Question: - The requisite data is daily and should go back five years, i.e., it should run from March or October five years ago (T -

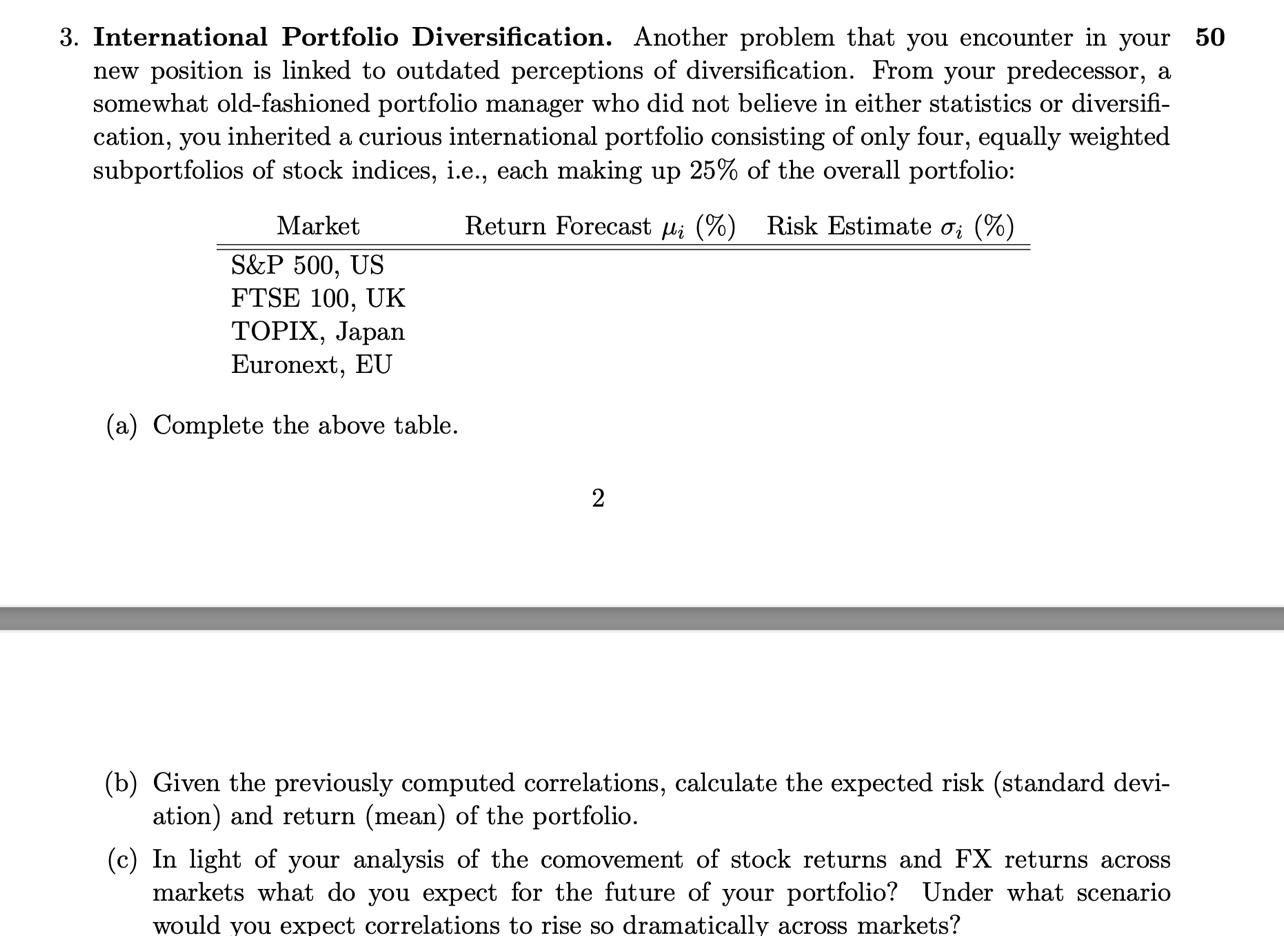

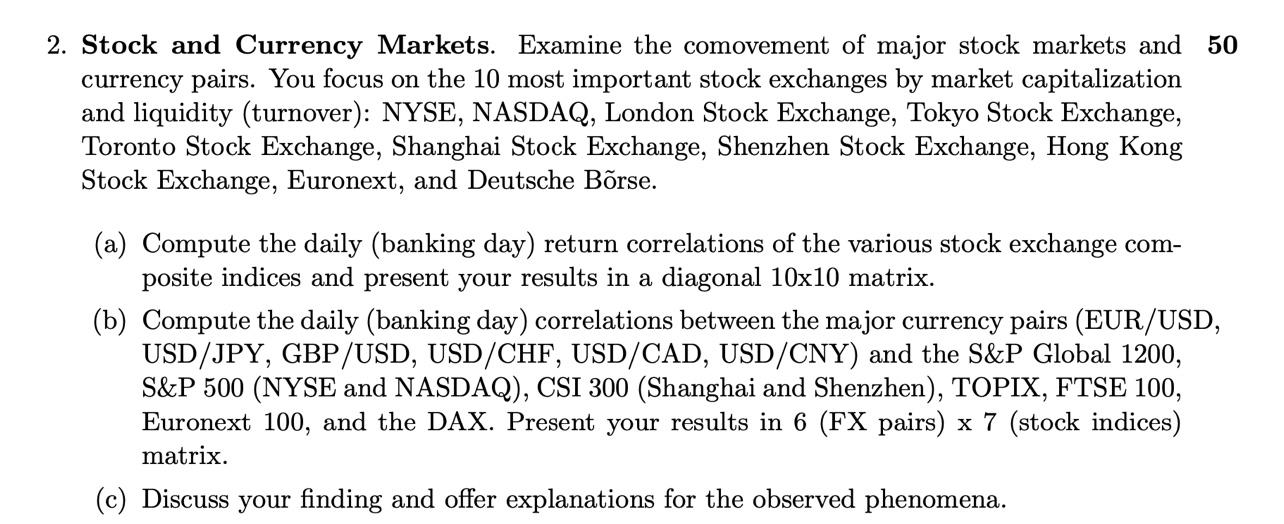

- The requisite data is daily and should go back five years, i.e., it should run from March or October five years ago (T - 5) to April or November of this year (T) depending on the semester (spring or fall). All the calculations can be carried out either in Bloomberg or by downloading the data and using Excel depending on your preferences. Depending on the mode of instruction, 3. International Portfolio Diversification. Another problem that you encounter in your 50 new position is linked to outdated perceptions of diversification. From your predecessor, a somewhat old-fashioned portfolio manager who did not believe in either statistics or diversifi- cation, you inherited a curious international portfolio consisting of only four, equally weighted subportfolios of stock indices, i.e., each making up 25% of the overall portfolio: a Return Forecast Mi (%) Risk Estimate oi (%) Market S&P 500, US FTSE 100, UK TOPIX, Japan Euronext, EU (a) Complete the above table. 2 (b) Given the previously computed correlations, calculate the expected risk (standard devi- ation) and return (mean) of the portfolio. (c) In light of your analysis of the comovement of stock returns and FX returns across markets what do you expect for the future of your portfolio? Under what scenario would you expect correlations to rise so dramatically across markets? 2. Stock and Currency Markets. Examine the comovement of major stock markets and 50 currency pairs. You focus on the 10 most important stock exchanges by market capitalization and liquidity (turnover): NYSE, NASDAQ, London Stock Exchange, Tokyo Stock Exchange, Toronto Stock Exchange, Shanghai Stock Exchange, Shenzhen Stock Exchange, Hong Kong Stock Exchange, Euronext, and Deutsche Brse. (a) Compute the daily (banking day) return correlations of the various stock exchange com- posite indices and present your results in a diagonal 10x10 matrix. (b) Compute the daily (banking day) correlations between the major currency pairs (EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, USD/CNY) and the S&P Global 1200, S&P 500 (NYSE and NASDAQ), CSI 300 (Shanghai and Shenzhen), TOPIX, FTSE 100, Euronext 100, and the DAX. Present your results in 6 (FX pairs) x 7 (stock indices) matrix. (c) Discuss your finding and offer explanations for the observed phenomena. - The requisite data is daily and should go back five years, i.e., it should run from March or October five years ago (T - 5) to April or November of this year (T) depending on the semester (spring or fall). All the calculations can be carried out either in Bloomberg or by downloading the data and using Excel depending on your preferences. Depending on the mode of instruction, 3. International Portfolio Diversification. Another problem that you encounter in your 50 new position is linked to outdated perceptions of diversification. From your predecessor, a somewhat old-fashioned portfolio manager who did not believe in either statistics or diversifi- cation, you inherited a curious international portfolio consisting of only four, equally weighted subportfolios of stock indices, i.e., each making up 25% of the overall portfolio: a Return Forecast Mi (%) Risk Estimate oi (%) Market S&P 500, US FTSE 100, UK TOPIX, Japan Euronext, EU (a) Complete the above table. 2 (b) Given the previously computed correlations, calculate the expected risk (standard devi- ation) and return (mean) of the portfolio. (c) In light of your analysis of the comovement of stock returns and FX returns across markets what do you expect for the future of your portfolio? Under what scenario would you expect correlations to rise so dramatically across markets? 2. Stock and Currency Markets. Examine the comovement of major stock markets and 50 currency pairs. You focus on the 10 most important stock exchanges by market capitalization and liquidity (turnover): NYSE, NASDAQ, London Stock Exchange, Tokyo Stock Exchange, Toronto Stock Exchange, Shanghai Stock Exchange, Shenzhen Stock Exchange, Hong Kong Stock Exchange, Euronext, and Deutsche Brse. (a) Compute the daily (banking day) return correlations of the various stock exchange com- posite indices and present your results in a diagonal 10x10 matrix. (b) Compute the daily (banking day) correlations between the major currency pairs (EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, USD/CNY) and the S&P Global 1200, S&P 500 (NYSE and NASDAQ), CSI 300 (Shanghai and Shenzhen), TOPIX, FTSE 100, Euronext 100, and the DAX. Present your results in 6 (FX pairs) x 7 (stock indices) matrix. (c) Discuss your finding and offer explanations for the observed phenomena

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts