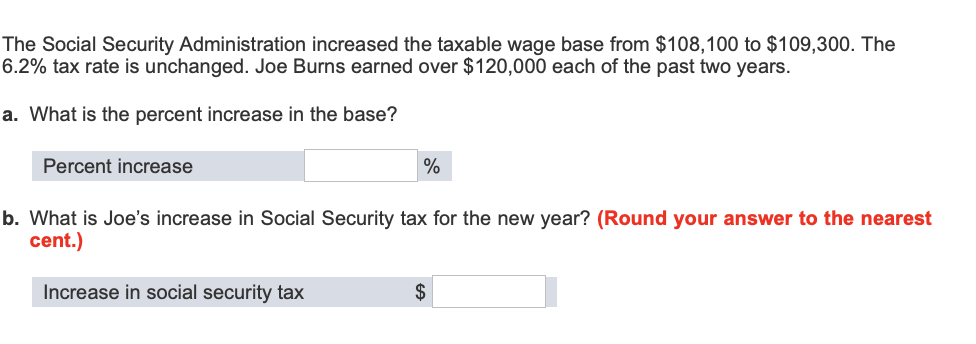

Question: The Social Security Administration increased the taxable wage base from $108,100 to $109,300. The 6.2% tax rate is unchanged. Joe Burns earned over $120,000 each

The Social Security Administration increased the taxable wage base from $108,100 to $109,300. The 6.2% tax rate is unchanged. Joe Burns earned over $120,000 each of the past two years. a. What is the percent increase in the base? Percent increase b. What is Joe's increase in Social Security tax for the new year? (Round your answer to the nearest cent.) Increase in social security tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock