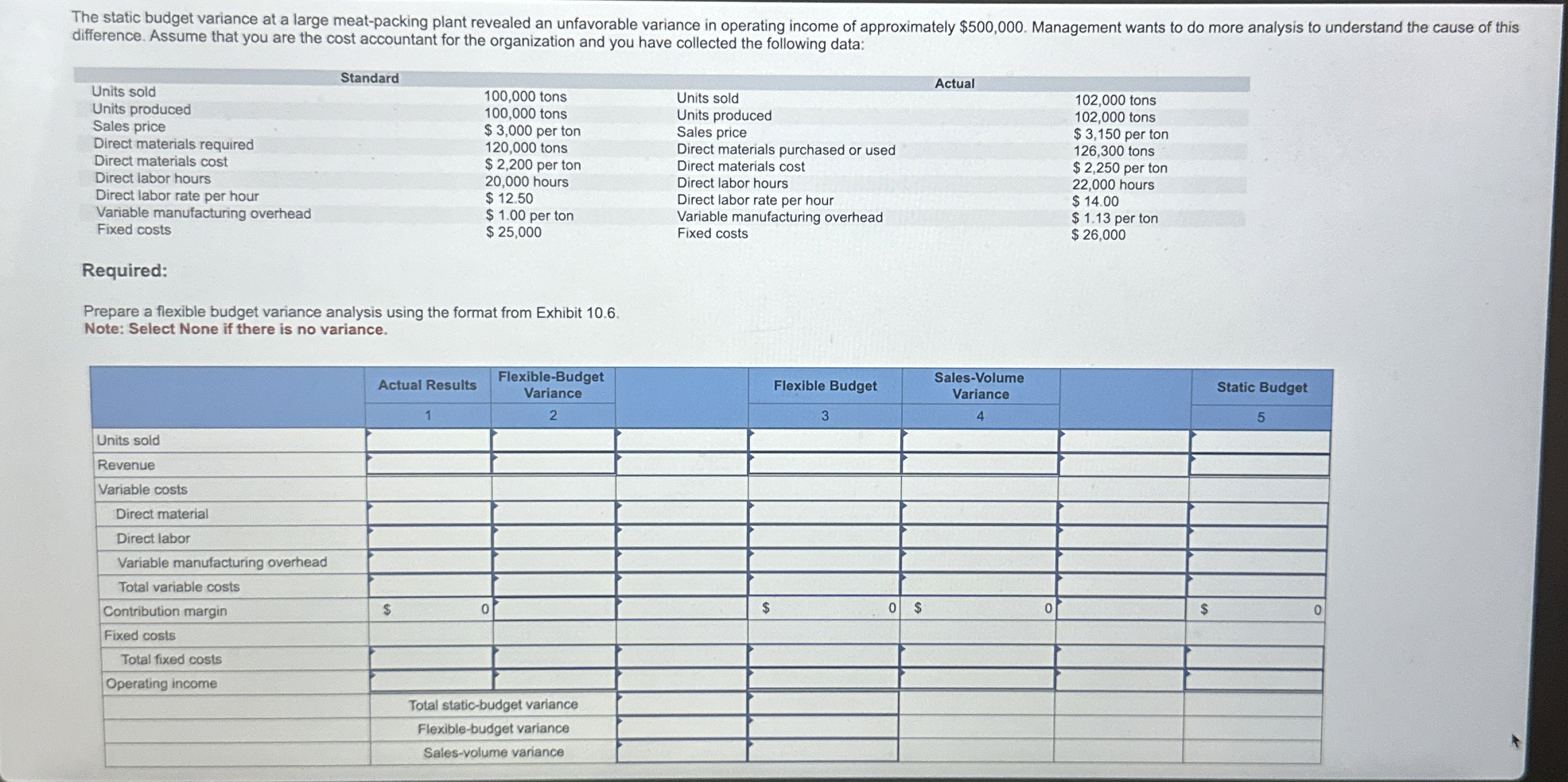

Question: The static budget variance at a large meat - packing plant revealed an unfavorable variance in operating income of approximately $ 5 0 0 ,

The static budget variance at a large meatpacking plant revealed an unfavorable variance in operating income of approximately $ Management wants to do more analysis to understand the cause of this difference. Assume that you are the cost accountant for the organization and you have collected the following data:

tableUnits sold Standard,ActualUnits sold, tons,Units sold, tonsUnits produced, tons,Units produced, tonsSales price,$ per ton,Sales price,$ per tonDirect materials required, tons,Direct materials purchased or used, tonsDirect materials cost,$ per ton,Direct materials cost,$ per tonDirect labor hours, hours,Direct labor hours, hoursDirect labor rate per hour,$ Direct labor rate per hour,$ Variable manufacturing overhead,$ per ton,Variable manufacturing overhead,$ per tonFixed costs,$ Fixed costs,$

Required:

Prepare a flexible budget variance analysis using the format from Exhibit

Note: Select None if there is no variance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock