Question: the relevant figures include GST P5-1A on page 262, with the following modifications 1) Prepare journal entries using both the gross and net purchases metho

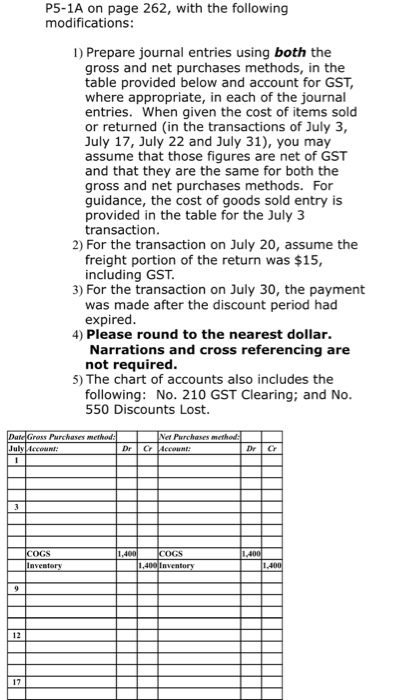

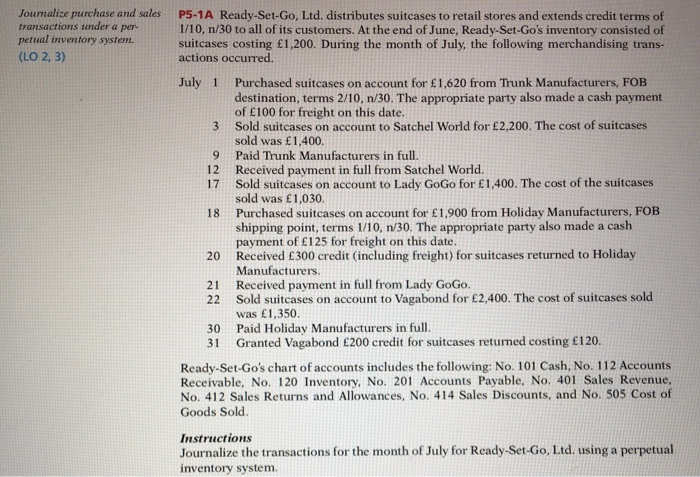

P5-1A on page 262, with the following modifications 1) Prepare journal entries using both the gross and net purchases metho table provided below and account for GST, where appropriate, in each of the journal entries. When given the cost of items sold or returned (in the transactions of July 3, July 17, July 22 and July 31), you may assume that those figures are net of GST and that they are the same for both the gross and net purchases methods. For guidance, the cost of goods sold entry is provided in the table for the July 3 transaction ds, in the 2) For the transaction on July 20, assume the freight portion of the return was $15, including GST 3) For the transaction on July 30, the payment was made after the discount period had expired 4) Please round to the nearest dollar. Narrations and cross referencing are not required 5) The chart of accounts also includes the following: No. 210 GST Clearing; and No 550 Discounts Lost. Gress Purchases method Net Purchases method uly Accoun 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts