Question: the second part is the options, on the right side is fill in the blank Cunt incorporate Vogel Corporation on January 15 of the curent

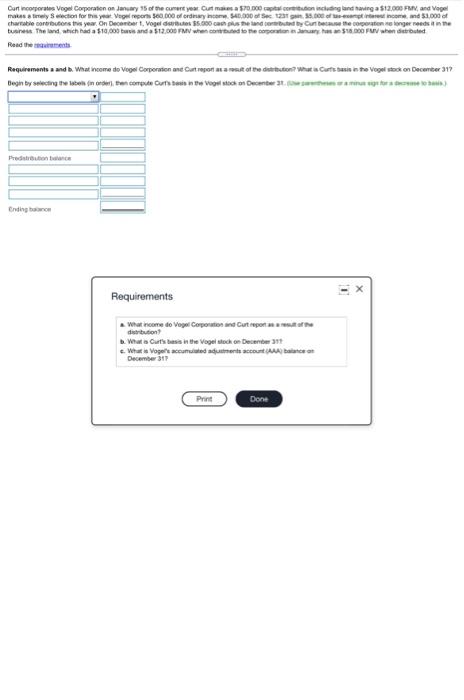

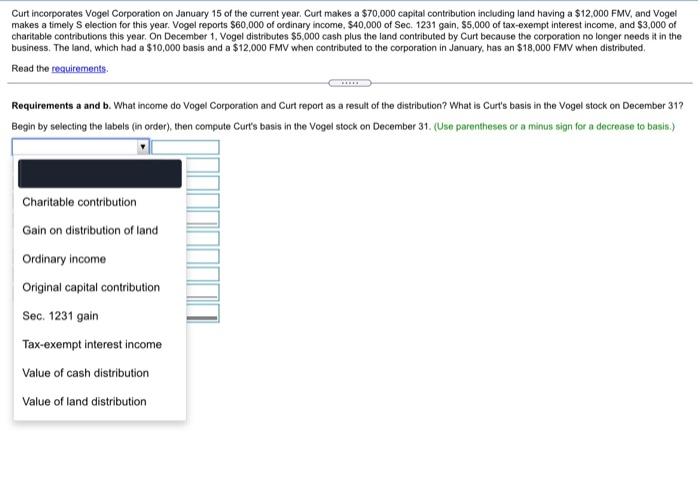

Cunt incorporate Vogel Corporation on January 15 of the curent year. Cutes a $70 capital cortion including and wing a $12.000 F, and Vogel MARAS try section for this year ago reports 500.000 dinary Income S40.000 Sect25.00 Income and $1,000 charitable corbutions this year. On December. Vogel deres .000 cash the land buted by our be the one longer needs the business The land which had a $10,000 and 512.000 FM when couted to the common 8.000 FU hendred Read the Requirements and b. What come do Vogo Corporation and art report narut at the distetton Whata Curte basis in the Vogeista on December 31 Begin by selecting the behind the computers in the stock on Decemberg) Predistribution Ending on Requirements What come do Vegol Corporation and Cut report of the distribution What a Cat's basis in the Vogel och on December What is Vogel's aucun December 31 Print Done Curt incorporates Vogel Corporation on January 15 of the current year. Curt makes a $70,000 capital contribution including land having a $12,000 FMV, and Vogel makes a timely Selection for this year. Vogel reports $60,000 of ordinary income, $40.000 of Sec. 1231 gain, $5,000 of tax-exempt interest income, and $3,000 of charitable contributions this year. On December 1, Vogel distributes $5,000 cash plus the land contributed by Curt because the corporation no longer needs it in the business. The land, which had a $10,000 basis and a $12,000 FMV when contributed to the corporation in January, has an $18,000 FMV when distributed Read the requirements Requirements a and b. What income do Vogel Corporation and Curt report as a result of the distribution? What is Curt's basis in the Vogel stock on December 312 Begin by selecting the labels (in order), then compute Curt's basis in the Vogel stock on December 31. (Use parentheses or a minus sign for a decrease to basis.) Charitable contribution Gain on distribution of land Ordinary income Original capital contribution Sec. 1231 gain Tax-exempt interest income Value of cash distribution Value of land distribution Cunt incorporate Vogel Corporation on January 15 of the curent year. Cutes a $70 capital cortion including and wing a $12.000 F, and Vogel MARAS try section for this year ago reports 500.000 dinary Income S40.000 Sect25.00 Income and $1,000 charitable corbutions this year. On December. Vogel deres .000 cash the land buted by our be the one longer needs the business The land which had a $10,000 and 512.000 FM when couted to the common 8.000 FU hendred Read the Requirements and b. What come do Vogo Corporation and art report narut at the distetton Whata Curte basis in the Vogeista on December 31 Begin by selecting the behind the computers in the stock on Decemberg) Predistribution Ending on Requirements What come do Vegol Corporation and Cut report of the distribution What a Cat's basis in the Vogel och on December What is Vogel's aucun December 31 Print Done Curt incorporates Vogel Corporation on January 15 of the current year. Curt makes a $70,000 capital contribution including land having a $12,000 FMV, and Vogel makes a timely Selection for this year. Vogel reports $60,000 of ordinary income, $40.000 of Sec. 1231 gain, $5,000 of tax-exempt interest income, and $3,000 of charitable contributions this year. On December 1, Vogel distributes $5,000 cash plus the land contributed by Curt because the corporation no longer needs it in the business. The land, which had a $10,000 basis and a $12,000 FMV when contributed to the corporation in January, has an $18,000 FMV when distributed Read the requirements Requirements a and b. What income do Vogel Corporation and Curt report as a result of the distribution? What is Curt's basis in the Vogel stock on December 312 Begin by selecting the labels (in order), then compute Curt's basis in the Vogel stock on December 31. (Use parentheses or a minus sign for a decrease to basis.) Charitable contribution Gain on distribution of land Ordinary income Original capital contribution Sec. 1231 gain Tax-exempt interest income Value of cash distribution Value of land distribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts