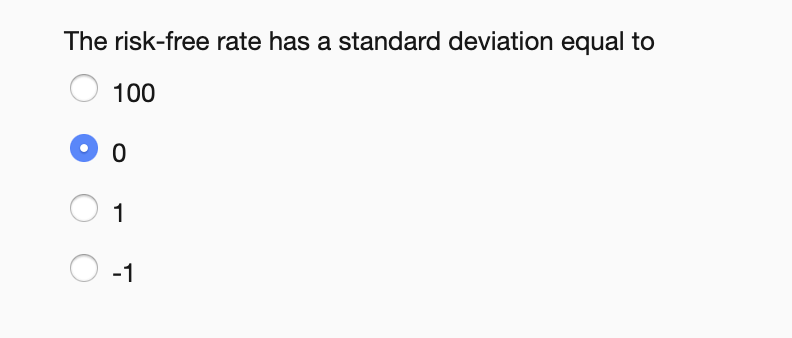

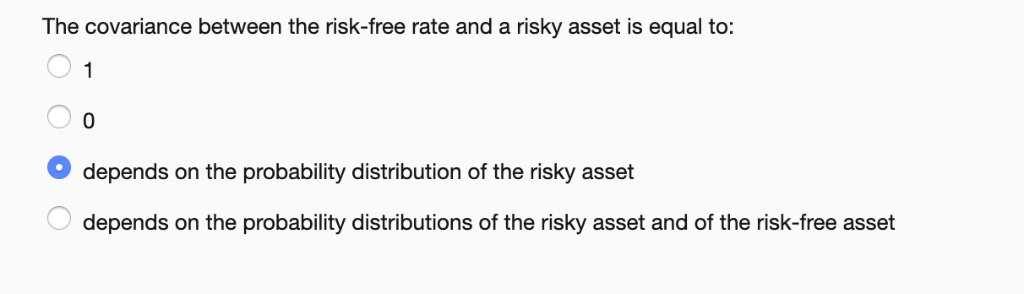

Question: The risk-free rate has a standard deviation equal to 100 0 -1 The covariance between the risk-free rate and a risky asset is equal to:

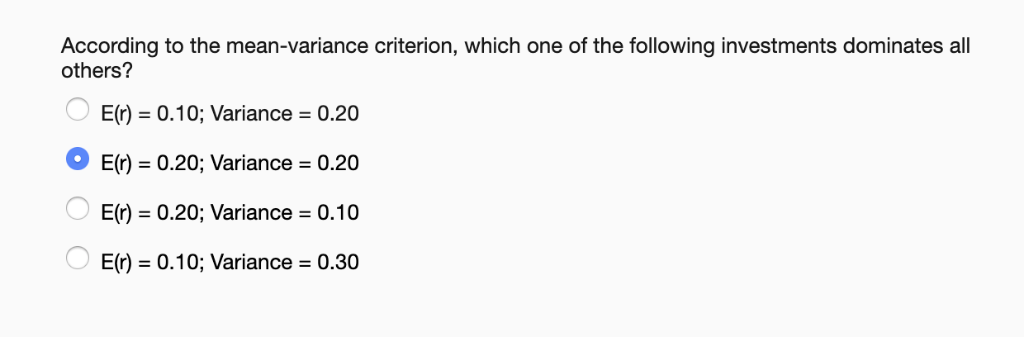

The risk-free rate has a standard deviation equal to 100 0 -1 The covariance between the risk-free rate and a risky asset is equal to: O o 0 depends on the probability distribution of the risky asset depends on the probability distributions of the risky asset and of the risk-free asset According to the mean-variance criterion, which one of the following investments dominates all others? E(r) 0.10; Variance 0.20 O E(r)-0.20; Variances 0.20 E(r) 0.20; Variance 0.10 E(r) 0.10; Variance 0.30

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock