Question: The report should include: An Executive Summary giving an overview of the five years. An analysis of performance highlighting the important driving forces for the

The report should include:

An Executive Summary giving an overview of the five years.

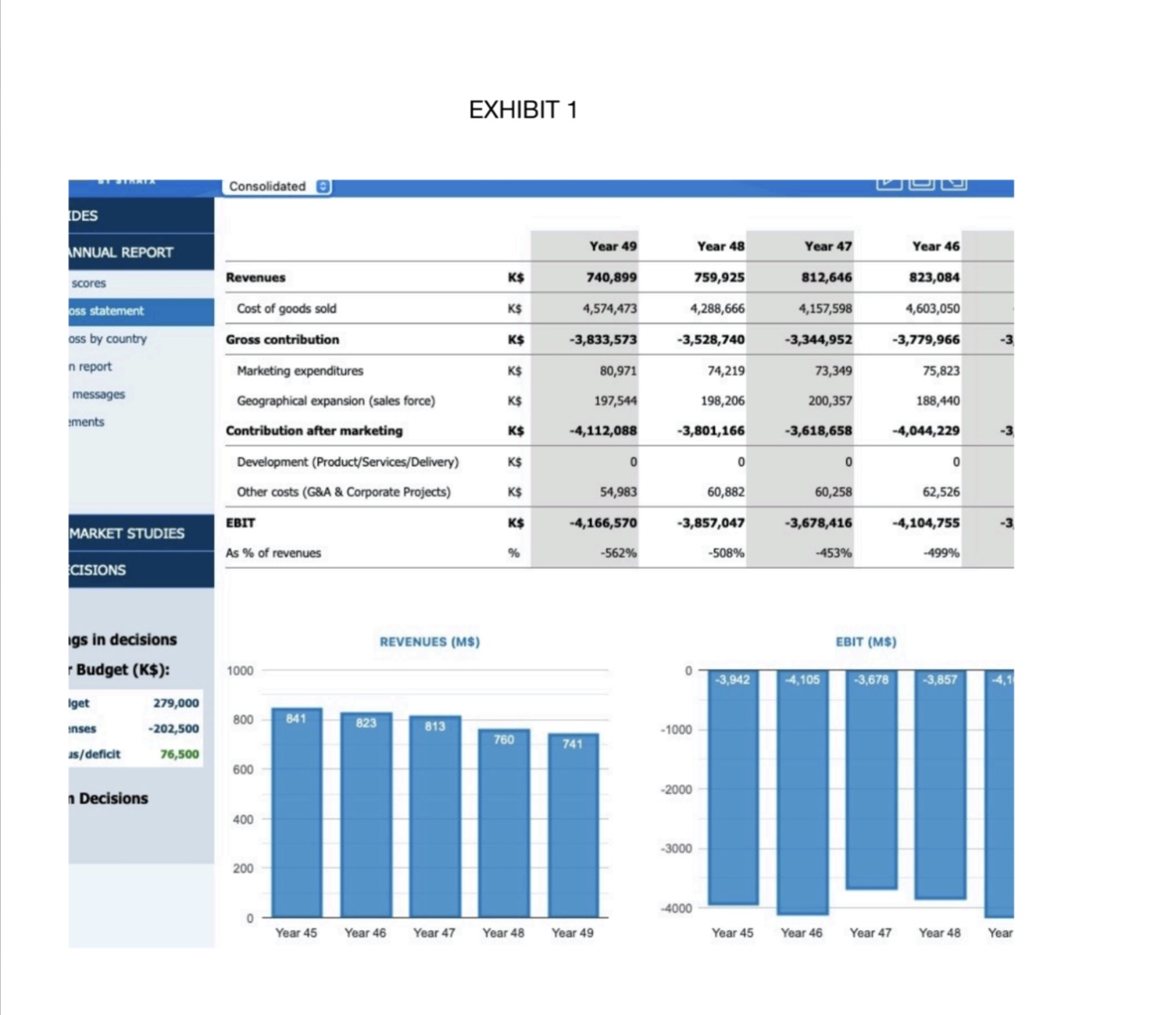

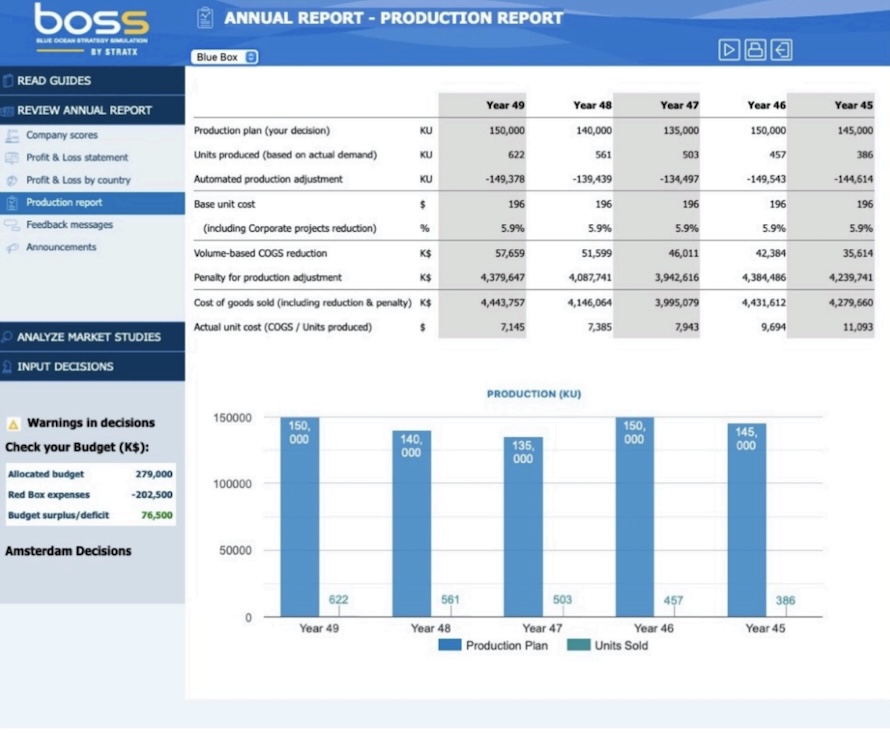

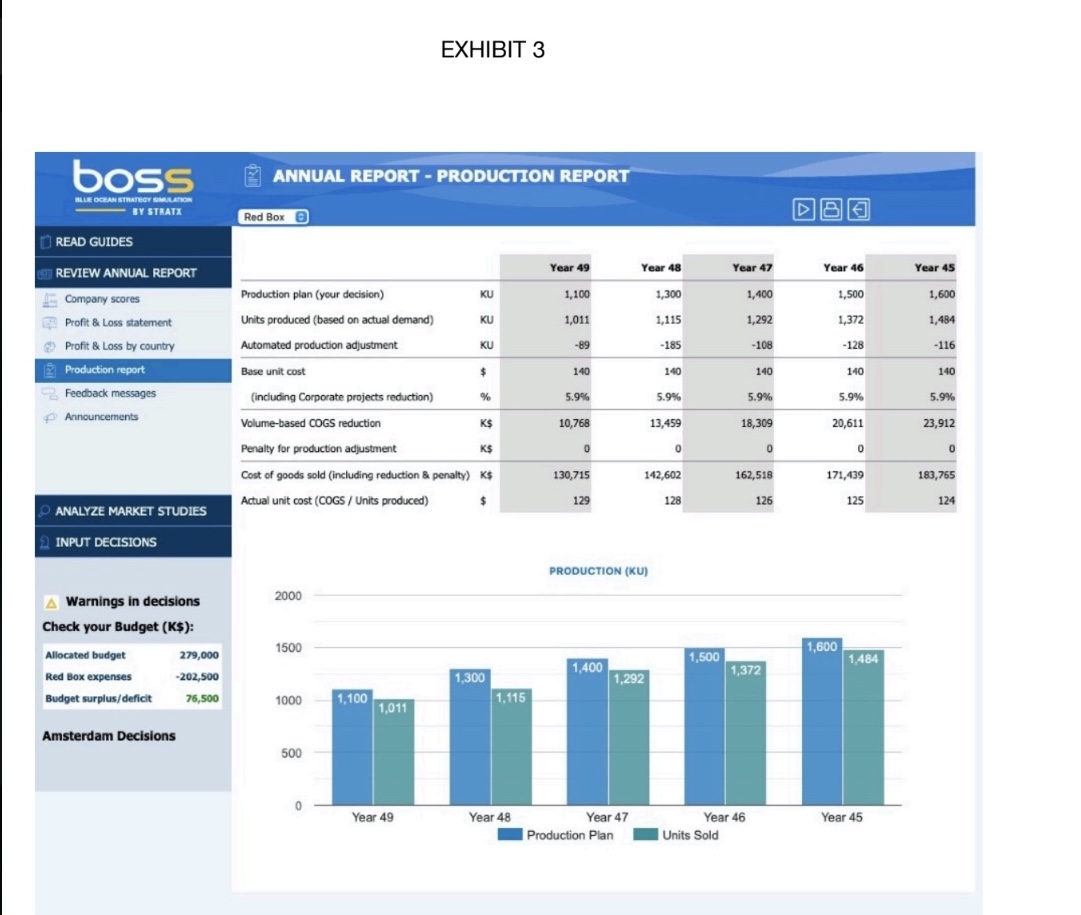

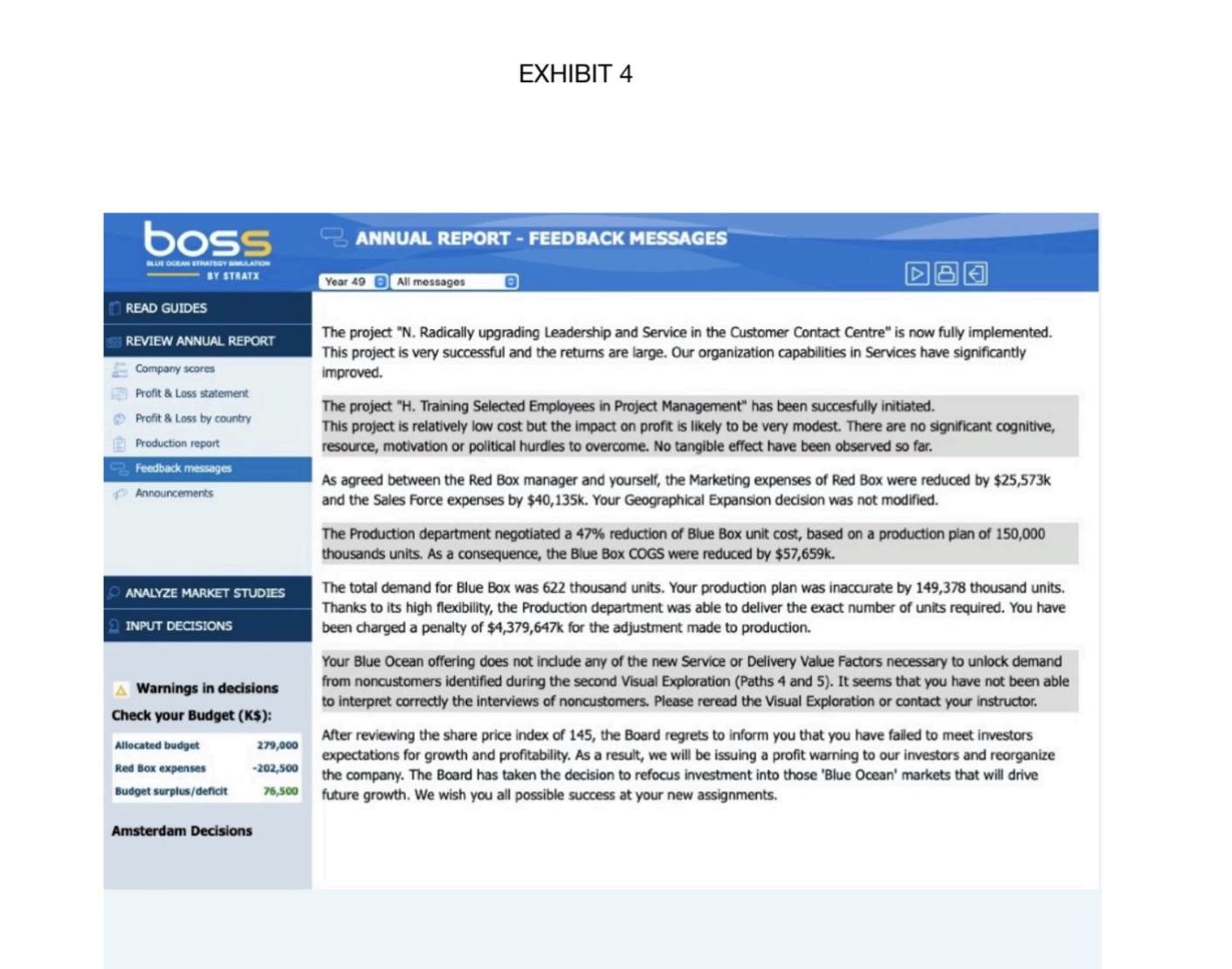

An analysis of performance highlighting the important driving forces for the industry and company (See Exhibits 1, 2, 3, and 4)

(I KNOW EXHIBIT IS MISSING DATA PLEASE DO WITHOUT THE MISSING YEAR)

EXHIBIT 1 ANNUAL REPORT - PRODUCTION REPORT READ GUIDES REVIEW ANNUAL REPORT Company scores Profit \& Loss statement Profit \& Loss by country Production report Feedback messages Announcements ANALYZE MARKET STUDIES INPUT DECISIONS Warnings in decisions Check your Budget (K\$): Amsterdam Decisions EXHIBIT 3 ANNUAL REPORT - FEEDBACK MESSAGES The project "N. Radically upgrading Leadership and Service in the Customer Contact Centre" is now fully implemented. This project is very successful and the returns are large. Our organization capabilities in Services have significantly improved. The project "H. Training Selected Employees in Project Management" has been succesfully initiated. This project is relatively low cost but the impact on profit is likely to be very modest. There are no significant cognitive, resource, motivation or political hurdles to overcome. No tangible effect have been observed so far. As agreed between the Red Box manager and yourself, the Marketing expenses of Red Box were reduced by $25,573k and the Sales Force expenses by $40,135k. Your Geographical Expansion decision was not modified. The Production department negotiated a 47% reduction of Blue Box unit cost, based on a production plan of 150,000 thousands units. As a consequence, the Blue Box COGS were reduced by $57,659K. The total demand for Blue Box was 622 thousand units. Your production plan was inaccurate by 149,378 thousand units. Thanks to its high flexibility, the Production department was able to deliver the exact number of units required. You have been charged a penalty of $4,379,647k for the adjustment made to production. Your Blue Ocean offering does not indude any of the new Service or Delivery Value Factors necessary to unlock demand from noncustomers identified during the second Visual Exploration (Paths 4 and 5). It seems that you have not been able to interpret correctly the interviews of noncustomers. Please reread the Visual Exploration or contact your instructor. After reviewing the share price index of 145 , the Board regrets to inform you that you have failed to meet investors expectations for growth and profitability. As a result, we will be issuing a profit warning to our investors and reorganize the company. The Board has taken the decision to refocus investment into those 'Blue Ocean' markets that will drive future growth. We wish you all possible success at your new assignments. EXHIBIT 1 ANNUAL REPORT - PRODUCTION REPORT READ GUIDES REVIEW ANNUAL REPORT Company scores Profit \& Loss statement Profit \& Loss by country Production report Feedback messages Announcements ANALYZE MARKET STUDIES INPUT DECISIONS Warnings in decisions Check your Budget (K\$): Amsterdam Decisions EXHIBIT 3 ANNUAL REPORT - FEEDBACK MESSAGES The project "N. Radically upgrading Leadership and Service in the Customer Contact Centre" is now fully implemented. This project is very successful and the returns are large. Our organization capabilities in Services have significantly improved. The project "H. Training Selected Employees in Project Management" has been succesfully initiated. This project is relatively low cost but the impact on profit is likely to be very modest. There are no significant cognitive, resource, motivation or political hurdles to overcome. No tangible effect have been observed so far. As agreed between the Red Box manager and yourself, the Marketing expenses of Red Box were reduced by $25,573k and the Sales Force expenses by $40,135k. Your Geographical Expansion decision was not modified. The Production department negotiated a 47% reduction of Blue Box unit cost, based on a production plan of 150,000 thousands units. As a consequence, the Blue Box COGS were reduced by $57,659K. The total demand for Blue Box was 622 thousand units. Your production plan was inaccurate by 149,378 thousand units. Thanks to its high flexibility, the Production department was able to deliver the exact number of units required. You have been charged a penalty of $4,379,647k for the adjustment made to production. Your Blue Ocean offering does not indude any of the new Service or Delivery Value Factors necessary to unlock demand from noncustomers identified during the second Visual Exploration (Paths 4 and 5). It seems that you have not been able to interpret correctly the interviews of noncustomers. Please reread the Visual Exploration or contact your instructor. After reviewing the share price index of 145 , the Board regrets to inform you that you have failed to meet investors expectations for growth and profitability. As a result, we will be issuing a profit warning to our investors and reorganize the company. The Board has taken the decision to refocus investment into those 'Blue Ocean' markets that will drive future growth. We wish you all possible success at your new assignments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts