Question: The solution is detailed on paper In problems where no equity risk premium or tax rate are pro- vided, please use an equity risk premium

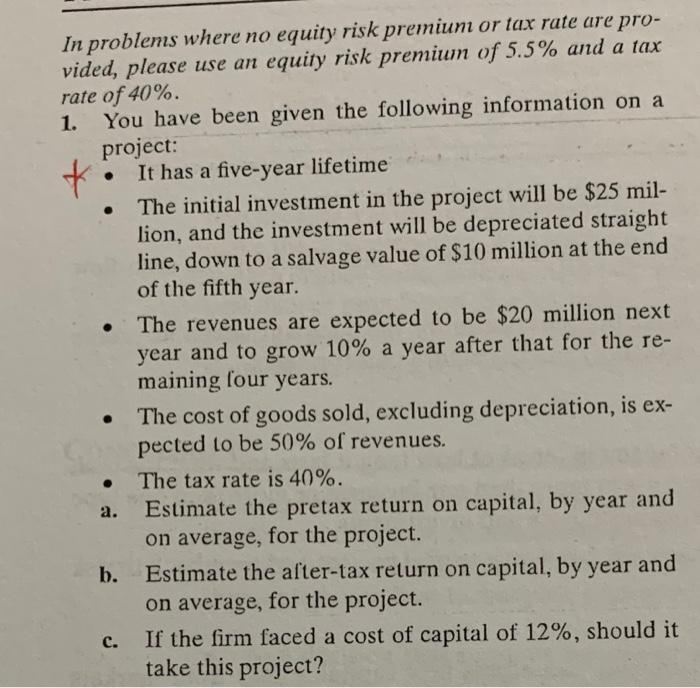

In problems where no equity risk premium or tax rate are pro- vided, please use an equity risk premium of 5.5% and a tax rate of 40%. 1. You have been given the following information on a project: + It has a five-year lifetime The initial investment in the project will be $25 mil- lion, and the investment will be depreciated straight line, down to a salvage value of $10 million at the end of the fifth year. The revenues are expected to be $20 million next year and to grow 10% a year after that for the re- maining four years. The cost of goods sold, excluding depreciation, is ex- pected to be 50% of revenues. The tax rate is 40%. Estimate the pretax return on capital, by year and on average, for the project. b. Estimate the after-tax return on capital, by year and on average, for the project. If the firm faced a cost of capital of 12%, should it take this project? a. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts