Question: The table below shows a book balance sheet for the Wishing Well Motel chain. The companys long-term debt is secured by its real estate assets,

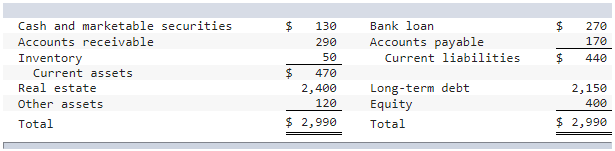

The table below shows a book balance sheet for the Wishing Well Motel chain. The companys long-term debt is secured by its real estate assets, but it also uses short-term bank loans as a permanent source of financing. It pays 13% interest on the bank debt and 11% interest on the secured debt. Wishing Well has 10 million shares of stock outstanding, trading at $85 per share. The expected return on Wishing Wells common stock is 18%. (Table figures in $ millions.)

Calculate Wishing Wells WACC. Assume that the book and market values of Wishing Wells debt are the same. The marginal tax rate is 21%. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)

Weighted-average cost of capital: _______%

Same question has been posted and answered with incorrect answer. Please show calculations. Thanks.,

$ $ Bank loan Accounts payable Current liabilities 270 170 440 $ Cash and marketable securities Accounts receivable Inventory Current assets Real estate Other assets Total 130 290 50 470 2,400 120 $ Long-term debt Equity Total 2,150 400 $ 2,990 $ 2,990

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts