Question: The risk-free rate is 10% per annum, the expected return on the market is 18% per annum, and the standard deviation of the market

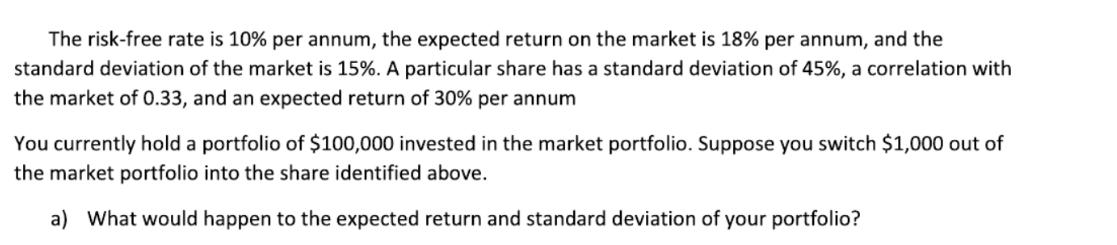

The risk-free rate is 10% per annum, the expected return on the market is 18% per annum, and the standard deviation of the market is 15%. A particular share has a standard deviation of 45%, a correlation with the market of 0.33, and an expected return of 30% per annum You currently hold a portfolio of $100,000 invested in the market portfolio. Suppose you switch $1,000 out of the market portfolio into the share identified above. a) What would happen to the expected return and standard deviation of your portfolio?

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

To calculate the expected return and standard deviation of your portfolio after switching 1000 out o... View full answer

Get step-by-step solutions from verified subject matter experts