Question: The Talbot Company uses electrical assemblies to produce an array of small appliances. One of its high cost / high volume assemblies, the XO-01, has

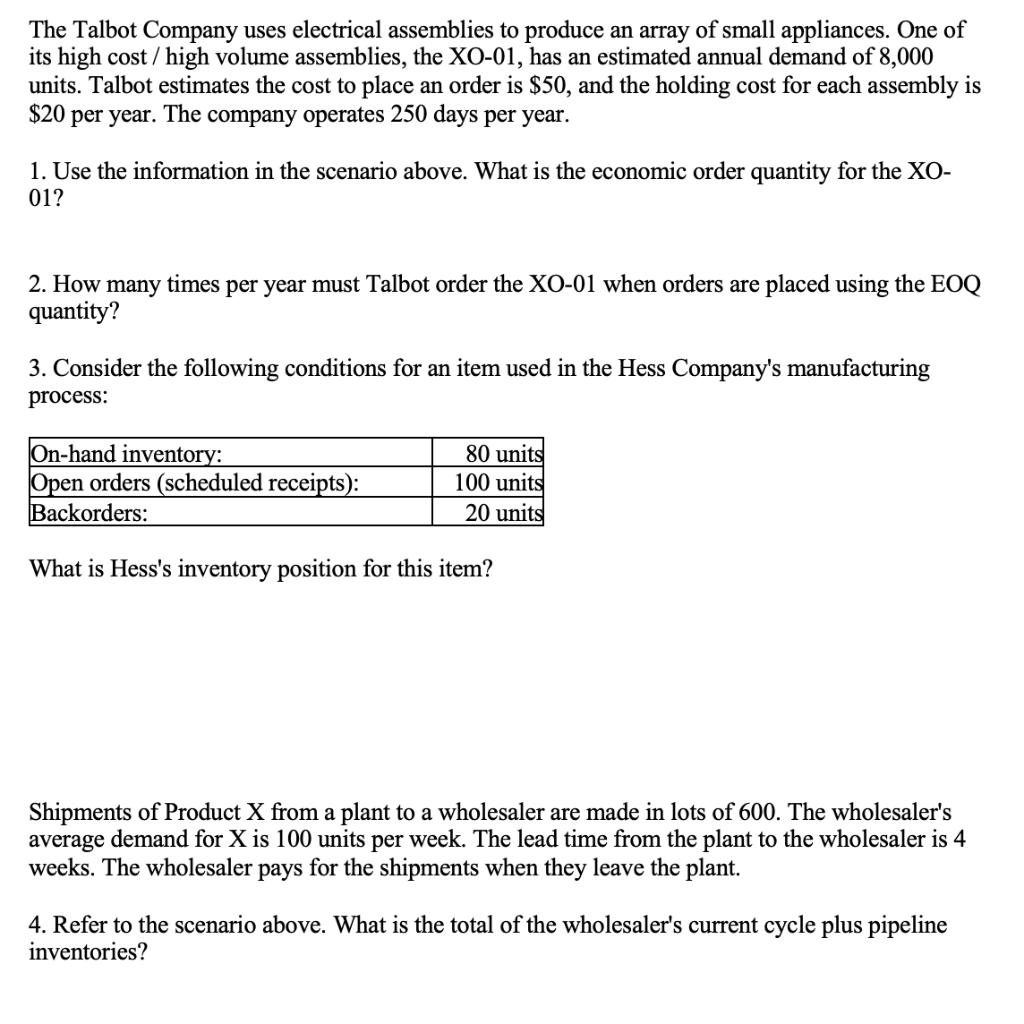

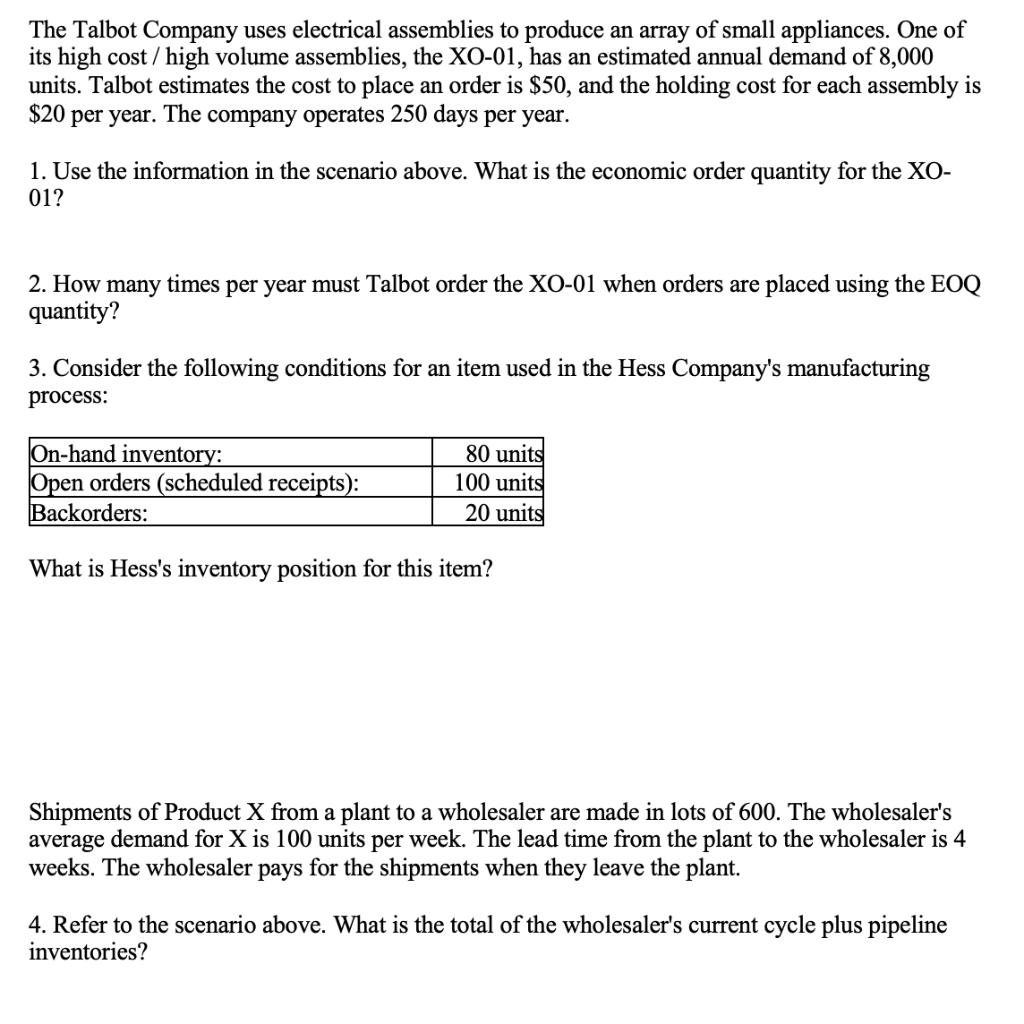

The Talbot Company uses electrical assemblies to produce an array of small appliances. One of its high cost / high volume assemblies, the XO-01, has an estimated annual demand of 8,000 units. Talbot estimates the cost to place an order is $50, and the holding cost for each assembly is $20 per year. The company operates 250 days per year.

1. Use the information in the scenario above. What is the economic order quantity for the XO-01?

2. How many times per year must Talbot order the XO-01 when orders are placed using the EOQ quantity?

The Talbot Company uses electrical assemblies to produce an array of small appliances. One of its high cost /high volume assemblies, the XO-01, has an estimated annual demand of 8,000 units. Talbot estimates the cost to place an order is $50, and the holding cost for each assembly is The company operates 250 days per year. $20 per year. 1. Use the information in the scenario above. What is the economic order quantity for the XO- 01? 2. How many times per year must Talbot order the XO-01 when orders are placed using the EOQ quantity? 3. Consider the following conditions for an item used in the Hess Company's manufacturing process: On-hand inventory: Open orders (scheduled receipts): Backorders: 80 units 100 units 20 units What is Hess's inventory position for this item? Shipments of Product X from a plant to a wholesaler are made in lots of 600. The wholesaler's average demand for X is 100 units per week. The lead time from the plant to the wholesaler is 4 weeks. The wholesaler pays for the shipments when they leave the plant. 4. Refer to the scenario above. What is the total of the wholesaler's current cycle plus pipeline inventories