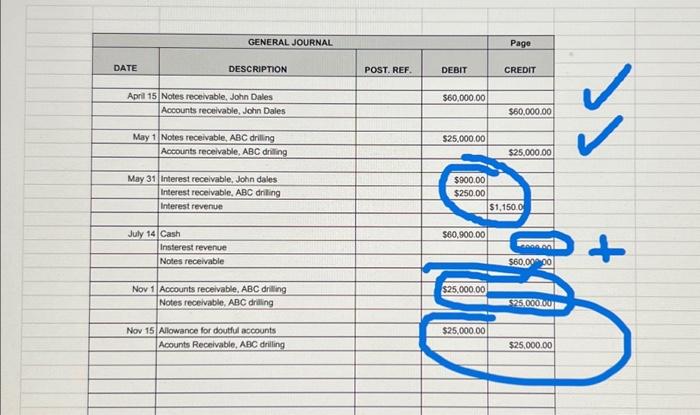

Question: the second picture shows the incorrect answer Conway Servicing monitors its accounts receivable carefully. A review determined that a customer, John Dales, was unable to

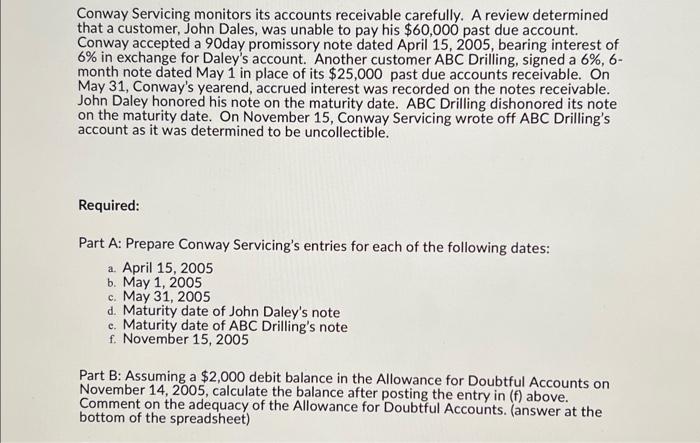

Conway Servicing monitors its accounts receivable carefully. A review determined that a customer, John Dales, was unable to pay his $60,000 past due account. Conway accepted a 90 day promissory note dated April 15, 2005, bearing interest of 6% in exchange for Daley's account. Another customer ABC Drilling, signed a 6\%, 6month note dated May 1 in place of its $25,000 past due accounts receivable. On May 31, Conway's yearend, accrued interest was recorded on the notes receivable. John Daley honored his note on the maturity date. ABC Drilling dishonored its note on the maturity date. On November 15, Conway Servicing wrote off ABC Drilling's account as it was determined to be uncollectible. Required: Part A: Prepare Conway Servicing's entries for each of the following dates: a. April 15, 2005 b. May 1,2005 c. May 31, 2005 d. Maturity date of John Daley's note c. Maturity date of ABC Drilling's note f. November 15,2005 Part B: Assuming a $2,000 debit balance in the Allowance for Doubtful Accounts on November 14,2005 , calculate the balance after posting the entry in (f) above. Comment on the adequacy of the Allowance for Doubtful Accounts. (answer at the bottom of the spreadsheet)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts