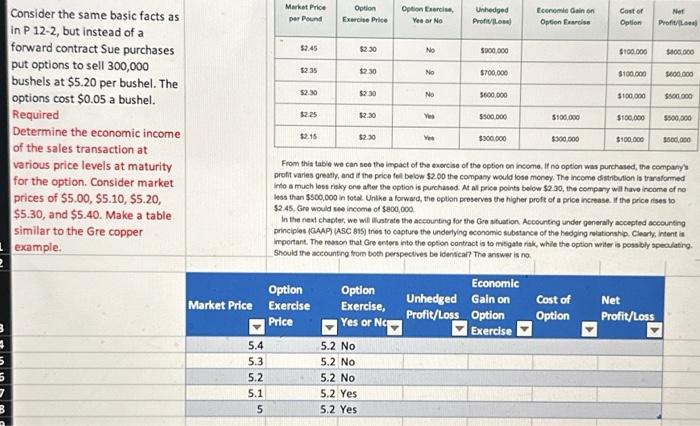

Question: The table above is the Gre copper example that we are asked to make a table similar too. Consider the same basic facts as in

Consider the same basic facts as in P 12-2, but instead of a forward contract Sue purchases put options to sell 300,000 bushels at $5.20 per bushel. The options cost $0.05 a bushel. Required Determine the economic income of the sales transaction at various price levels at maturity for the option. Consider market prices of $5.00,$5.10,$5.20, $5.30, and $5.40. Make a table similar to the Gre copper example. From this table we can see the impact of the exercise of the eption on ineome. If no option was purchased, the comparys profit varies greatly, and if the price fel below $200 the company would lose money. The income distribution is trarsformed into a much less risky ore ather the option is purchased. At at price points below $2.30, the compary will have income of no Wess than $00,000 in fotal. Unike a forward, the eption preserves the higher proft of a price increase. If the price nises to $2.45, Gre would see inceme of $800,000 In the next chapter, we wil Illustrate the accounting for the Gee stuation. Accounting under generaly accepted sccounting principles (CAAP) (ASC BAS) tries to capture the undertying economic substarce of the hedging relationship. Clesply, intent ia important. The resson that Gre enters into the option contract is to mitigate riak, while the option writer is possibly speculating. Should the accounting from both perspectves be identical? The answer is no

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts