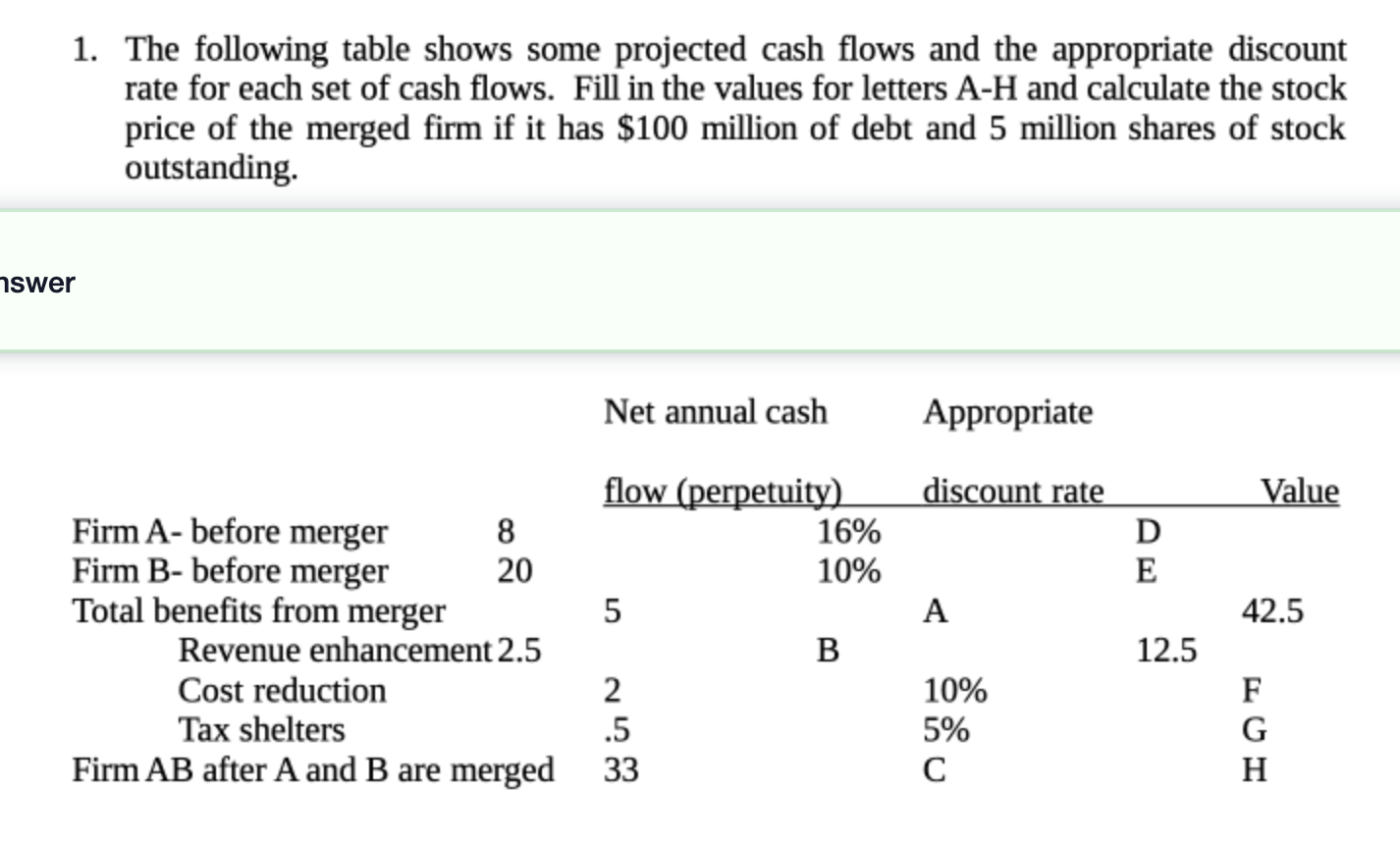

Question: 1. The following table shows some projected cash flows and the appropriate discount rate for each set of cash flows. Fill in the values

1. The following table shows some projected cash flows and the appropriate discount rate for each set of cash flows. Fill in the values for letters A-H and calculate the stock price of the merged firm if it has $100 million of debt and 5 million shares of stock outstanding. nswer Firm A- before merger Firm B- before merger Total benefits from merger 8 20 Revenue enhancement 2.5 Cost reduction Tax shelters Firm AB after A and B are merged Net annual cash flow (perpetuity) 5 2 .5 33 16% 10% B Appropriate discount rate A 10% 5% C D E 12.5 Value 42.5 FGH

Step by Step Solution

There are 3 Steps involved in it

Lets recalculate the stock price using the correct values A Firm AB after A and B are merged 33 mill... View full answer

Get step-by-step solutions from verified subject matter experts