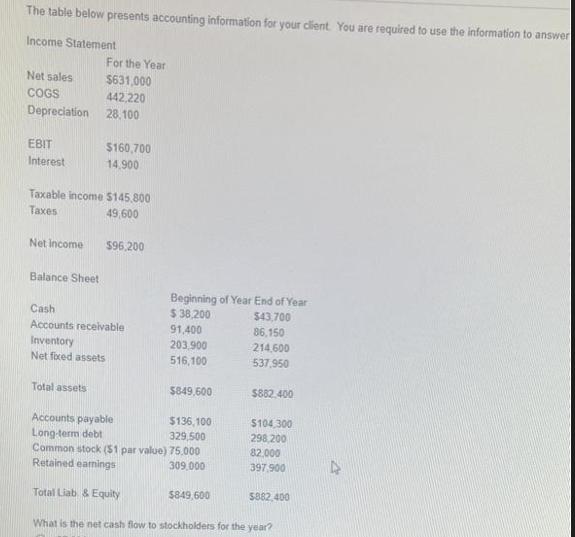

Question: The table below presents accounting information for your client. You are required to use the information to answer Income Statement Net sales COGS Depreciation

The table below presents accounting information for your client. You are required to use the information to answer Income Statement Net sales COGS Depreciation EBIT Interest Net income Taxable income $145.800 Taxes 49,600 Balance Sheet For the Year $631,000 442,220 28,100 $160,700 14,900 Total assets $96,200 Cash Accounts receivable Inventory Net fixed assets Beginning of Year End of Year $ 38,200 91,400 203,900 516,100 $849,600 $43,700 86,150 214,600 537,950 $849,600 $882.400 Accounts payable $136,100 Long-term debt 329,500 Common stock ($1 par value) 75.000 Retained earnings 309,000 Total Liab & Equity What is the net cash flow to stockholders for the year? $104,300 298,200 82,000 397,900 $882,400

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

To calculate the net cash flow to stockholders for the year we need to consider the changes in the s... View full answer

Get step-by-step solutions from verified subject matter experts