Question: The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed

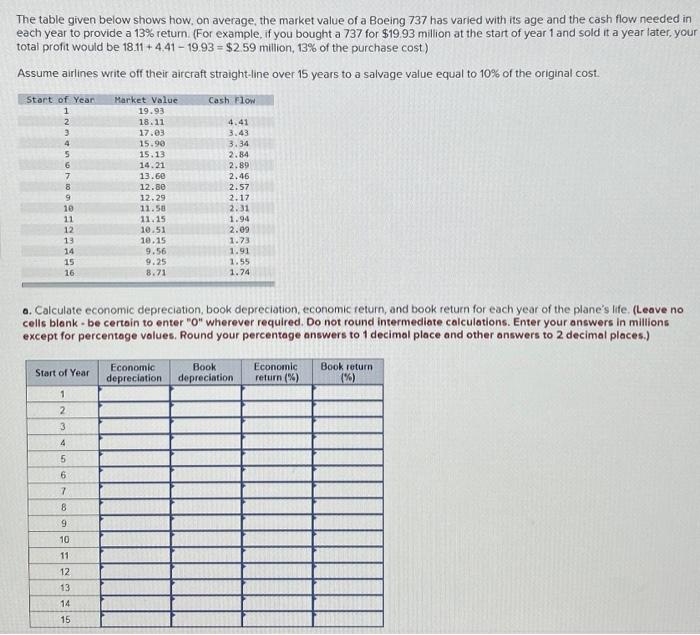

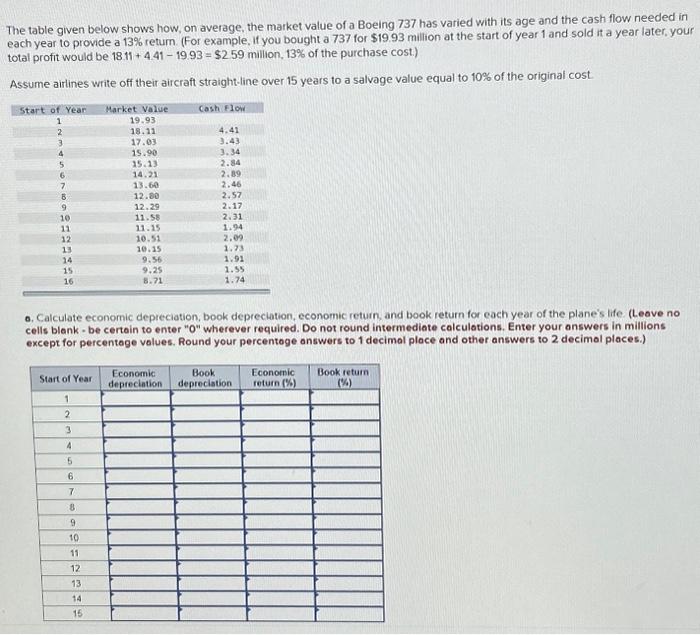

The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed in each year to provide a 13%% return. (For example. if you bought a 737 for $19.93 million at the start of year 1 and sold it a year later, your total profit would be 18.11 + 4.41 -19.93 = $2 59 million, 13%% of the purchase cost ) Assume airlines write off their aircraft straight line over 15 years to a salvage value equal to 10% of the original cost. Start of Year Market Value Cash Flow 1 19.93 18.11 4.41 17.03 3. 43 15.90 3.34 15.13 2.84 14. 21 2. 89 13. 60 2.46 12.80 2.57 12.29 2.17 10 11.58 2:31 11 11. 15 1.94 12 10.51 2.09 13 10.15 1:73 14 9.56 1.91 15 9.25 1.45 8.71 1. 74 s. Calculate economic depreciation, book depreciation, economic return, and book return for each year of the plane's life. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your answers In millions except for percentage values. Round your percentage answers to 1 decimal place and other answers to 2 decimal places.) Start of Year Economic Book Economic Book return depreciation depreciation return ( ) 1 5 6 : 15The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed in each year to provide a 13% return. (for example. If you bought a 737 for $19.93 million at the start of year 1 and sold it a year later, your total profit would be 18.11 + 4 41 - 19.93 = $2 59 million, 13% of the purchase cost.) Assume airlines write off their aircraft straight-line over 15 years to a salvage value equal to 10% of the original cost Start of Year Market Value Cash Flow 1 19.93 18.11 4.41 17.03 3143 15.90 15.13 2.84 14.21 2. 09 13.60 2.46 B 12.80 2.57 9 12.29 2.17 10 11.58 2.31 11 11.15 1494 12 10.51 2.09 10.15 1,73 14 9.56 1.91 15 9425 1.55 8. 71 1:74 a. Calculate economic depreciation, book depreciation, economic return, and book return for each year of the plane's life (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your answers in millions except for percentage values. Round your percentage answers to 1 decimal place and other answers to 2 decimal places.) Start of Year Economic Book Economic Book return depreciation deproclation toturn (") (4) 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts