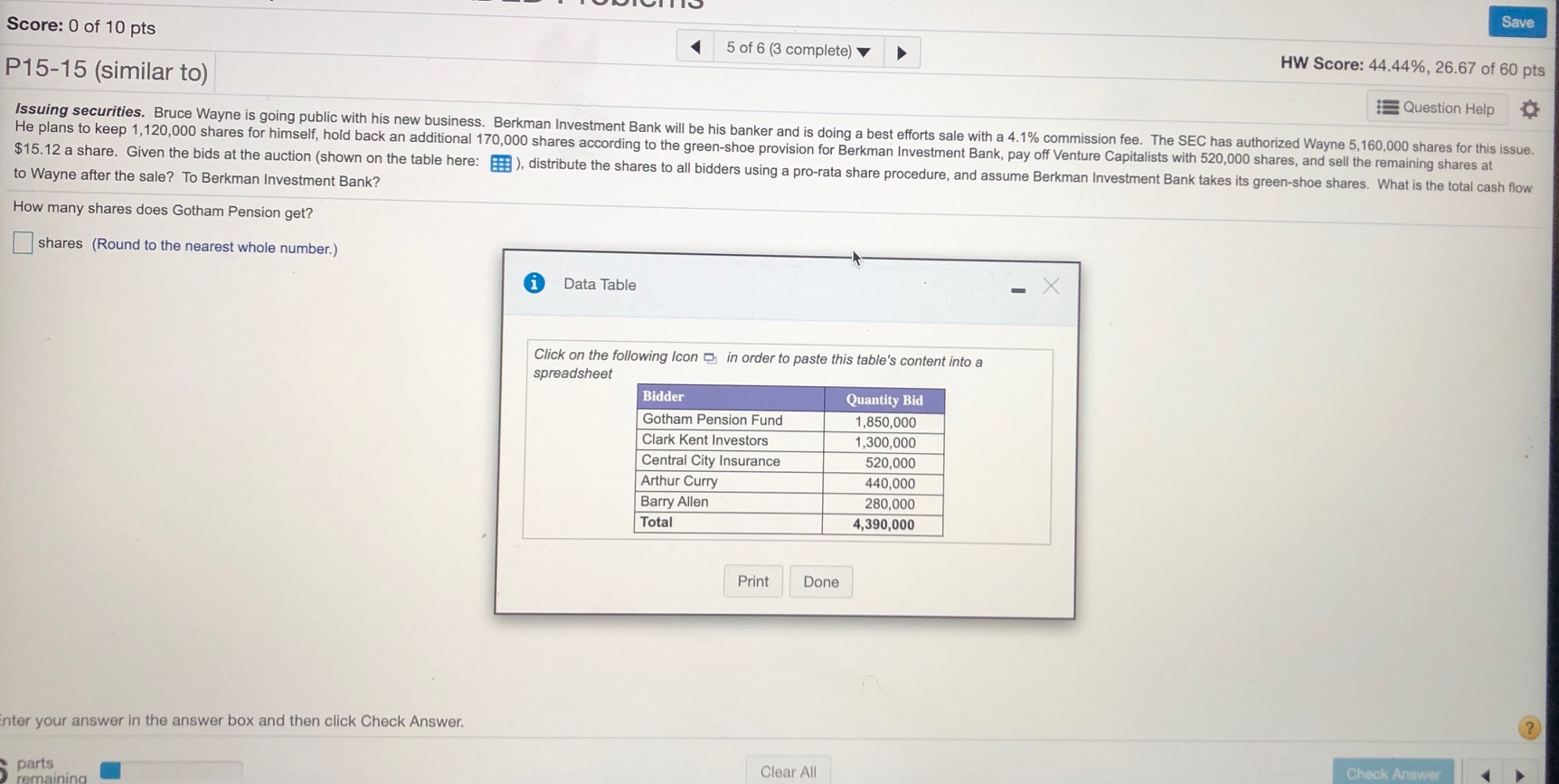

Question: The second picture has the right values that I need help with. The first picture is an example of what questions there are, it has

The second picture has the right values that I need help with. The first picture is an example of what questions there are, it has different values. Please help me out with those problems but considering the values in the second photo.

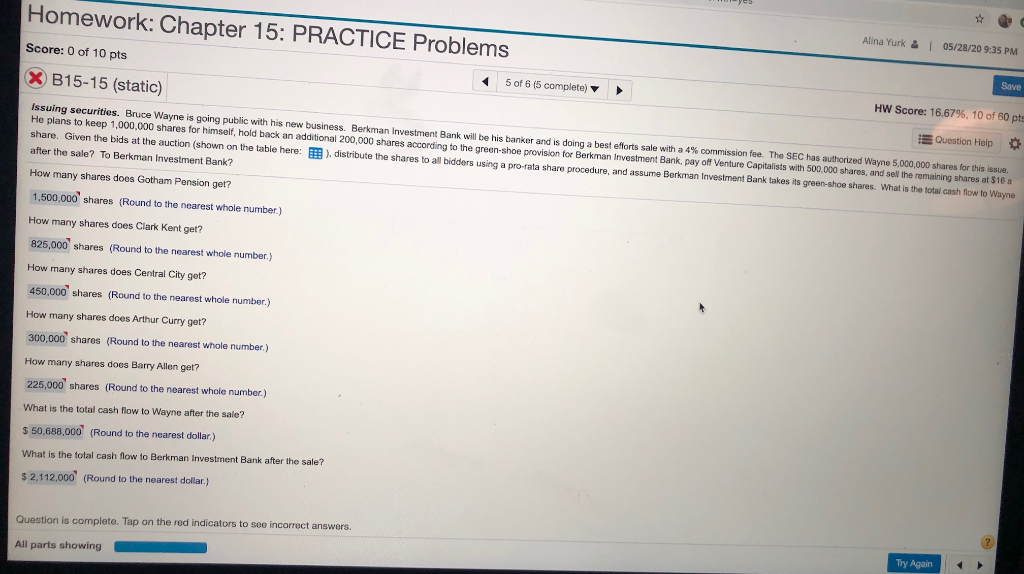

Homework: Chapter 15: PRACTICE Problems Alina Yurk & 1 05/28/20 9:35 PM Score: 0 of 10 pts X B15-15 (static) 5 of 6 (5 complete) Save HW Score: 16.67%, 10 of 60 pts Issuing securities. Bruce Wayne is going public with his new business. Berkman Investment Bank will be his banker and is doing a best efforts sale with a 4% commission fee. The SEC has authorized Wayne 5,000,000 shares for this issue. He plans to keep 1,000,000 shares for himself, hold back an additional 200,000 shares according to the green-shoe provision for Berkman Investment Bank, pay off Venture Capitalists with 500,000 shares, and sell the remaining shares at $16 a share. Given the bids at the auction (shown on the table here: E )distribute the shares to all bidders using a pro-rata share procedure, and assume Borkman Investment Bank takes green-shoe shares. What is the total cash flow to Wayne after the sale? To Berkman Investment Bank? Question Help How many shares does Gotham Pension get? 1,500,000 shares (Round to the nearest whole number.) How many shares does Clark Kent get? 825,000 shares (Round to the nearest whole number.) How many shares does Central City get? 450,000 shares (Round to the nearest whole number.) How many shares does Arthur Curry get? 300,000 shares (Round to the nearest whole number) How many shares does Barry Allen get? 225,000 shares (Round to the nearest whole number.) What is the total cash flow to Wayne after the sale? $ 50,688,000 (Round to the nearest dollar.) What is the total cash flow to Berkman Investment Bank after the sale? $ 2,112,000 (Round to the nearest dollar) Question is complete. Tap on the red indicators to see incorrect answers. All parts showing 2 Try Again Score: 0 of 10 pts Save 5 of 6 (3 complete) P15-15 (similar to) HW Score: 44.44%, 26.67 of 60 pts Question Help Issuing securities. Bruce Wayne is going public with his new business. Berkman Investment Bank will be his banker and is doing a best efforts sale with a 4.1% commission fee. The SEC has authorized Wayne 5,160,000 shares for this issue. He plans to keep 1,120,000 shares for himself, hold back an additional 170,000 shares according to the green-shoe provision for Berkman Investment Bank, pay off Venture Capitalists with 520,000 shares, and sell the remaining shares at $15.12 a share. Given the bids at the auction (shown on the table here: E ), distribute the shares to all bidders using a pro-rata share procedure, and assume Berkman Investment Bank takes its green-shoe shares. What is the total cash flow to Wayne after the sale? To Berkman Investment Bank? How many shares does Gotham Pension get? shares (Round to the nearest whole number.) Data Table Click on the following Icon in order to paste this table's content into a spreadsheet Bidder Quantity Bid Gotham Pension Fund 1,850,000 Clark Kent Investors 1,300,000 Central City Insurance 520,000 Arthur Curry 440,000 Barry Allen 280,000 Total 4,390,000 Print Done Enter your answer in the answer box and then click Check Answer parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts