Question: The stack price for Tesla, the maker af the popular electric, has been quite volatile over the last few years. According to Yahoo Finance, the

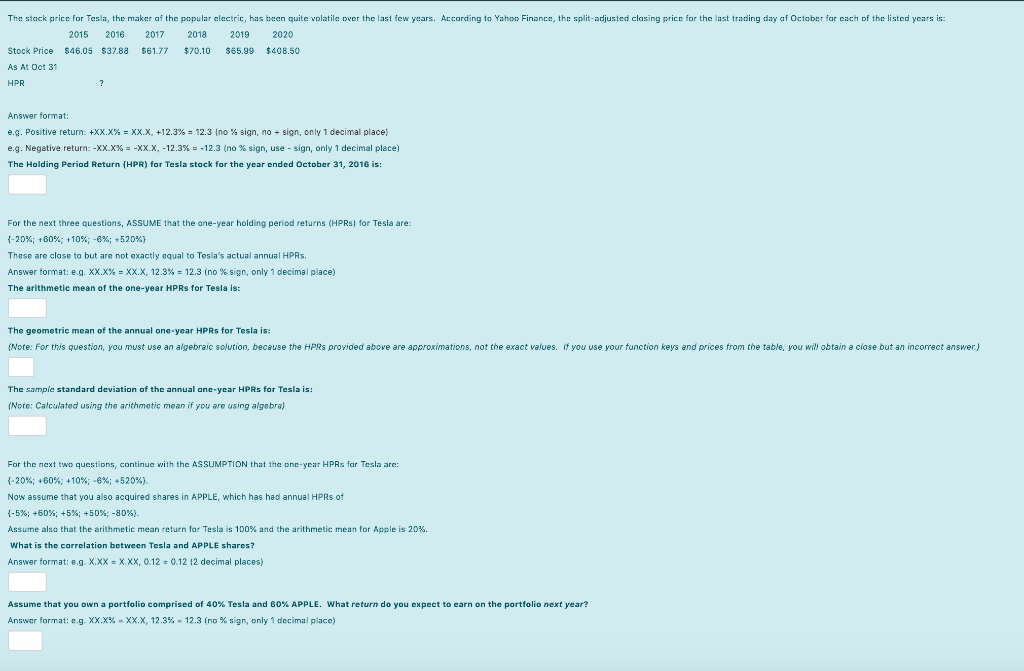

The stack price for Tesla, the maker af the popular electric, has been quite volatile over the last few years. According to Yahoo Finance, the split-adjusted closing price for the last trading day af October for each of the listed years is: 2015 2016 2017 2018 2019 2020 Stock Price $46.05 $37.88 $61.77 $70.10 $65.99 $408.50 As At Oct 31 HPR ? Answer format: e.g. Positive return: +XX.X% = XX.X, +12.3% = 12.3 (no % sign, no - sign, only 1 decimal place) e.g. Negative return:-XX.X% = -XX.X, -12.3% = -12.3 (no % sign, use - sign, only 1 decimal place) The Holding Period Return (HPR) for Tesla stock for the year ended October 31, 2016 is: For the next three questions, ASSUME that the ane-year holding period returns (HPRS) for Tesla are: {-20%; +60%; +10%; -8%; +520%) These are close to but are not exactly equal to Tesla's actual annual HPRs. Answer format: e.g. XX.X% = XX.X, 12.3% = 12.3 (no % sign, only 1 decimal place) The arithmetic mean of the one-year HPRs for Tesla is: The geometric mean of the annual one-year HPRs for Tesla is: (Note: For this question, you must use an algebraic solution, because the HPRS provided above are approximations, not the exact values. if you use your function keys and prices from the table, you will obtain a close but an incorrect answer) The sample standard deviation of the annual one-year HPRs for Tesla is: (Note: Calculated using the arithmetic mean if you are using algebra) For the next two questions, continue with the ASSUMPTION that the one-year HPRS Tesla are: (-20%; +60%; +10%; -6%; 520%). Now assume that you also acquired shares in APPLE, which has had annual HPRs of {-5%; +60%; +5%; +50% -80%). Assume also that the arithmetic mean return far Tesla is 100% and the arithmetic mean for Apple is 20%. What is the correlation between Tesla and APPLE shares? Answer format: e.g. X.XX = X.XX, 0.12 = 0.12 12 decimal places) Assume that you own a portfolio comprised of 40% Tesla and 60% APPLE. What return do you expect to earn on the portfolio next year? Answer format: c.g. XX.X% - XX.X, 12.3% -12.3 Ino % sign, only 1 decimal place) The stack price for Tesla, the maker af the popular electric, has been quite volatile over the last few years. According to Yahoo Finance, the split-adjusted closing price for the last trading day af October for each of the listed years is: 2015 2016 2017 2018 2019 2020 Stock Price $46.05 $37.88 $61.77 $70.10 $65.99 $408.50 As At Oct 31 HPR ? Answer format: e.g. Positive return: +XX.X% = XX.X, +12.3% = 12.3 (no % sign, no - sign, only 1 decimal place) e.g. Negative return:-XX.X% = -XX.X, -12.3% = -12.3 (no % sign, use - sign, only 1 decimal place) The Holding Period Return (HPR) for Tesla stock for the year ended October 31, 2016 is: For the next three questions, ASSUME that the ane-year holding period returns (HPRS) for Tesla are: {-20%; +60%; +10%; -8%; +520%) These are close to but are not exactly equal to Tesla's actual annual HPRs. Answer format: e.g. XX.X% = XX.X, 12.3% = 12.3 (no % sign, only 1 decimal place) The arithmetic mean of the one-year HPRs for Tesla is: The geometric mean of the annual one-year HPRs for Tesla is: (Note: For this question, you must use an algebraic solution, because the HPRS provided above are approximations, not the exact values. if you use your function keys and prices from the table, you will obtain a close but an incorrect answer) The sample standard deviation of the annual one-year HPRs for Tesla is: (Note: Calculated using the arithmetic mean if you are using algebra) For the next two questions, continue with the ASSUMPTION that the one-year HPRS Tesla are: (-20%; +60%; +10%; -6%; 520%). Now assume that you also acquired shares in APPLE, which has had annual HPRs of {-5%; +60%; +5%; +50% -80%). Assume also that the arithmetic mean return far Tesla is 100% and the arithmetic mean for Apple is 20%. What is the correlation between Tesla and APPLE shares? Answer format: e.g. X.XX = X.XX, 0.12 = 0.12 12 decimal places) Assume that you own a portfolio comprised of 40% Tesla and 60% APPLE. What return do you expect to earn on the portfolio next year? Answer format: c.g. XX.X% - XX.X, 12.3% -12.3 Ino % sign, only 1 decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts