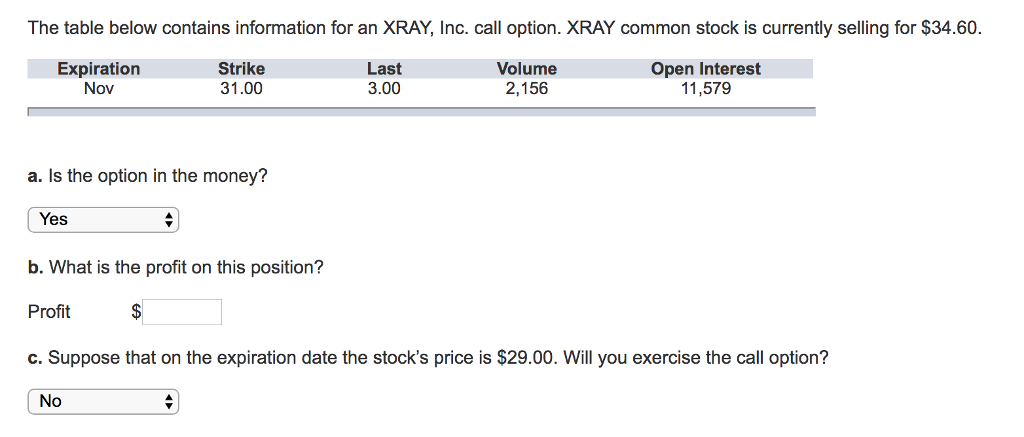

Question: The table below contains information for an XRAY, Inc. call option. XRAY common stock is currently selling for $34.60. Volume 2,156 Expiration Strike 31.00 Last

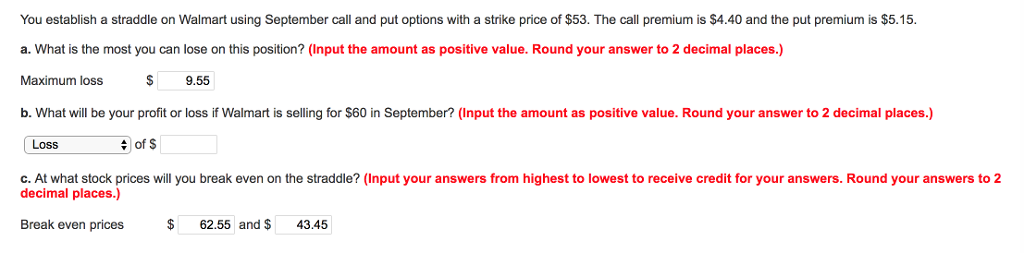

The table below contains information for an XRAY, Inc. call option. XRAY common stock is currently selling for $34.60. Volume 2,156 Expiration Strike 31.00 Last 3.00 Open Interest 11,579 a. Is the option in the money? Yes b. What is the profit on this position? Profit c. Suppose that on the expiration date the stock's price is $29.00. Will you exercise the call option? No You establish a straddle on Walmart using September call and put options with a strike price of $53. The call premium is $4.40 and the put premium is $5.15 a. What is the most you can lose on this position? (Input the amount as positive value. Round your answer to 2 decimal places.) Maximum loss b. What will be your profit or loss if Walmart is selling for $60 in September? (Input the amount as positive value. Round your answer to 2 decimal places.) $ 9.55 Loss #lds of S c. At what stock prices will you break even on the straddle? (Input your answers from highest to lowest to receive credit for your answers. Round your answers to 2 decimal places.) Break even prices 62.55 and 43.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts