Question: The Sampsons-A Continuing Case: Chapter 3 NAME DATE MyLab Finance LO Dave and Sharon Sampson recently established a plan to save $300 per month (or

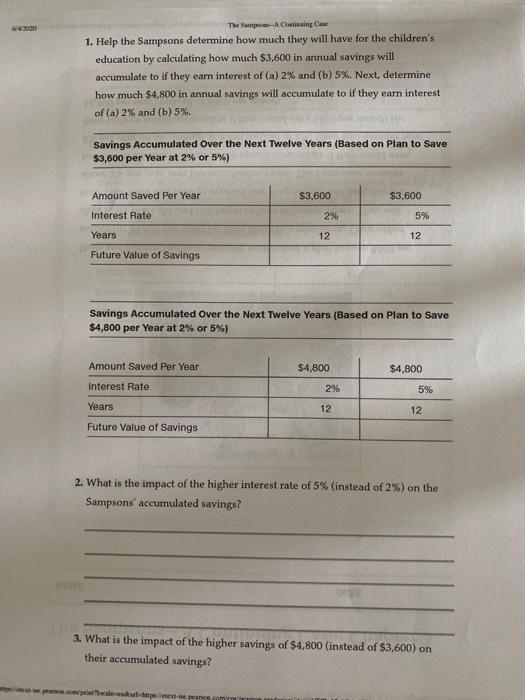

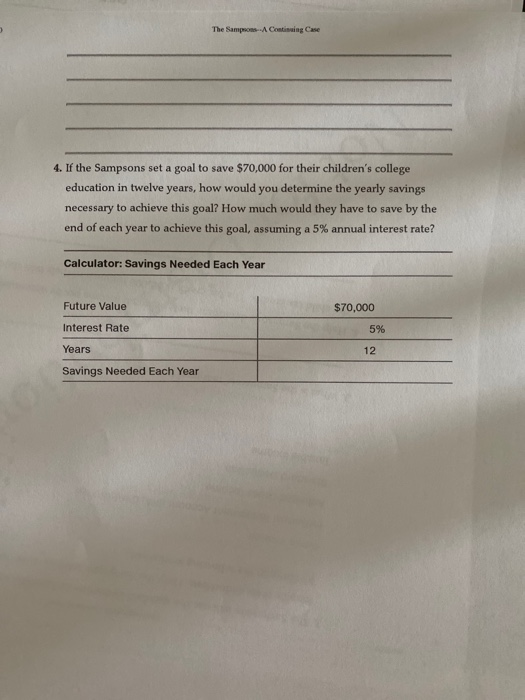

The Sampsons-A Continuing Case: Chapter 3 NAME DATE MyLab Finance LO Dave and Sharon Sampson recently established a plan to save $300 per month (or $3,600 per year) for their children's education. Their oldest child is six years old and will begin college in twelve years. They will invest the $300 in a savings account that they expect will earn interest of about 2% per year over the next twelve years. The Sampsons wonder how much additional money they would accumulate if they could earn 5% per year on the savings account instead of 2%. They also wonder how their savings would accumulate if they could save $400 per month (or $4,800 per year) instead of $300 per month. The Sam Continuing Case 1. Help the Sampsons determine how much they will have for the children's education by calculating how much $3,600 in annual savings will accumulate to if they earn interest of (a) 2% and (b) 5%. Next, determine how much $4,800 in annual savings will accumulate to if they earn interest of (a) 2% and (b) 5%. Savings Accumulated Over the Next Twelve Years (Based on Plan to Save $3,600 per Year at 2% or 5%) Amount Saved Per Year $3,600 $3,600 Interest Rate 2% 5% Years 12 12 Future Value of Savings Savings Accumulated Over the Next Twelve Years (Based on Plan to Save $4,800 per Year at 2% or 5%) Amount Saved Per Year $4,800 $4,800 2% 5% Interest Rate Years 12 12 Future Value of Savings 2. What is the impact of the higher interest rate of 5% (instead of 2%) on the Sampsons' accumulated savings? 3. What is the impact of the higher savings of $4,800 (instead of $3,600) on their accumulated savings? peisepas.com The Sampsons-A Continuing Case 4. If the Sampsons set a goal to save $70,000 for their children's college education in twelve years, how would you determine the yearly savings necessary to achieve this goal? How much would they have to save by the end of each year to achieve this goal, assuming a 5% annual interest rate? Calculator: Savings Needed Each Year Future Value $70,000 Interest Rate 5% Years 12 Savings Needed Each Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts