Question: the table below shows the current coupon yields to maturity and spot rates of interest for six US Treasury securities. assume all securities pay interest

the table below shows the current coupon yields to maturity and spot rates of interest for six US Treasury securities. assume all securities pay interest annual.

compute the two-year implied forward right three years from now given the information provided the proceeding table do not round intermediate calculations around your answer to two decimal places

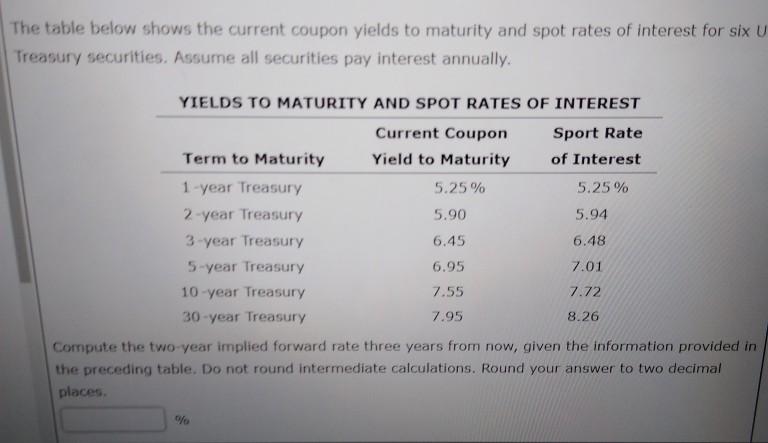

The table below shows the current coupon yields to maturity and spot rates of interest for six U Treasury securities. Assume all securities pay interest annually. YIELDS TO MATURITY AND SPOT RATES OF INTEREST Current Coupon Sport Rate Term to Maturity Yield to Maturity of Interest 1 year Treasury 5.25% 5.25% 2-year Treasury 5.90 5.94 3-year Treasury 6.45 6.48 5-year Treasury 6.95 7.01 10-year Treasury 7.55 7.72 30-year Treasury 7.95 8.26 Compute the two year implied forward rate three years from now, given the information provided in the preceding table. Do not round intermediate calculations. Round your answer to two decimal places %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts