Question: The table below shoes the option quote information for a company called RWJ Corp. The stock shares of RWJ Corp. can be bought or sold

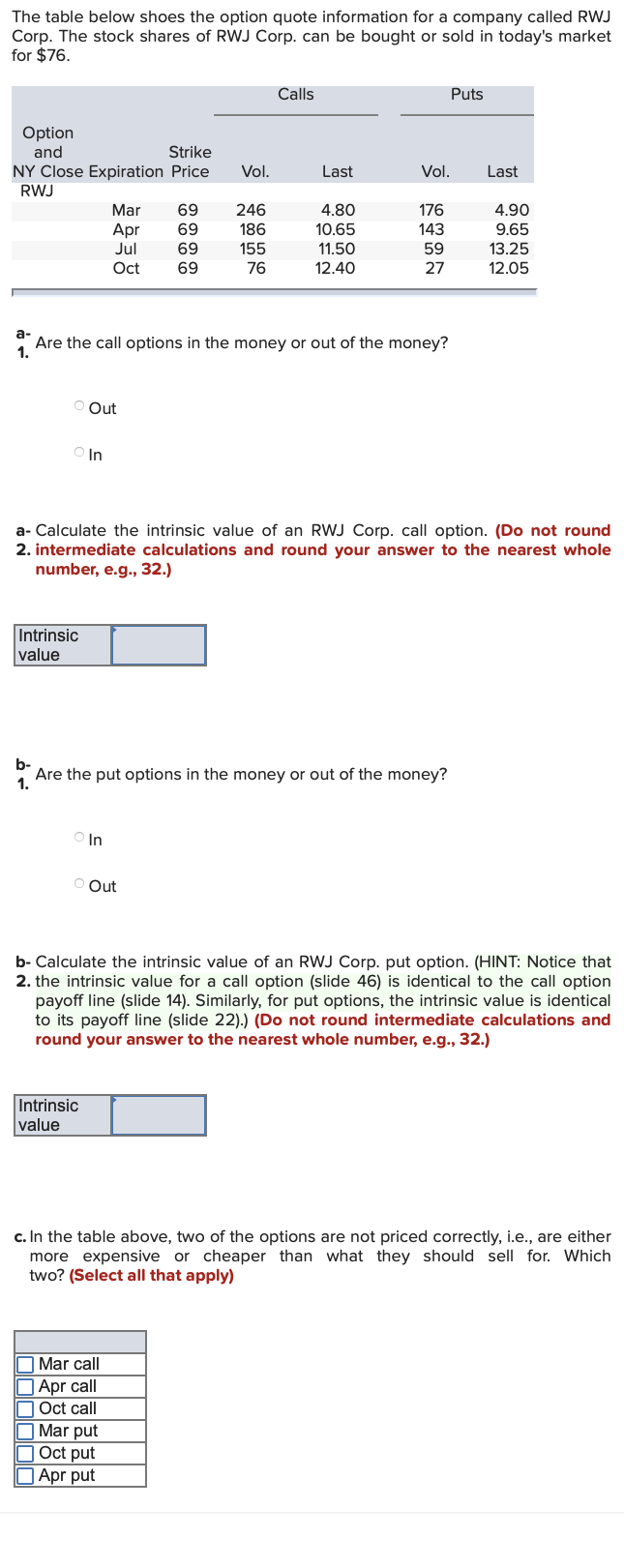

The table below shoes the option quote information for a company called RWJ Corp. The stock shares of RWJ Corp. can be bought or sold in today's market for $76. Calls Puts Vol. Last Vol. Last Option and Strike NY Close Expiration Price RWJ Mar 69 Apr 69 Jul 69 Oct 69 246 186 155 76 4.80 10.65 11.50 12.40 176 143 59 27 4.90 9.65 13.25 12.05 a- 1. Are the call options in the money or out of the money? Out In a- Calculate the intrinsic value of an RWJ Corp. call option. (Do not round 2. intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Intrinsic value b- 1. Are the put options in the money or out of the money? In Out b- Calculate the intrinsic value of an RWJ Corp. put option. (HINT: Notice that 2. the intrinsic value for a call option (slide 46) is identical to the call option payoff line (slide 14). Similarly, for put options, the intrinsic value is identical to its payoff line (slide 22).) (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Intrinsic value c. In the table above, two of the options are not priced correctly, i.e., are either more expensive or cheaper than what they should sell for. Which two? (Select all that apply) Mar call Apr call Oct call Mar put Oct put Apr put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts