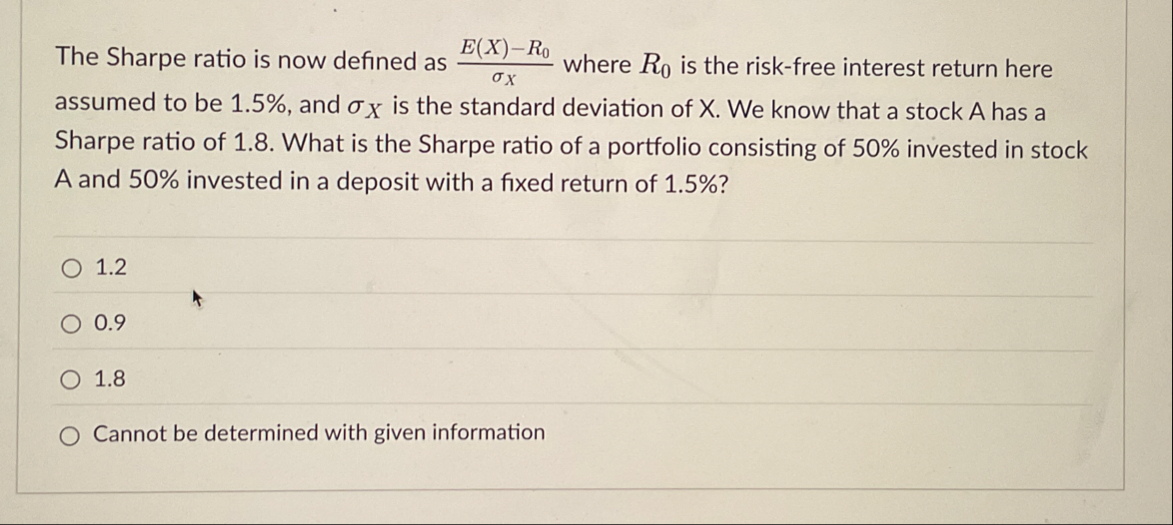

Question: The Sharpe ratio is now defined as E ( x ) - R 0 x where R 0 is the risk - free interest return

The Sharpe ratio is now defined as where is the riskfree interest return here assumed to be and is the standard deviation of We know that a stock A has a Sharpe ratio of What is the Sharpe ratio of a portfolio consisting of invested in stock A and invested in a deposit with a fixed return of

Cannot be determined with given information

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock