Question: The table given below summarizes the 2019 income statement and end-year balance sheet of Drake's Bowling Alleys. Drake's financial manager forecasts a 10% increase in

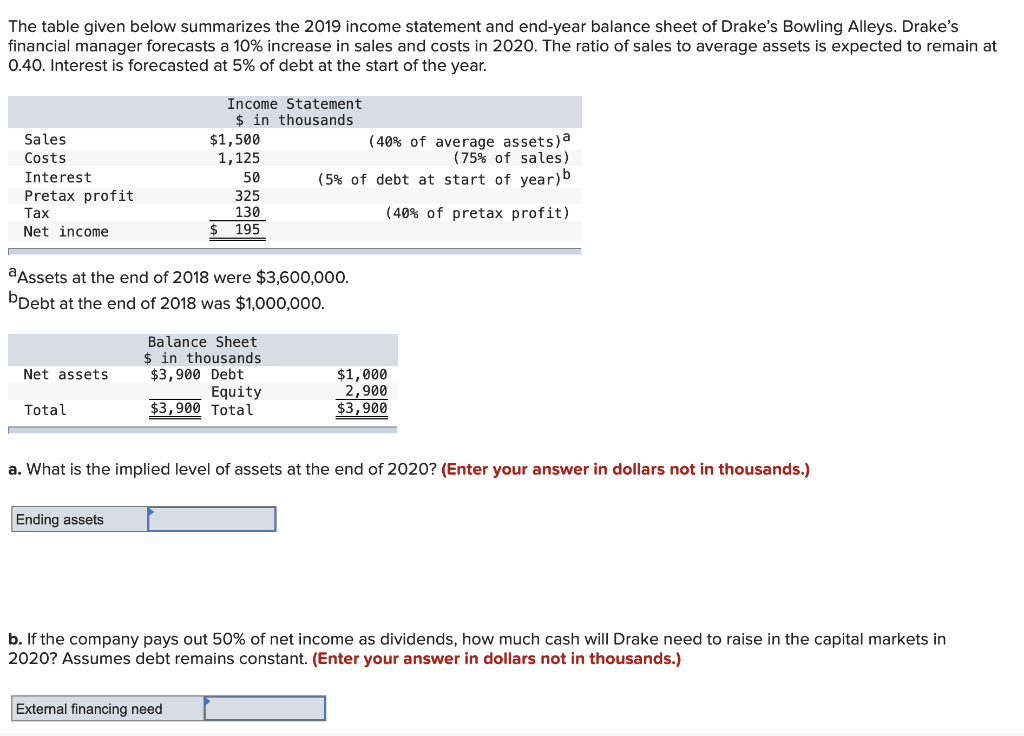

The table given below summarizes the 2019 income statement and end-year balance sheet of Drake's Bowling Alleys. Drake's financial manager forecasts a 10% increase in sales and costs in 2020. The ratio of sales to average assets is expected to remain at 0.40. Interest is forecasted at 5% of debt at the start of the year. Sales Costs Interest Pretax profit Tax Net income Income Statement $ in thousands $1,500 (40% of average assets) 1,125 (75% of sales) 50 (5% of debt at start of year) 325 130 (40% of pretax profit) 195 a Assets at the end of 2018 were $3,600,000. bDebt at the end of 2018 was $1,000,000. Net assets Balance Sheet $ in thousands $3,900 Debt Equity $3,900 Total $1,000 2,900 $3,900 Total a. What is the implied level of assets at the end of 2020? (Enter your answer in dollars not in thousands.) Ending assets b. If the company pays out 50% of net income as dividends, how much cash will Drake need to raise in the capital markets in 2020? Assumes debt remains constant. (Enter your answer in dollars not in thousands.) External financing need c. If Drake is unwilling to make an equity issue, what will be the debt ratio at the end of 2020? Debt ratio %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts