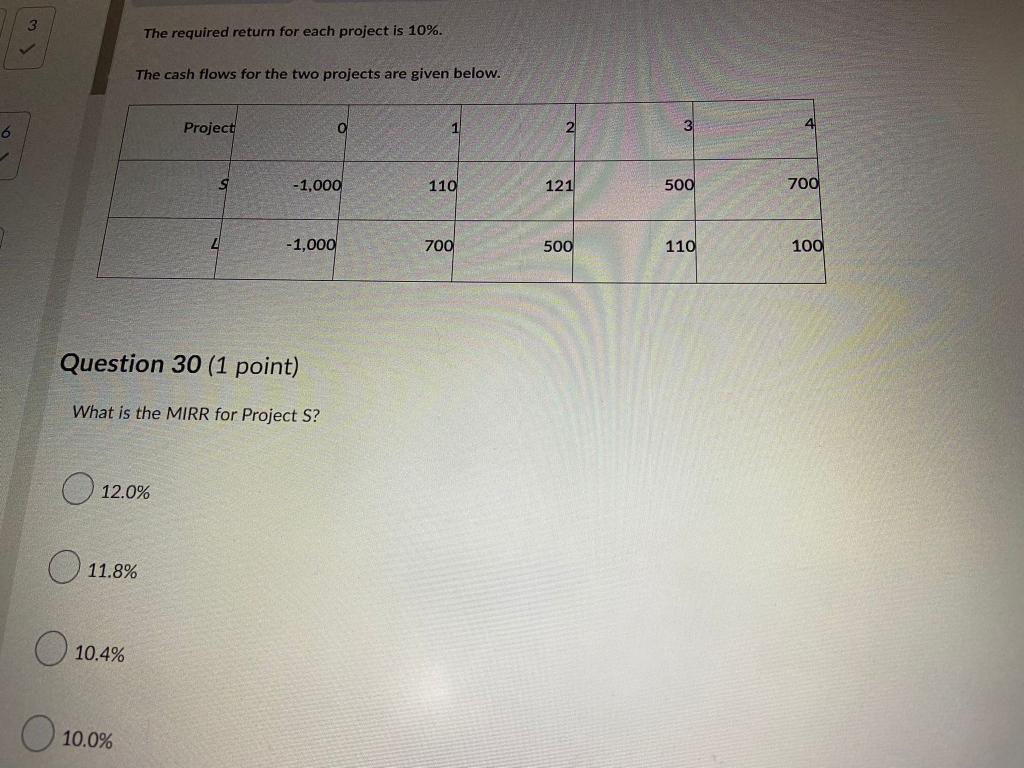

Question: The required return for each project is 10%. The cash flows for the two projects are given below. 6 Project 1 2 3 s -1,000

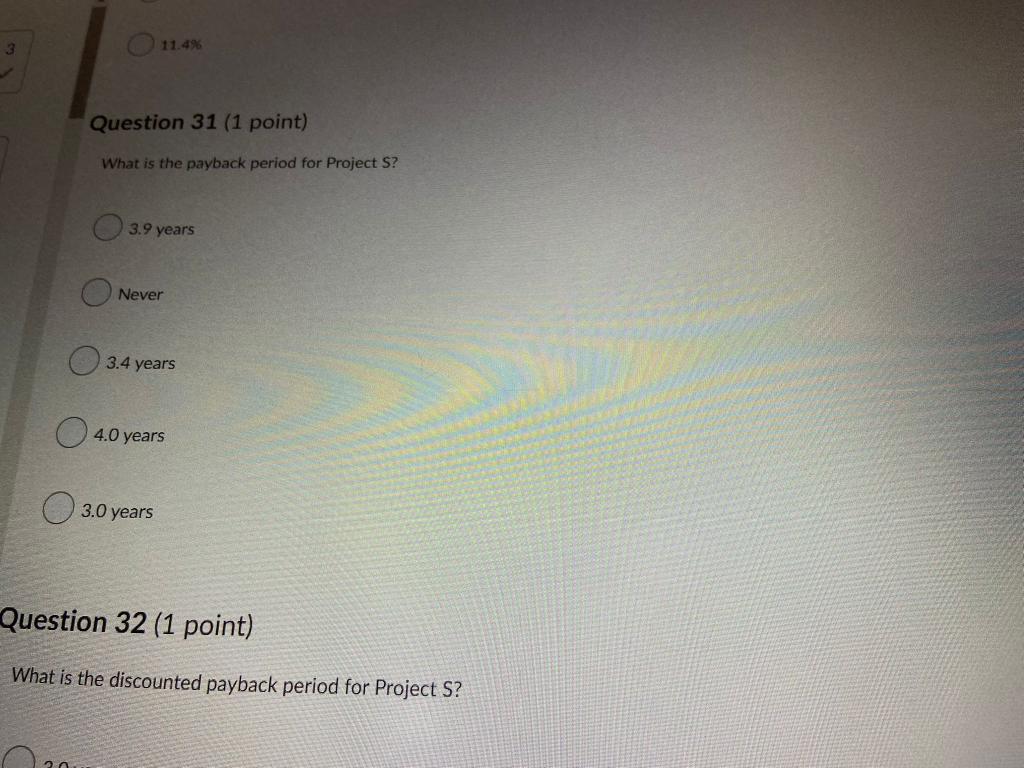

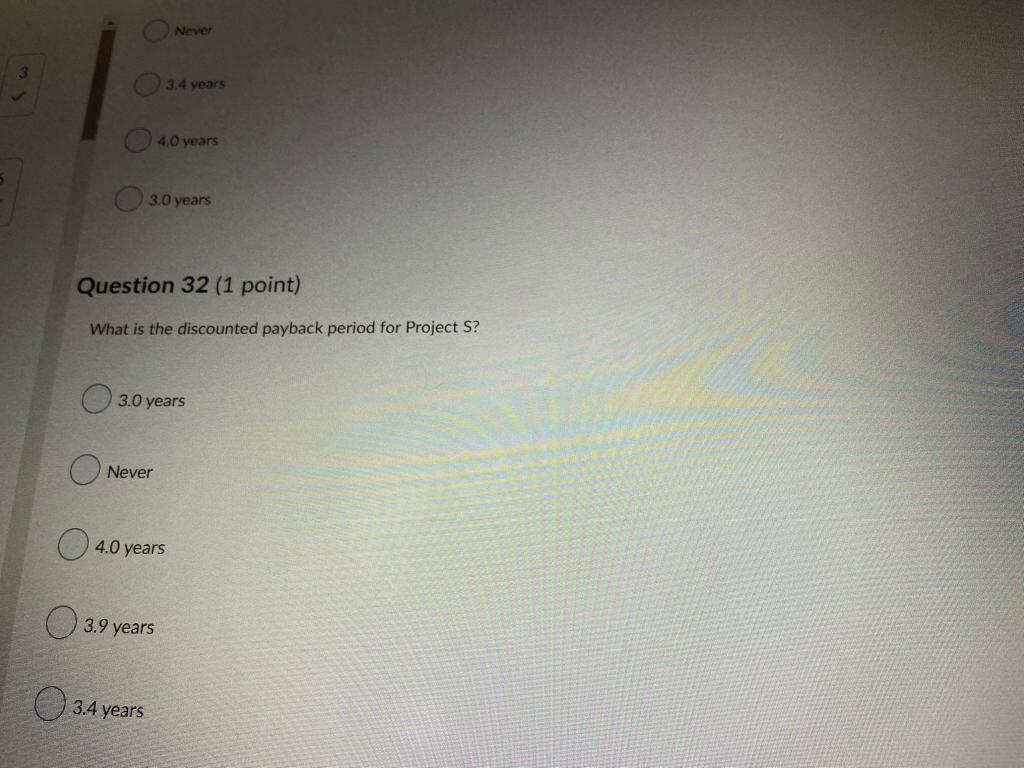

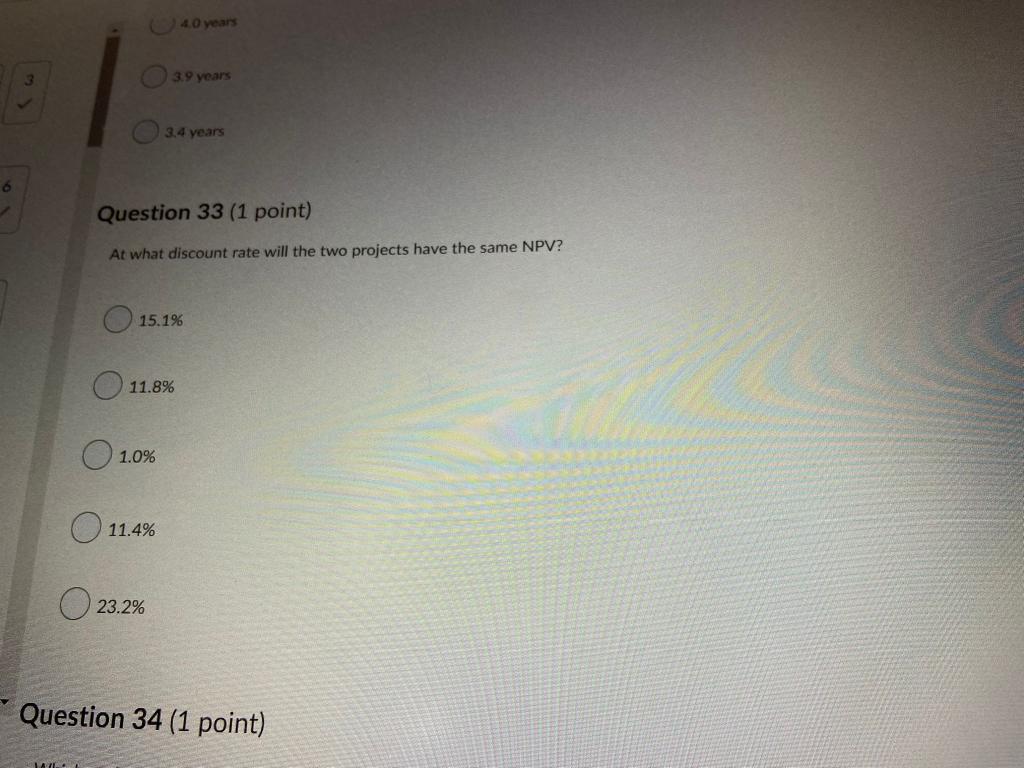

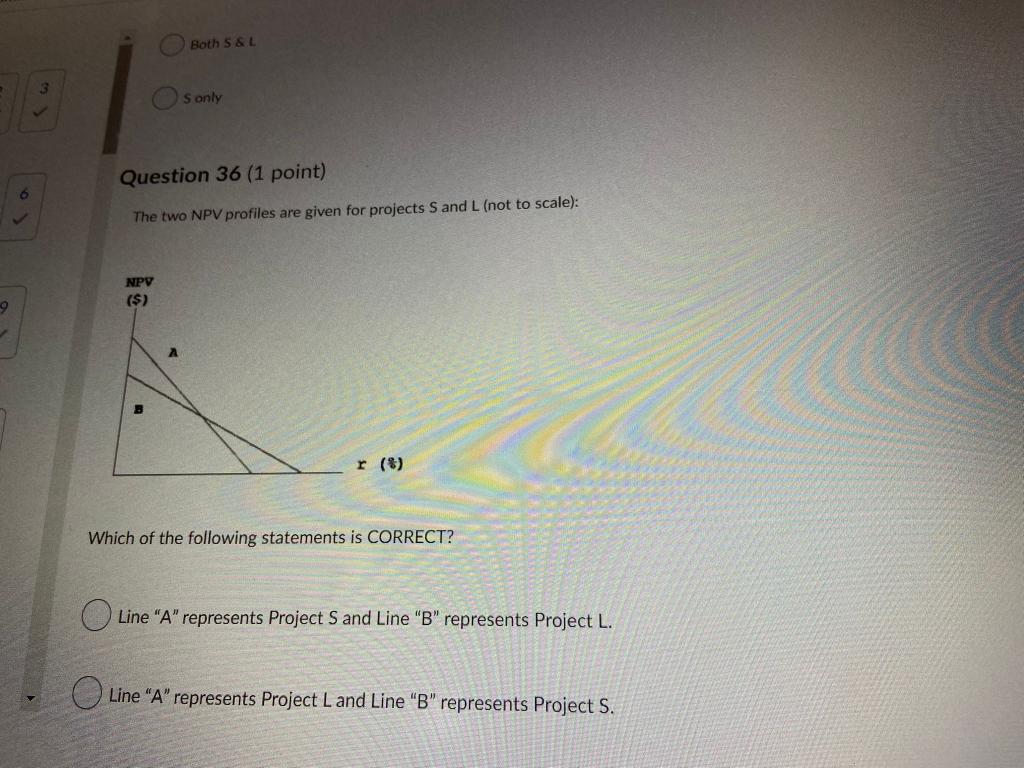

The required return for each project is 10%. The cash flows for the two projects are given below. 6 Project 1 2 3 s -1,000 110 121 500 700 2 -1,000 700 500 110 100 Question 30 (1 point) What is the MIRR for Project S? 12.0% 11.8% 10.4% O 10.0% 3 11.4% Question 31 (1 point) What is the payback period for Project S? 3.9 years Never 3.4 years 4.0 years 3.0 years Question 32 (1 point) What is the discounted payback period for Project S? Never 3.4 years 4.0 years 3.0 years Question 32 (1 point) What is the discounted payback period for Project S? 3.0 years Never 4.0 years 3.9 years 03.4 years 4.0 years 3 3.9 years 3.4 years 6. Question 33 (1 point) At what discount rate will the two projects have the same NPV? 15.1% 11.8% 1.0% 11.4% 23.2% Question 34 (1 point) LAL 1.09 11.4% 23.2% Question 34 (1 point) Which project(s) should be accepted if the two projects are independent? Neither S nor L Lonly Both S and L S only Question 35 (1 point) Which project(s) should be accepted if the two projects are mutually exclusive? 1: Neither S norL 2 3 L only Both S and L S only 9 Question 35 (1 point) Which project(s) should be accepted if the two projects are mutually exclusive? 2 Neither S nor L Lonly Both S&L sonly Both S&L S only Question 36 (1 point) The two NPV profiles are given for projects S and L (not to scale): NPV ($) r (8) Which of the following statements is CORRECT? Line "A" represents Project S and Line "B" represents Project L. Line "A" represents Project Land Line "B" represents Project S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts