Question: The responses are still incorrect even if I put parentheses around the amount. Please assist. Maybe my numbers are off. On December 31, Pacifica, Inc.,

The responses are still incorrect even if I put parentheses around the amount. Please assist. Maybe my numbers are off.

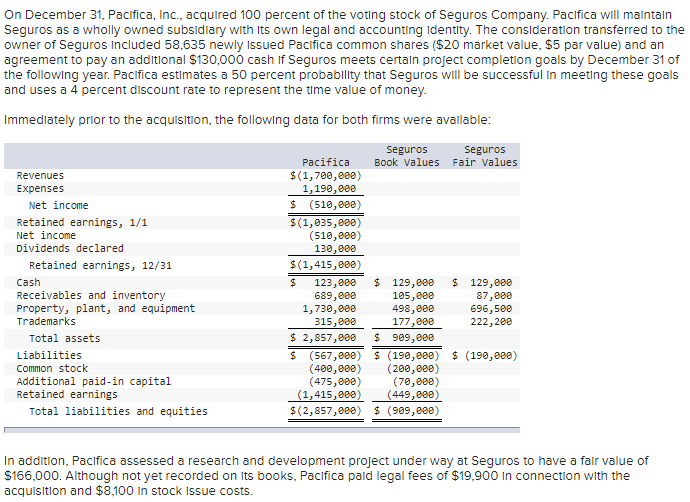

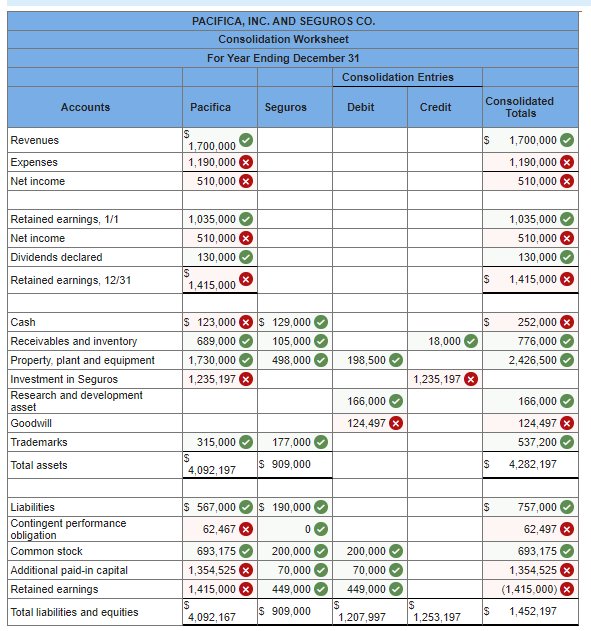

On December 31, Pacifica, Inc., acquired 100 percent of the voting stock of Seguros Company. Pacifica will maintain Seguros as a wholly owned subsidiary with its own legal and accounting Identity. The consideration transferred to the owner of Seguros included 58,635 newly Issued Pacifica common shares ($20 market value, $5 par value) and an agreement to pay an additional $130,000 cash If Seguros meets certain project completion goals by December 31 of the following year. Pacifica estimates a 50 percent probability that Seguros will be successful in meeting these goals and uses a 4 percent discount rate to represent the time value of money. Immediately prior to the acquisition, the following data for both firms were available: Seguros Seguros Pacifica Book values Fair values Revenues $(1,700,880) Expenses 1,190,000 Net income $ (510,000) Retained earnings, 1/1 $(1,035,880) Net income (510,880) Dividends declared 130,000 Retained earnings, 12/31 $(1,415,000) Cash $ 123,888 $ 129,880 $ 129,000 Receivables and inventory 689,000 105,000 87,000 Property, plant, and equipment 1,730,000 498,888 696,500 Trademarks 315,000 177,000 222,200 Total assets $ 2,857,800 $ 909,888 Liabilities $ (567,880) $ (190,880) $ (190,880) Common stock (480,880) (200,000) Additional paid-in capital (475,000) (70,880) Retained earnings (1,415,880) (449,000) Total liabilities and equities $(2,857,880) $ (909,880) In addition, Pacifica assessed a research and development project under way at Seguros to have a fair value of $166,000. Although not yet recorded on its books, Pacifica pald legal fees of $19,900 In connection with the acquisition and $8,100 in stock Issue costs. PACIFICA, INC. AND SEGUROS CO. Consolidation Worksheet For Year Ending December 31 Consolidation Entries Accounts Pacifica Seguros Debit Credit Consolidated Totals S Revenues Expenses Net income S 1,700,000 1,190,000 510,000 1,700,000 1,190,000 510,000 1,035,000 Retained earnings, 1/1 Net income Dividends declared 1,035,000 510,000 130,000 S 1,415,000 510,000 130,000 Retained earnings, 12/31 S 1,415,000 $ 18,000 $ 123,000 $ 129,000 689,000 105,000 1,730,000 498,000 1.235,197 252,000 776,000 2,426,500 Cash Receivables and inventory Property, plant and equipment Investment in Seguros Research and development asset Goodwill Trademarks 198,500 1,235,197 166,000 166,000 124,497 124,497 x 537,200 315,000 S 4,092,197 177,000 S 909,000 Total assets S 4,282, 197 > IS 757,000 Liabilities Contingent performance obligation Common stock Additional paid-in capital Retained earnings Total liabilities and equities S 567,000 $ 190,000 62,467 x 0 693,175 200,000 1,354,525 70,000 1,415,000 449,000 S s 909,000 4,092, 167 200,000 70,000 449,000 $ 1,207,997 62,497 693,175 1,354.525 X (1,415,000) IS 1,253,197 IS 1,452,197

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts