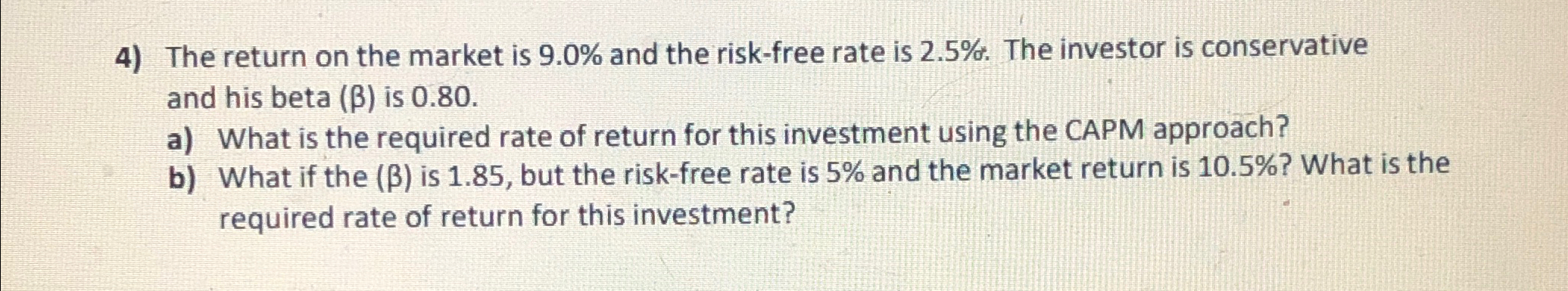

Question: The return on the market is 9 . 0 % and the risk - free rate is 2 . 5 % . The investor is

The return on the market is and the riskfree rate is The investor is conservative and his beta is

a What is the required rate of return for this investment using the CAPM approach?

b What if the is but the riskfree rate is and the market return is What is the required rate of return for this investment?

SHOW ALL WORK IN EXCEL FORMAT FOR A LIKE.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Solution We will use the Capital Asset Pricing Model CAPM formula Ri Rf beta Rm Rf Where Ri R... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock