Question: The second picture is the information to answer the first question. Based on information from the previous question, which qualitative factor(s) may convince TFL to

The second picture is the information to answer the first question.

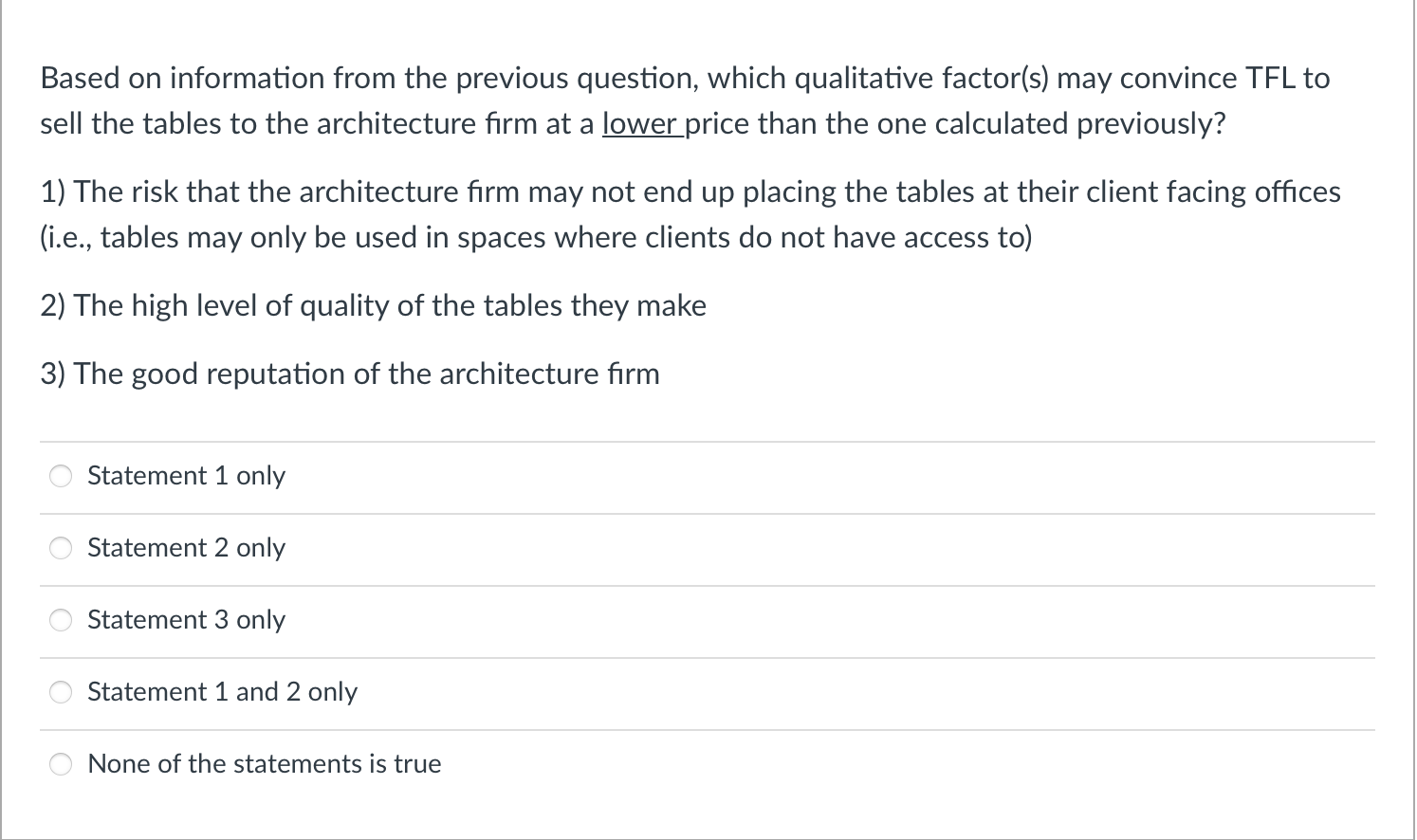

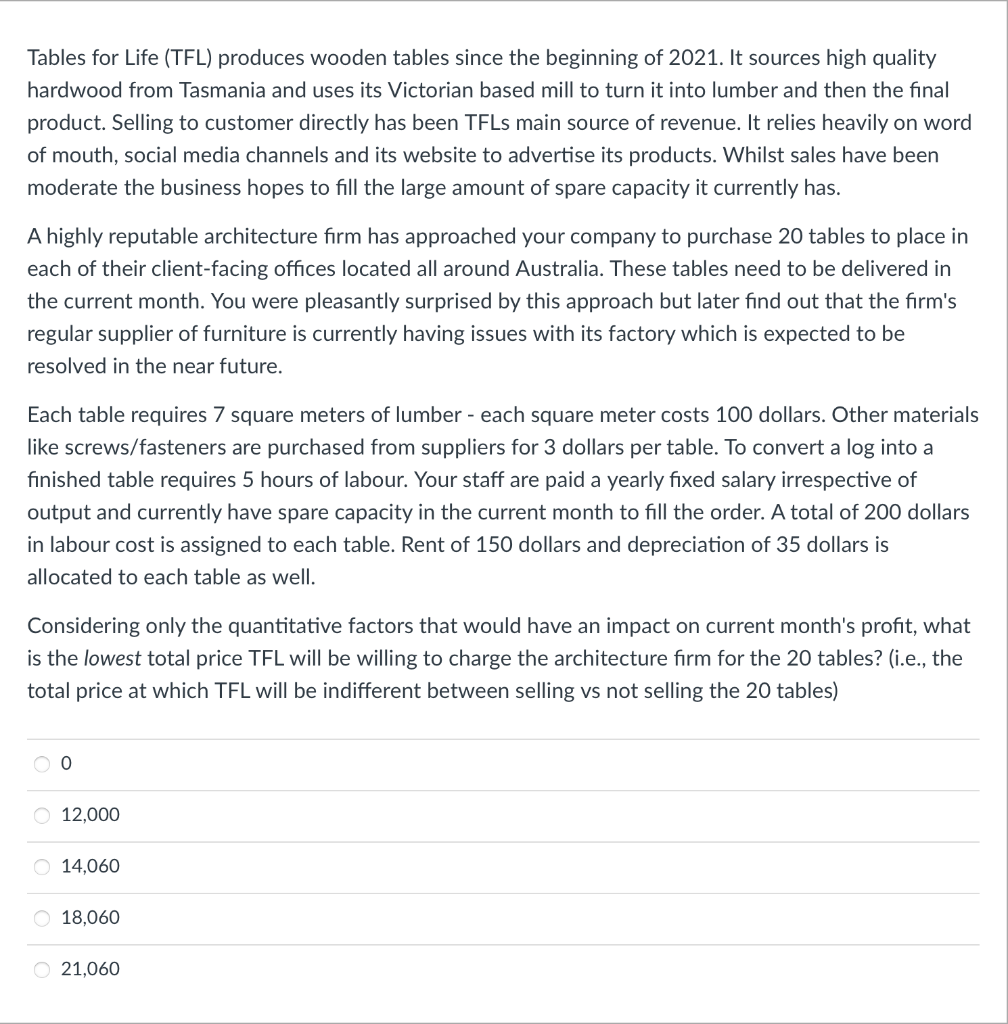

Based on information from the previous question, which qualitative factor(s) may convince TFL to sell the tables to the architecture firm at a lower price than the one calculated previously? 1) The risk that the architecture firm may not end up placing the tables at their client facing offices (i.e., tables may only be used in spaces where clients do not have access to) 2) The high level of quality of the tables they make 3) The good reputation of the architecture firm Statement 1 only Statement 2 only Statement 3 only Statement 1 and 2 only None of the statements is true Tables for Life (TFL) produces wooden tables since the beginning of 2021. It sources high quality hardwood from Tasmania and uses its Victorian based mill to turn it into lumber and then the final product. Selling to customer directly has been TFLs main source of revenue. It relies heavily on word of mouth, social media channels and its website to advertise its products. Whilst sales have been moderate the business hopes to fill the large amount of spare capacity it currently has. A highly reputable architecture firm has approached your company to purchase 20 tables to place in each of their client-facing offices located all around Australia. These tables need to be delivered in the current month. You were pleasantly surprised by this approach but later find out that the firm's regular supplier of furniture is currently having issues with its factory which is expected to be resolved in the near future. Each table requires 7 square meters of lumber - each square meter costs 100 dollars. Other materials like screws/fasteners are purchased from suppliers for 3 dollars per table. To convert a log into a finished table requires 5 hours of labour. Your staff are paid a yearly fixed salary irrespective of output and currently have spare capacity in the current month to fill the order. A total of 200 dollars in labour cost is assigned to each table. Rent of 150 dollars and depreciation of 35 dollars is allocated to each table as well. Considering only the quantitative factors that would have an impact on current month's profit, what is the lowest total price TFL will be willing to charge the architecture firm for the 20 tables? (i.e., the total price at which TFL will be indifferent between selling vs not selling the 20 tables) 0 O 12,000 O 14,060 O 18,060 21,060

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts