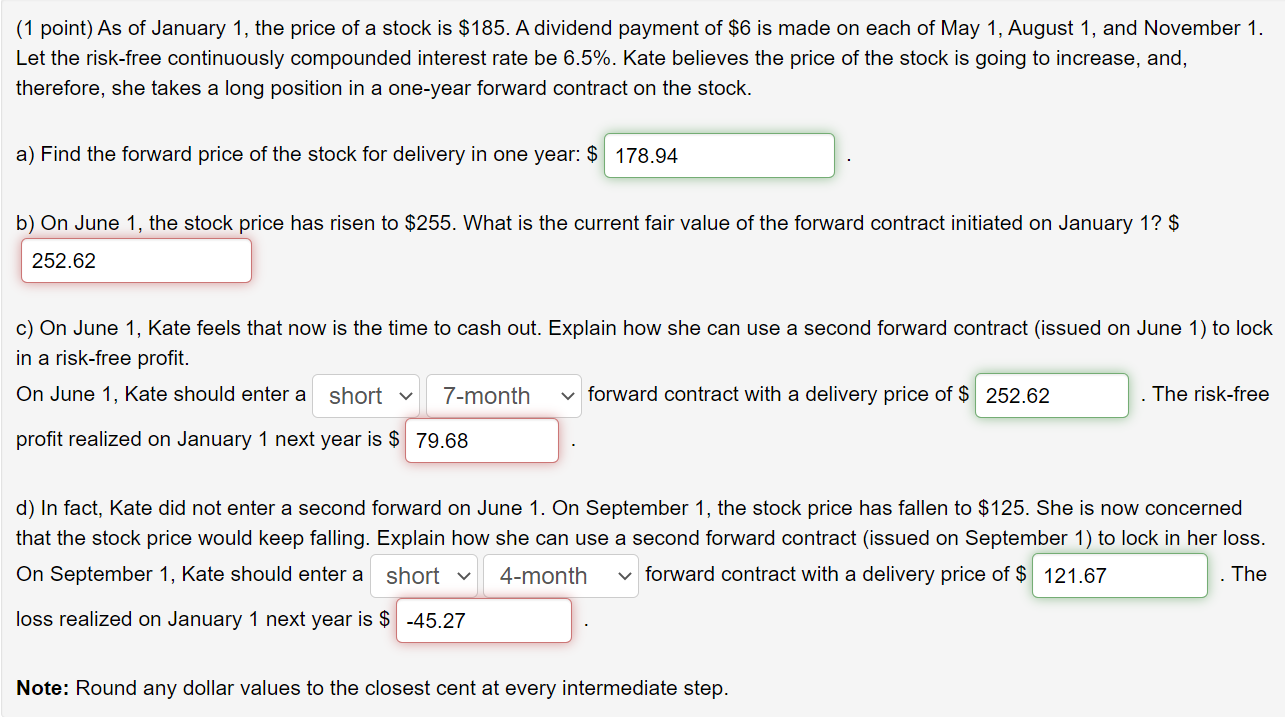

(1 point) Today is January 1. The current (Le. spot) price of silver is $22 per ounce, and the relevent rate of interest is 2% compounded continuously. a) What is the fair delivery price for a forward contract on silver with delivery on July 1, assuming it does not cost anything to store silver? Please round your answer to the nearest cent. 35 22.22 b) On March 1, the price of silver is $20.9. What is the fair price of silver with delivery on July 1? Please round your answer to the nearest cent. $ 21.04 c) On January 1 I entered a fonivard oontract on silver, at the price determined in (a). What is the value of my contract on March 1? Assume the contract requires me to make delivery of silver on July 1. Please round your answer to the nearest cent. $ -1.17 (1 point) As of January 1, the price of a stock is $185. A dividend payment of $6 is made on each of May 1, August 1, and November 1. Let the risk-free continuously compounded interest rate be 6.5%. Kate believes the price of the stock is going to increase, and, therefore, she takes a long position in a one-year forward contract on the stock. a) Find the forward price of the stock for delivery in one year: $ 178.94 b) On June 1, the stock price has risen to $255. What is the current fair value of the forward contract initiated on January 1? $ 252.62 c) On June 1, Kate feels that now is the time to cash out. Explain how she can use a second forward contract (issued on June 1) to lock in a risk-free profit. On June 1, Kate should enter a short v 7-month v forward contract with a delivery price of $ 252.62 . The risk-free profit realized on January 1 next year is $ 79.68 d) In fact, Kate did not enter a second forward on June 1. On September 1, the stock price has fallen to $125. She is now concerned that the stock price would keep falling. Explain how she can use a second forward contract (issued on September 1) to lock in her loss. On September 1, Kate should enter a short v 4-month v forward contract with a delivery price of $ 121.67 The loss realized on January 1 next year is $ -45.27 Note: Round any dollar values to the closest cent at every intermediate step

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts