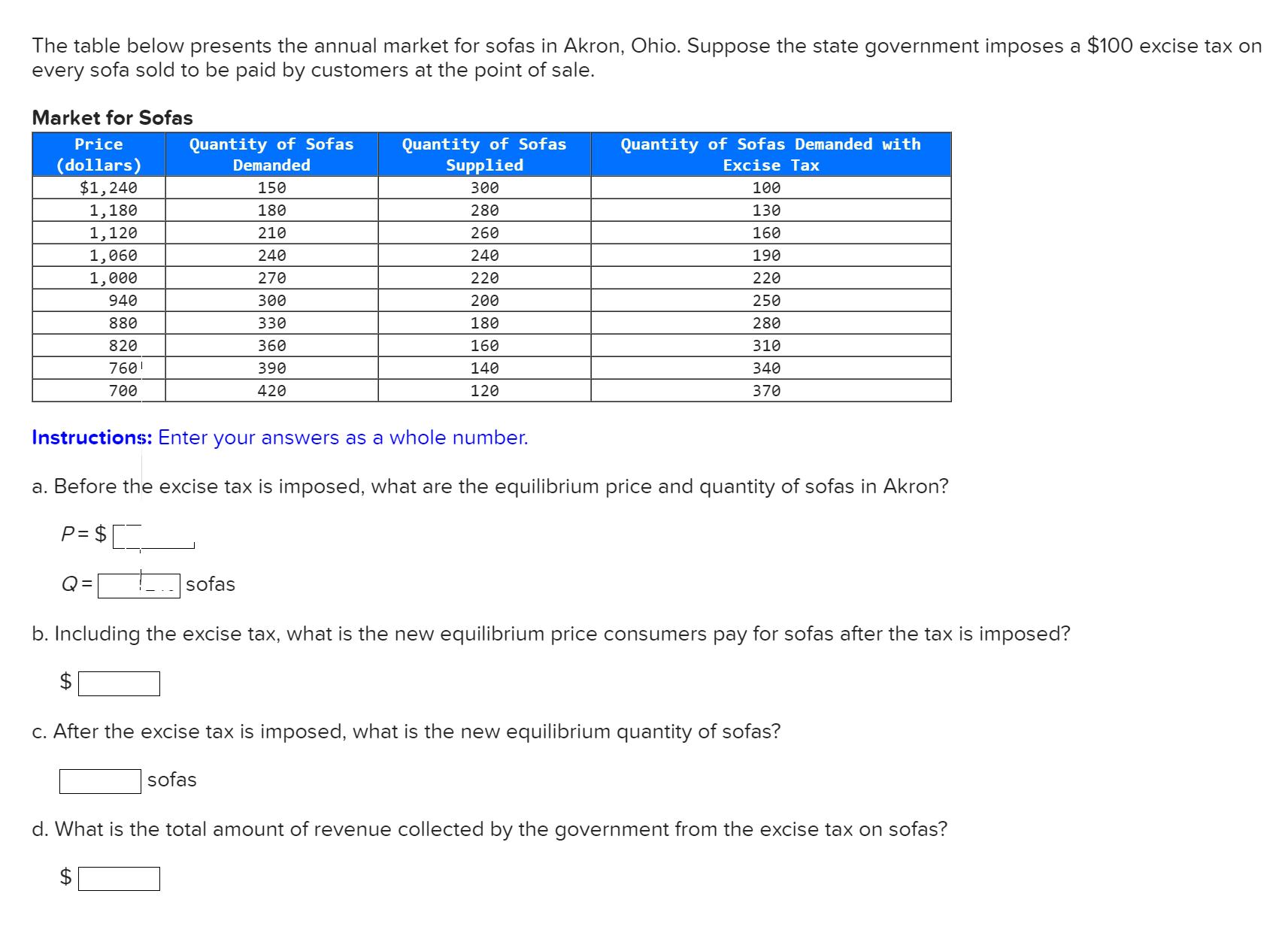

Question: The table below presents the annual market for sofas in Akron, Ohio. Suppose the state government imposes a $100 excise tax on every sofa

The table below presents the annual market for sofas in Akron, Ohio. Suppose the state government imposes a $100 excise tax on every sofa sold to be paid by customers at the point of sale. Market for Sofas Price (dollars) $1,240 1,180 1,120 1,060 1,000 Q= 940 880 820 760 700 Quantity of Sofas Demanded 150 180 210 240 270 300 330 360 390 420 +A Instructions: Enter your answers as a whole number. a. Before the excise tax is imposed, what are the equilibrium price and quantity of sofas in Akron? P = $ sofas Quantity of Sofas Supplied 300 280 260 240 220 200 180 160 140 120 Quantity of Sofas Demanded with Excise Tax 100 130 160 190 220 250 280 310 340 370 b. Including the excise tax, what is the new equilibrium price consumers pay for sofas after the tax is imposed? sofas c. After the excise tax is imposed, what is the new equilibrium quantity of sofas? d. What is the total amount of revenue collected by the government from the excise tax on sofas?

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts