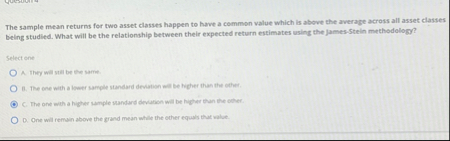

Question: The sample mean returns for two asset classes happen to have a common walue which is above the average across all asset classes being studied.

The sample mean returns for two asset classes happen to have a common walue which is above the average across all asset classes being studied. What will be the relationship between their expected return estimates using the jamesStein methodology?

Select one

The one with a lower sample standard devation wal be higher than the other.

C The one with a higher rample standard devation will be higher than the obver.

in cone wall remain ahove the erand mean while the other equals that value.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock