Question: the require is 1,2 and 3 2-6 General Long-term Liability and Capital Asset Transactions. The Village of Nassau issued a 3 -year, 6 percent note

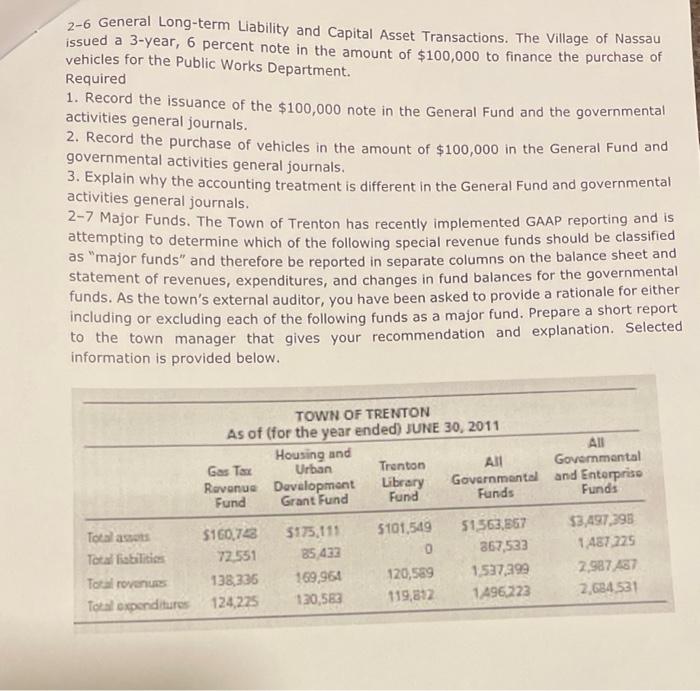

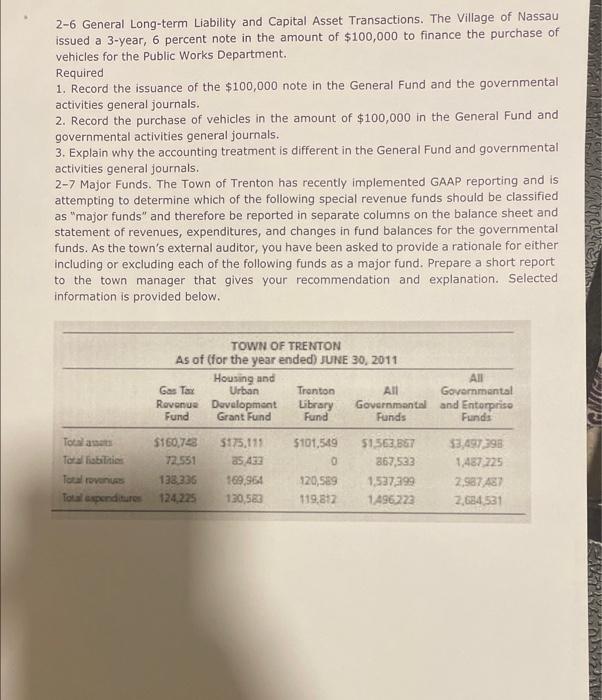

2-6 General Long-term Liability and Capital Asset Transactions. The Village of Nassau issued a 3 -year, 6 percent note in the amount of $100,000 to finance the purchase of vehicles for the Public Works Department. Required 1. Record the issuance of the $100,000 note in the General Fund and the governmental activities general journals. 2. Record the purchase of vehicles in the amount of $100,000 in the General Fund and governmental activities general journals. 3. Explain why the accounting treatment is different in the General Fund and governmental activities general journals. 2-7 Major Funds. The Town of Trenton has recently implemented GAAP reporting and is attempting to determine which of the following special revenue funds should be classified as "major funds" and therefore be reported in separate columns on the balance sheet and statement of revenues, expenditures, and changes in fund balances for the governmental funds. As the town's external auditor, you have been asked to provide a rationale for either including or excluding each of the following funds as a major fund. Prepare a short report to the town manager that gives your recommendation and explanation. Selected information is provided below. 2-6 General Long-term Liability and Capital Asset Transactions. The Village of Nassau issued a 3 -year, 6 percent note in the amount of $100,000 to finance the purchase of vehicles for the Public Works Department. Required 1. Record the issuance of the $100,000 note in the General Fund and the governmental activities general journals. 2. Record the purchase of vehicles in the amount of $100,000 in the General Fund and governmental activities general journals. 3. Explain why the accounting treatment is different in the General Fund and governmental activities general journals. 2-7 Major Funds. The Town of Trenton has recently implemented GAAP reporting and is attempting to determine which of the following special revenue funds should be classified as "major funds" and therefore be reported in separate columns on the balance sheet and statement of revenues, expenditures, and changes in fund balances for the governmental funds. As the town's external auditor, you have been asked to provide a rationale for either including or excluding each of the following funds as a major fund. Prepare a short report to the town manager that gives your recommendation and explanation. Selected information is provided below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts