Question: The sixth, seventh and eighth question is required 1. What is the value of the following set of cash flows today? The interest rate is

The sixth, seventh and eighth question is required

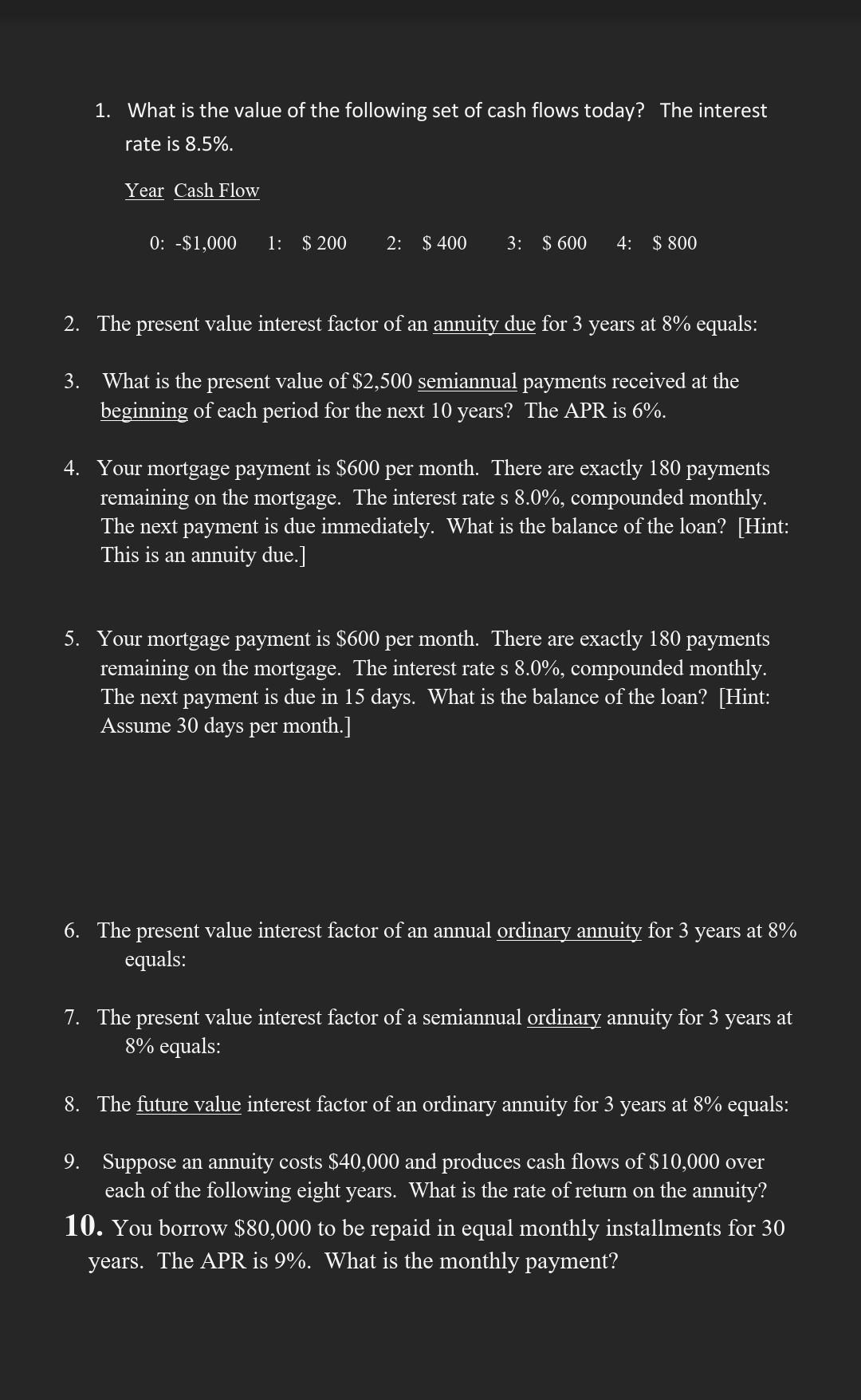

1. What is the value of the following set of cash flows today? The interest rate is 8.5%. Year Cash Flow 2. The present value interest factor of an annuity due for 3 years at 8% equals: 3. What is the present value of $2,500 semiannual payments received at the beginning of each period for the next 10 years? The APR is 6%. 4. Your mortgage payment is $600 per month. There are exactly 180 payments remaining on the mortgage. The interest rate s 8.0%, compounded monthly. The next payment is due immediately. What is the balance of the loan? [Hint: This is an annuity due.] 5. Your mortgage payment is $600 per month. There are exactly 180 payments remaining on the mortgage. The interest rate s 8.0%, compounded monthly. The next payment is due in 15 days. What is the balance of the loan? [Hint: Assume 30 days per month.] 6. The present value interest factor of an annual ordinary annuity for 3 years at 8% equals: 7. The present value interest factor of a semiannual ordinary annuity for 3 years at 8% equals: The future value interest factor of an ordinary annuity for 3 years at 8% equals: 9. Suppose an annuity costs $40,000 and produces cash flows of $10,000 over each of the following eight years. What is the rate of return on the annuity? 10. You borrow $80,000 to be repaid in equal monthly installments for 30 years. The APR is 9%. What is the monthly payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts