Question: The return on common stockholders' equity is computed by dividing net income available to common stockholders by A) average total stockholders' equity B) ending total

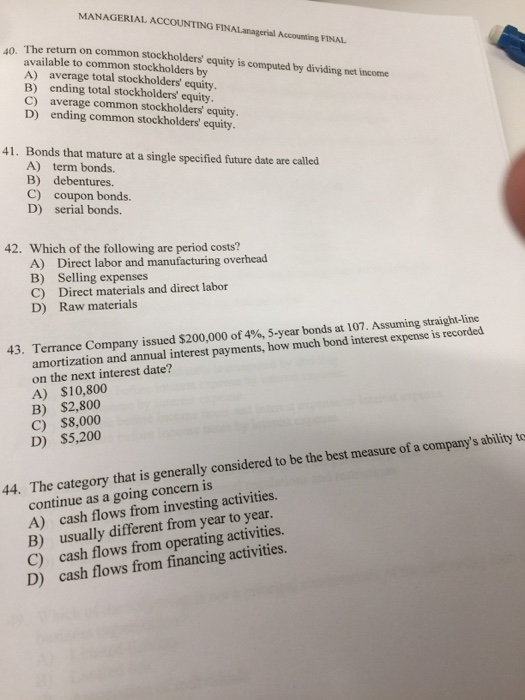

The return on common stockholders' equity is computed by dividing net income available to common stockholders by A) average total stockholders' equity B) ending total stockholders' equity. C) average common stockholders' equity. D) ending common stockholders' equity. Bonds that mature at a single specified future date are called A) term bonds. B) debentures. C) coupon bonds. D) serial bonds. Which of the following are period costs? A) Direct labor and manufacturing overhead B) Selling expenses. C) Direct materials and direct labor D) Raw materials Terrance Company issued $200,000 of 4% 5-year bonds at 107. Assuming straight line amortization and annual interest payments, how much bond interest expense is recorded on the next interest date? A) $10, 800 B) $2, 800 C. $8,000 D) $5, 200 The category that is generally considered to be the best measure of a company's ability to continue as a going concern is A) cash flows from investing activities. B) usually different from year to year C) cash flows from operating activities D) cash flows from financing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts