Question: The table, below, shows a partially completed reconciliation from book income to taxable income for Smith, Inc. (a C Corporation) for 2019. Complete the table

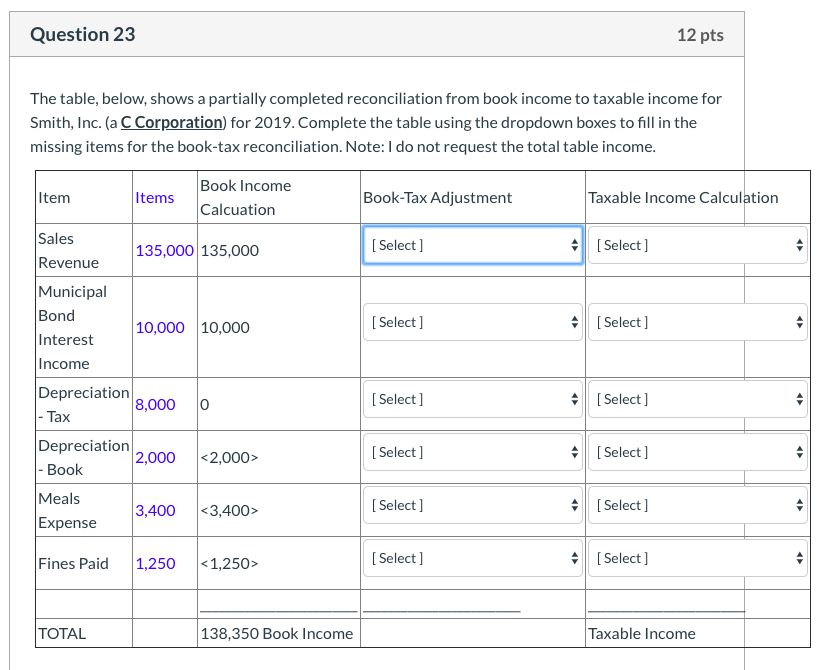

The table, below, shows a partially completed reconciliation from book income to taxable income for Smith, Inc. (a C Corporation) for 2019. Complete the table using the dropdown boxes to fill in the missing items for the book-tax reconciliation. Note: I do not request the total table income.

The table, below, shows a partially completed reconciliation from book income to taxable income for Smith, Inc. (a C Corporation) for 2019. Complete the table using the dropdown boxes to fill in the missing items for the book-tax reconciliation. Note: I do not request the total table income.

Question 23 12 pts The table, below, shows a partially completed reconciliation from book income to taxable income for Smith, Inc. (a C Corporation) for 2019. Complete the table using the dropdown boxes to fill in the missing items for the book-tax reconciliation. Note: I do not request the total table income. Item Items Book Income Calcuation Book-Tax Adjustment Taxable income Calculation Sales Revenue 135,000 135,000 [ Select] Select] Municipal Bond Interest Income 10,000 10,000 [Select] [Select] Depreciation 8,0000 - Tax [Select] [Select] Depreciation - Book 2,000 [ Select] [ Select] Meals Expense 3,400 [Select] [Select] Fines Paid 1,250 [ Select] [Select] TOTAL 138,350 Book Income Taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts