Question: The risk - free rate would increase while corporate bond yields remain stable. The spread between corporate bond yields and the risk - free rate

The riskfree rate would increase while corporate bond yields remain stable.

The spread between corporate bond yields and the riskfree rate would narrow.

Question

pts

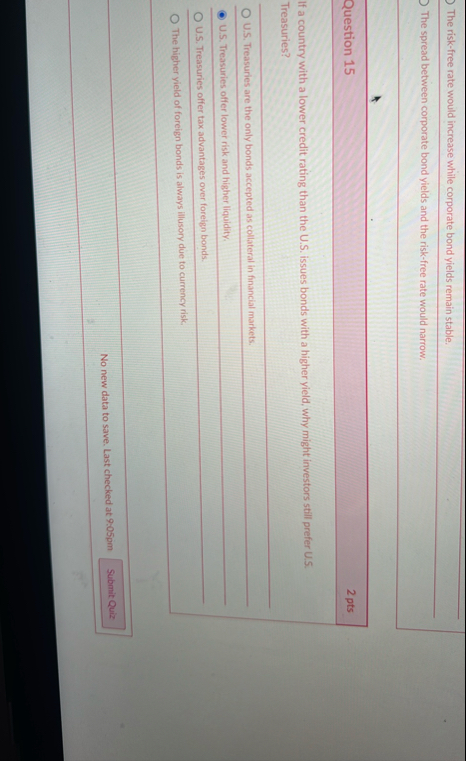

If a country with a lower credit rating than the US issues bonds with a higher yield, why might investors still prefer US Treasuries?

US Treasuries are the only bonds accepted as collateral in financial markets.

He Treacuries offer lower risk and higher liquidity.

US Treasuries offer tax advantages over foreign bonds.

The higher yield of foreign bonds is always illusory due to currency risk.

No new data to save. Last checked at :pm

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock