Question: The second question, they said my answer is not complete. Help Save & Exit Check my During Heaton Company's first two years of operations, it

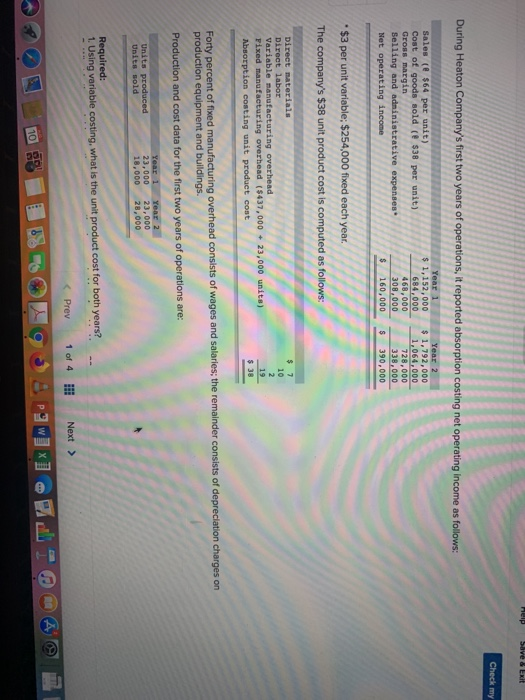

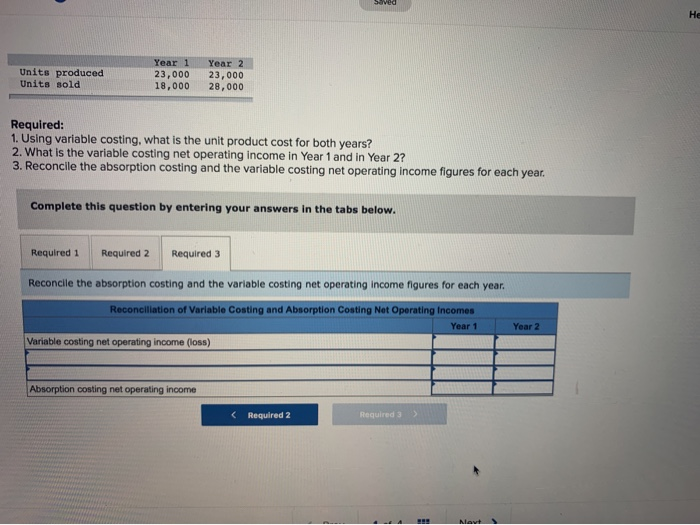

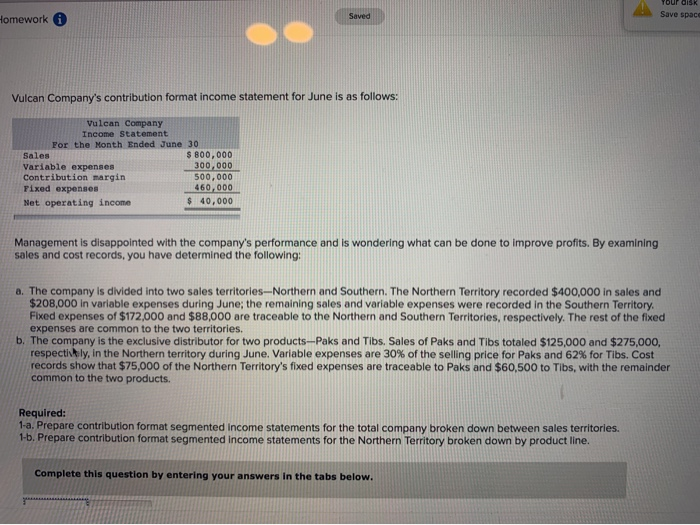

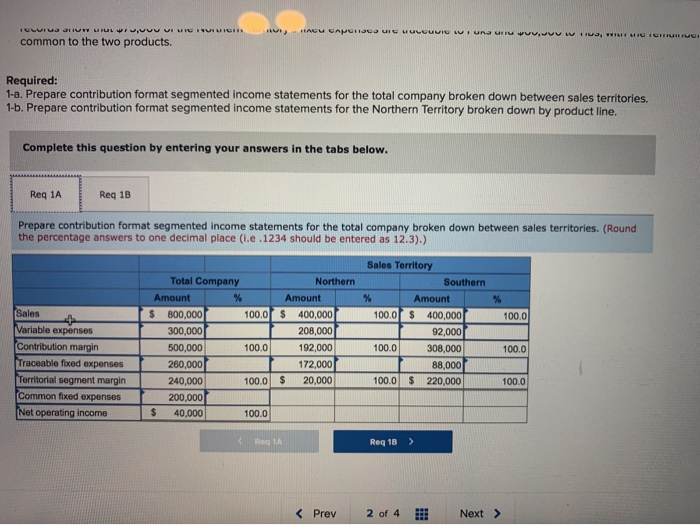

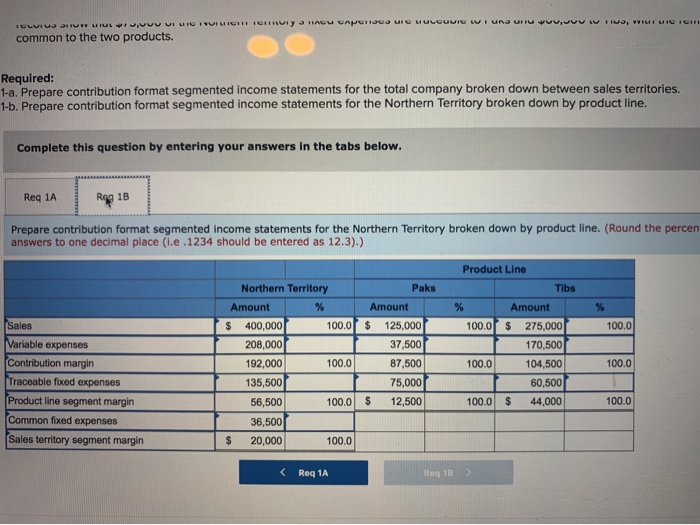

Help Save & Exit Check my During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Sales ( $64 per unit) Cost of goods sold ($38 per unit) Gross margin Selling and administrative expenses Net operating income Year 1 $ 1,152,000 684,000 468,000 308,000 $ 160,000 Year 2 $ 1,792,000 1,064,000 728,000 338,000 $ 390,000 *$3 per unit variable: $254,000 fixed each year. The company's $38 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($437,000 + 23,000 units) Absorption conting unit product cont 7 10 2 19 $ 38 Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges on production equipment and buildings. Production and cost data for the first two years of operations are: Units produced Units sold Year 1 23,000 18,000 Year 2 23,000 28,000 Required: 1. Using variable costing, what is the unit product cost for both years? Prev 1 of 4 !!! Next > w 10 Solved He Units produced Units sold Year 1 23,000 18,000 Year 2 23,000 28,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Reconcile the absorption costing and the variable costing net operating income figures for each year. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (loss) Absorption costing net operating income ILIUS SU Juvu VI LIG INVIMI!!! Y HACU CAPllus uiuuLCUNIC WI URS UIU wuvwUU UIN, WILI MICI common to the two products. Required: 1-a. Prepare contribution format segmented income statements for the total company broken down between sales territories. 1-b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. Complete this question by entering your answers in the tabs below. Reg 1A Rag 1B Prepare contribution format segmented income statements for the Northern Territory broken down by product line. (Round the percen answers to one decimal place (i.e.1234 should be entered as 12.3).) % 100.0 Northern Territory Paks Amount Amount $ 400,000 100.0 $ 125,000 208,000 37,500 192,000 100.0 87,500 135,500 75,000 56,500 100.0 $ 12,500 36,500 $ 20,000 100.0 Sales Variable expenses Contribution margin Traceable fixed expenses Product line segment margin Common fixed expenses Sales territory segment margin Product Line Tibs % Amount 100.00 $ 275,000 170,500 100.0 104,500 60,500 100.0 $ 44,000 100.0 100.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts