Question: The table below gives information on three assets (I, J and K). Assume that the CAPM model holds and that the expected return on the

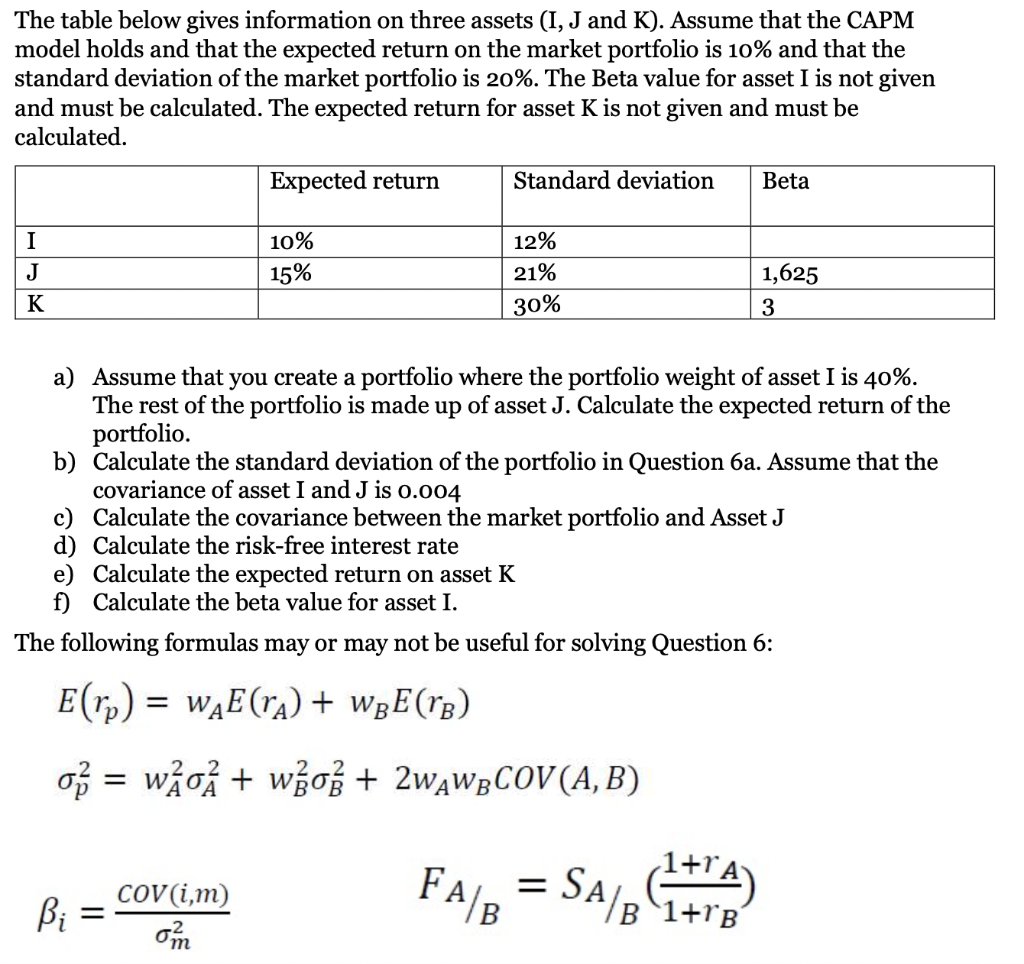

The table below gives information on three assets (I, J and K). Assume that the CAPM model holds and that the expected return on the market portfolio is 10% and that the standard deviation of the market portfolio is 20%. The Beta value for asset I is not given and must be calculated. The expected return for asset K is not given and must be calculated. a) Assume that you create a portfolio where the portfolio weight of asset I is 40%. The rest of the portfolio is made up of asset J. Calculate the expected return of the portfolio. b) Calculate the standard deviation of the portfolio in Question 6a. Assume that the covariance of asset I and J is 0.004 c) Calculate the covariance between the market portfolio and Asset J d) Calculate the risk-free interest rate e) Calculate the expected return on asset K f) Calculate the beta value for asset I. The following formulas may or may not be useful for solving Question 6: E(rp)=wAE(rA)+wBE(rB)p2=wA2A2+wB2B2+2wAwBCOV(A,B)i=m2COV(i,m)FA/B=SA/1+rB(1+rA)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts