Question: The standard Treasury Bond futures contract has a face value of $100,000, at least 15 years to maturity and a coupon of 6%, payable

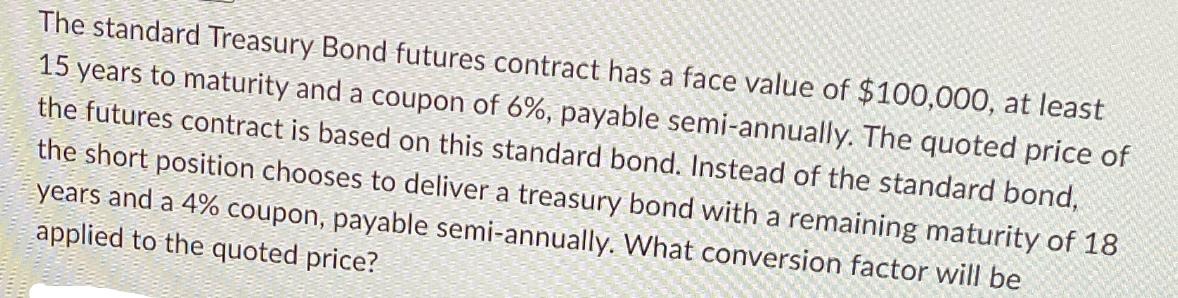

The standard Treasury Bond futures contract has a face value of $100,000, at least 15 years to maturity and a coupon of 6%, payable semi-annually. The quoted price of the futures contract is based on this standard bond. Instead of the standard bond, the short position chooses to deliver a treasury bond with a remaining maturity of 18 years and a 4% coupon, payable semi-annually. What conversion factor will be applied to the quoted price?

Step by Step Solution

There are 3 Steps involved in it

To determine the conversion factor for the treasury bond we can use the conversion factor formula The conversion factor is usually calculated using th... View full answer

Get step-by-step solutions from verified subject matter experts