Question: The single most important variable in the dividends-and-earnings approach is the 82. A. Rate of growth B. Applicable beta C. Appropriate P/E multiple to calculate

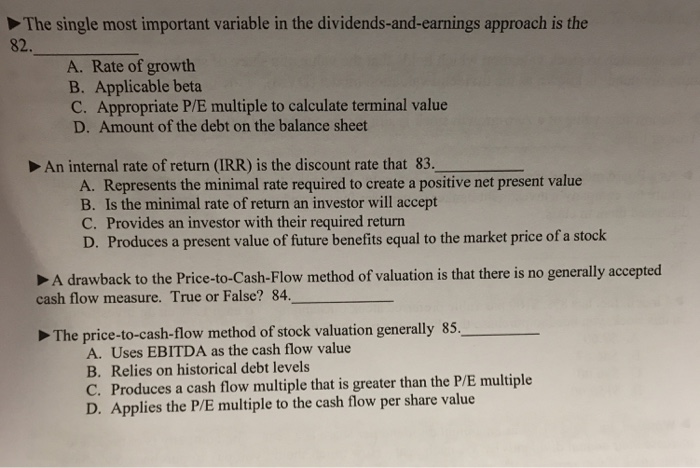

The single most important variable in the dividends-and-earnings approach is the 82. A. Rate of growth B. Applicable beta C. Appropriate P/E multiple to calculate terminal value D. Amount of the debt on the balance sheet An internal rate of return (IRR) is the discount rate that 83. A. Represents the minimal rate required to create a positive net present value B. Is the minimal rate of return an investor will accept C. Provides an investor with their required return D. Produces a present value of future benefits equal to the market price of a stock A drawback to the Price-to-Cash-Flow method of valuation is that there is no generally accepted cash flow measure. True or False? 84. w method of stock valuation generally 85. A. Uses EBITDA as the cash flow value B. Relies on historical debt levels C. Produces a cash flow multiple that is greater than the P/E multiple D. Applies the P/E multiple to the cash flow per share value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts