Question: The regression output below shows estimates from a capital structure model fitted for a sample of Thai firms. The dependent variable is Firm Value, whereas

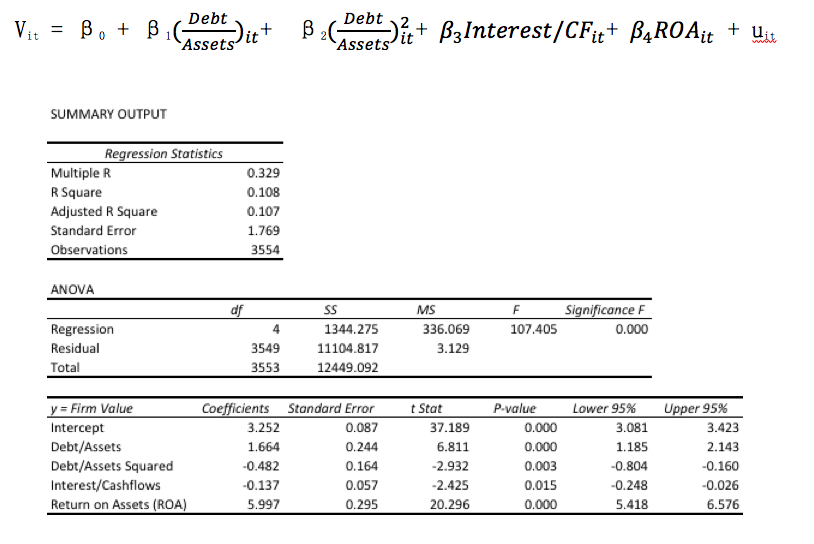

The regression output below shows estimates from a capital structure model fitted for a sample of Thai firms. The dependent variable is Firm Value, whereas the main explanatory variable is Leverage (Debt/Assets). Leverage also enters the model on its quadratic term (Debt/Assets Squared). The sample mean of Debt/Assets is 0.45. The model further accounts for the effect of Interest expenses as a share of Cash flows (Interest/CF) on Firm Value. The model also includes a control variable for Profitability (Return on Assets). The model is specified as:

Based on the estimated coefficients, critically discuss whether the empirical evidence presented in the regression output table is consistent with the predictions from the Trade-Off theory of capital structure. When developing your arguments, discuss the statistical significance and the interpretation of the effects of Leverage and of Interest expenses on Firm Value, as well as the potential limitations of the empirical model. (20 marks)

(word limit: 400 words).

Debt Vi: = B. + B assets) itt B BG B Debt-avit+ B3 Interest/CFit+ B4ROAit + Uit Assets SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.329 0.108 0.107 1.769 3554 ANOVA F. 107.405 df 4 3549 3553 Regression Residual Total SS 1344.275 11104.817 12449.092 MS 336.069 3.129 Significance F 0.000 y = Firm Value Intercept Debt/Assets Debt/Assets Squared Interest/Cashflows Return on Assets (ROA) Coefficients Standard Error 3.252 0.087 1.664 0.244 -0.482 0.164 -0.137 0.057 5.997 0.295 t Stat 37.189 6.811 -2.932 -2.425 20.296 P-value 0.000 0.000 0.003 0.015 0.000 Lower 95% 3.081 1.185 -0.804 -0.248 5.418 Upper 95% 3.423 2.143 -0.160 -0.026 6.576 Debt Vi: = B. + B assets) itt B BG B Debt-avit+ B3 Interest/CFit+ B4ROAit + Uit Assets SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.329 0.108 0.107 1.769 3554 ANOVA F. 107.405 df 4 3549 3553 Regression Residual Total SS 1344.275 11104.817 12449.092 MS 336.069 3.129 Significance F 0.000 y = Firm Value Intercept Debt/Assets Debt/Assets Squared Interest/Cashflows Return on Assets (ROA) Coefficients Standard Error 3.252 0.087 1.664 0.244 -0.482 0.164 -0.137 0.057 5.997 0.295 t Stat 37.189 6.811 -2.932 -2.425 20.296 P-value 0.000 0.000 0.003 0.015 0.000 Lower 95% 3.081 1.185 -0.804 -0.248 5.418 Upper 95% 3.423 2.143 -0.160 -0.026 6.576

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts