Question: The second page is answer to (a), please check whether it is correct Please help with (b) and (c) Supply Chain Questoin > > 2

The second page is answer to (a), please check whether it is correct

Please help with (b) and (c) Supply Chain Questoin

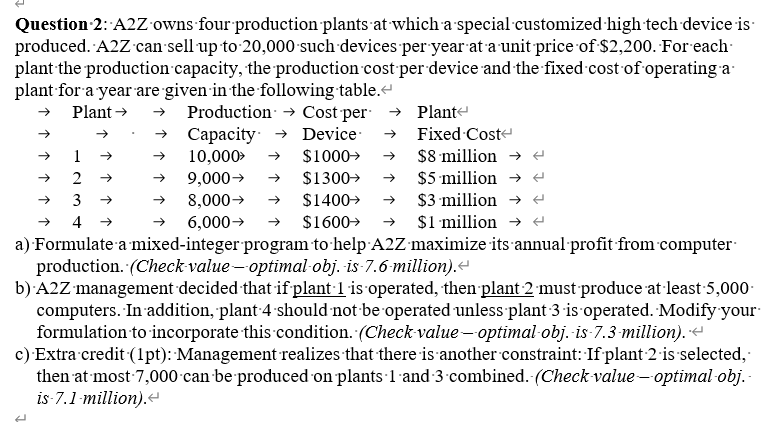

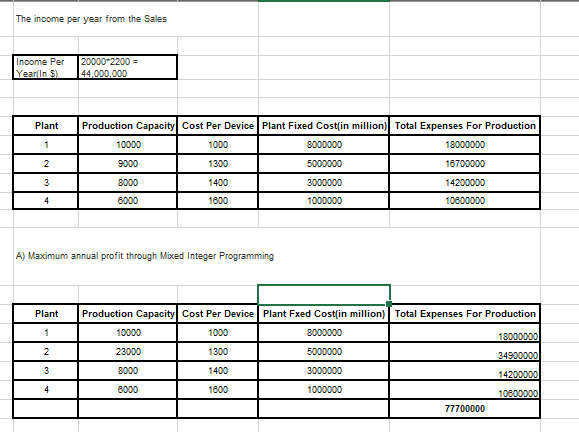

> > 2 Question-2: A2Z owns four production plants at which a special customized high tech device is produced. A2Z can sell up to 20,000 such devices per year at a unit price of $2,200. For each plant the production capacity, the production cost per device and the fixed cost of operating a plant for a year are given in the following table. Plant Production Cost per Plante Capacity Device Fixed Cost 1 10,000 $1000 $8 million 9,000 $1300 $5 million 3 8,000 $1400 $3 million 4 6,000 $1600 $1 million a) Formulate a mixed-integer program to help A2Z maximize its annual profit from computer production. (Check-value-optimal-obj. is-7.6 million). b) A2Z management decided that if plant-1 is operated, then plant 2 must produce at least 5,000 computers. In addition, plant:4 should not be operated unless plant 3-is operated. Modify your formulation to incorporate this condition. (Check value-optimal-obj. is 7.3-million). c) Extra credit (1pt): Management realizes that there is another constraint: If plant 2-is selected, then at most 7,000 can be produced on plants -1 and 3 combined. (Check value-optimal obj.- is-7.1 million). The income per year from the Sales Income Per Year(In 5 20000 2200 = 44,000,000 Plant 1 2 Production Capacity Cost Per Device Plant Fixed Cost(in million) Total Expenses For Production 10000 1000 8000000 18000000 9000 1300 5000000 16700000 8000 1400 3000000 14200000 8000 1600 1000000 10800000 3 4 A) Maximum annual profit through Mixed Integer Programming Plant 1 2 Production Capacity Cost Per Device Plant Fxed Costin million) Total Expenses For Production 10000 1000 8000000 18000000 23000 1300 5000000 34900000 8000 1400 3000000 14200000 8000 1600 1000000 10800000 77700000 3 4 > > 2 Question-2: A2Z owns four production plants at which a special customized high tech device is produced. A2Z can sell up to 20,000 such devices per year at a unit price of $2,200. For each plant the production capacity, the production cost per device and the fixed cost of operating a plant for a year are given in the following table. Plant Production Cost per Plante Capacity Device Fixed Cost 1 10,000 $1000 $8 million 9,000 $1300 $5 million 3 8,000 $1400 $3 million 4 6,000 $1600 $1 million a) Formulate a mixed-integer program to help A2Z maximize its annual profit from computer production. (Check-value-optimal-obj. is-7.6 million). b) A2Z management decided that if plant-1 is operated, then plant 2 must produce at least 5,000 computers. In addition, plant:4 should not be operated unless plant 3-is operated. Modify your formulation to incorporate this condition. (Check value-optimal-obj. is 7.3-million). c) Extra credit (1pt): Management realizes that there is another constraint: If plant 2-is selected, then at most 7,000 can be produced on plants -1 and 3 combined. (Check value-optimal obj.- is-7.1 million). The income per year from the Sales Income Per Year(In 5 20000 2200 = 44,000,000 Plant 1 2 Production Capacity Cost Per Device Plant Fixed Cost(in million) Total Expenses For Production 10000 1000 8000000 18000000 9000 1300 5000000 16700000 8000 1400 3000000 14200000 8000 1600 1000000 10800000 3 4 A) Maximum annual profit through Mixed Integer Programming Plant 1 2 Production Capacity Cost Per Device Plant Fxed Costin million) Total Expenses For Production 10000 1000 8000000 18000000 23000 1300 5000000 34900000 8000 1400 3000000 14200000 8000 1600 1000000 10800000 77700000 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts