Question: The risk-free rate of return is 7.0%, the expected rate of return on the market portfolio is 14%, and the stock of Xyrong Corporation has

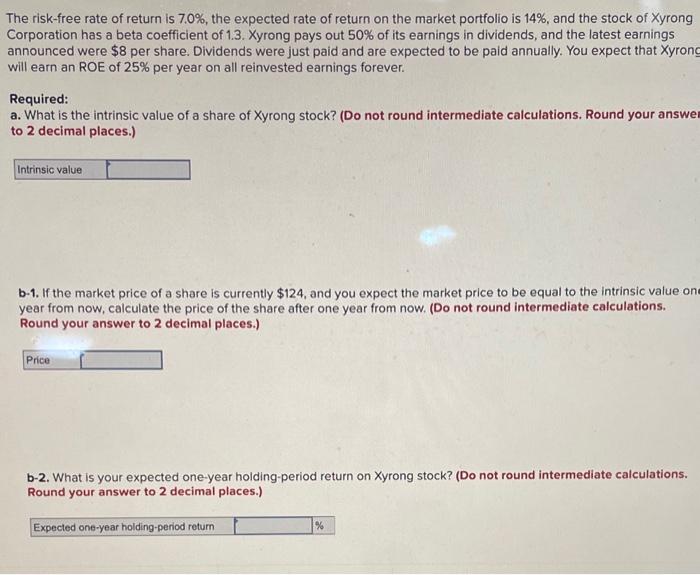

The risk-free rate of return is 7.0%, the expected rate of return on the market portfolio is 14%, and the stock of Xyrong Corporation has a beta coefficient of 1.3. Xyrong pays out 50% of its earnings in dividends, and the latest earnings announced were $8 per share. Dividends were just paid and are expected to be paid annually. You expect that Xyrong will earn an ROE of 25% per year on all reinvested earnings forever. Required: a. What is the intrinsic value of a share of Xyrong stock? (Do not round intermediate calculations. Round your answe to 2 decimal places.) b-1. If the market price of a share is currently $124, and you expect the market price to be equal to the intrinsic value on year from now, calculate the price of the share after one year from now. (Do not round intermediate calculations. Round your answer to 2 decimal places.) b-2. What is your expected one-year holding-period return on Xyrong stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts