Question: the steps and formula should be same for these two but found different steps applied, so please can you explain a little bit too. thanks

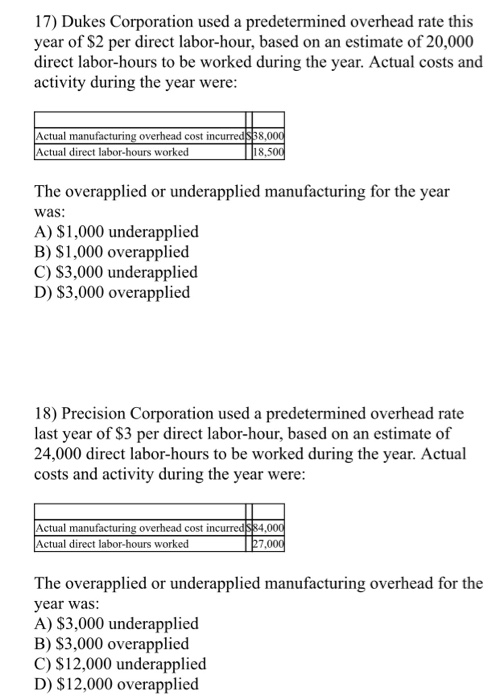

17) Dukes Corporation used a predetermined overhead rate this year of $2 per direct labor-hour, based on an estimate of 20,000 direct labor-hours to be worked during the year. Actual costs and activity during the year were: Actual manufacturing overhead cost incurred $38,000 Actual direct labor-hours worked 18,500 The overapplied or underapplied manufacturing for the year was: A) $1,000 underapplied B) $1,000 overapplied C) $3,000 underapplied D) $3,000 overapplied 18) Precision Corporation used a predetermined overhead rate last year of $3 per direct labor-hour, based on an estimate of 24,000 direct labor-hours to be worked during the year. Actual costs and activity during the year were: Actual manufacturing overhead cost incurred $84.000 Actual direct labor-hours worked 27,000 The overapplied or underapplied manufacturing overhead for the year was: A) $3,000 underapplied B) $3,000 overapplied C) $12,000 underapplied D) $12,000 overapplied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts