Question: The table below displays selected financial data for Mayflower, Inc. The firm's cost of equity is 13%, its WACC is 9%, and its tax rate

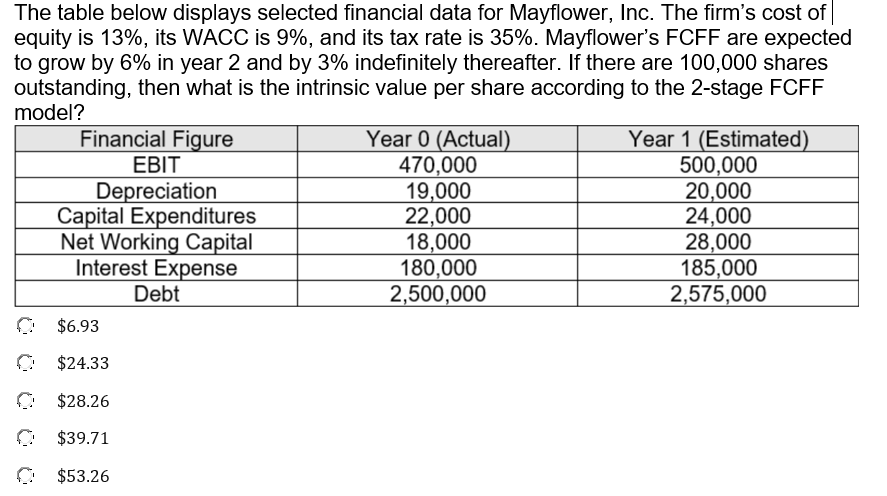

The table below displays selected financial data for Mayflower, Inc. The firm's cost of equity is 13%, its WACC is 9%, and its tax rate is 35%. Mayflower's FCFF are expected to grow by 6% in year 2 and by 3% indefinitely thereafter. If there are 100,000 shares outstanding, then what is the intrinsic value per share according to the 2-stage FCFF model? Financial Figure Year 0 (Actual) Year 1 (Estimated) EBIT 470.000 500,000 Depreciation 19.000 20.000 Capital Expenditures 22,000 24,000 Net Working Capital 18,000 28.000 Interest Expense 180,000 185,000 Debt 2,500,000 2,575,000 0 $6.93 @ $24.33 $28.26 $39.71 $53.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts