Question: THE TABLE SHOWN ABOVE HAS AN ADDITIONAL INFORMATION, ITS DIFFERENT FROM PREVIOUS QUESTION THAT POSTED THE SAME THING. PLEASE DO NOT COPY AND PASTE ANSWER

THE TABLE SHOWN ABOVE HAS AN ADDITIONAL INFORMATION, ITS DIFFERENT FROM PREVIOUS QUESTION THAT POSTED THE SAME THING.

PLEASE DO NOT COPY AND PASTE ANSWER FROM OTHER SOURCES. THIS QUESTION IS DIFFERENT FROM OTHERS.

HOPE SO Y'ALL CAN COOPERATE.

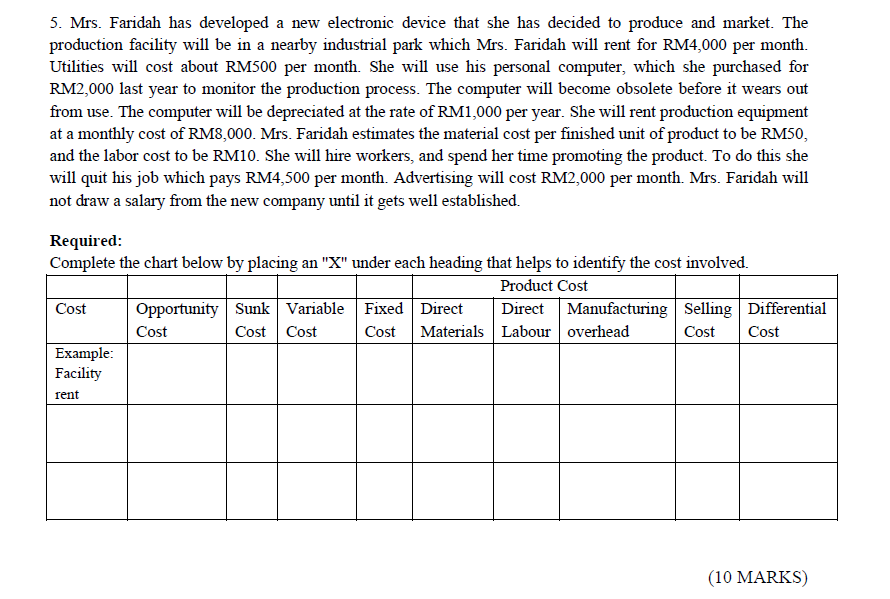

5. Mrs. Faridah has developed a new electronic device that she has decided to produce and market. The production facility will be in a nearby industrial park which Mrs. Faridah will rent for RM4,000 per month. Utilities will cost about RM500 per month. She will use his personal computer, which she purchased for RM2,000 last year to monitor the production process. The computer will become obsolete before it wears out from use. The computer will be depreciated at the rate of RM1,000 per year. She will rent production equipment at a monthly cost of RM8,000. Mrs. Faridah estimates the material cost per finished unit of product to be RM50, and the labor cost to be RM10. She will hire workers, and spend her time promoting the product. To do this she will quit his job which pays RM4,500 per month. Advertising will cost RM2,000 per month. Mrs. Faridah will not draw a salary from the new company until it gets well established. Required: Complete the chart below by placing an "X" under each heading that helps to identify the cost involved. Product Cost Cost Opportunity Sunk Variable Fixed Direct Cost Cost Cost Cost Materials Direct Manufacturing Selling Differential Labour overhead Cost Cost Example: Facility rent (10 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts